All three main stock indices closed at report highs on Thursday afternoon, and Bitcoin is now suing lawsuits on Friday.

BTC rises sharply when shares attain peak

One thing unusual occurred on Thursday. Inflation has been barely larger than anticipated after the Bureau of Labor Statistics reported an increase within the Shopper Worth Index (CPI), however Huge Information says it is not inflation and yesterday’s unemployed surge will seal trades subsequent week because of rate of interest cuts by the Federal Reserve. That sentiment sparked inventory rally, the place all three key indicators approached at report highs, and now Bitcoin is becoming a member of the occasion.

(Tyler Winklevoss, co-founder of Gemini, stated throughout an interview Friday that Bitcoin will attain $1 million over a decade.)

The S&P 500 ended the day with 6,587.47, with the Nasdaq breaking 22,000 for the primary time, and the Dow spiked above 46,000, reaching its highest nearer. Software program big Oracle (NYSE:ORCL) led its inventory on Wednesday with a 36% surge. In line with Oracle CEO Safra Catz, the corporate has ticked out a number of multi-billion greenback offers with a number of AI corporations. With Oracle Inventory’s sudden appreciation, Larry Ellison, the corporate’s co-founder and chairman, wobbled over $400 billion and earned a internet value, thrilling Tesla billionaire Elon Musk.

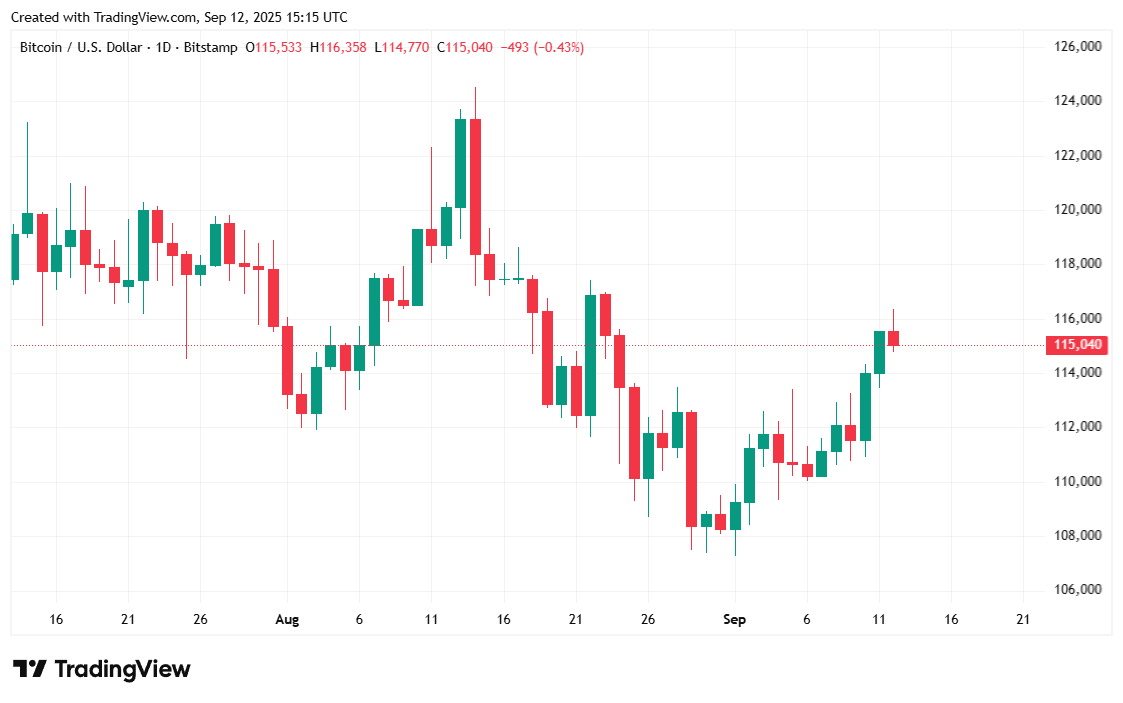

However within the crypto world, Bitcoin is a star, choosing up the place shares left earlier than settling down at round $115,000 on Friday morning, surpassing $116K in additional than $100 million trades.

“For those who mess with the cash, you see Bitcoin buying and selling for $1 million in Bitcoin, in order that’s nonetheless on the backside of the primary innings,” Gemini co-founder Tyler Winclevos stated in an interview Friday. “I feel it is ten occasions simpler from right here. It is nonetheless actually early. And I feel we’re sitting right here ten years from now and saying, ‘Wow, at present was actually early.’ ”

Market Metric Overview

Bitcoin was buying and selling at $115,026.52 on the time of writing, in response to information from CoinmarketCap. Cryptocurrency has moved between $114,030.39 and $116,317.21 since yesterday.

(Bitcoin Worth/Buying and selling View)

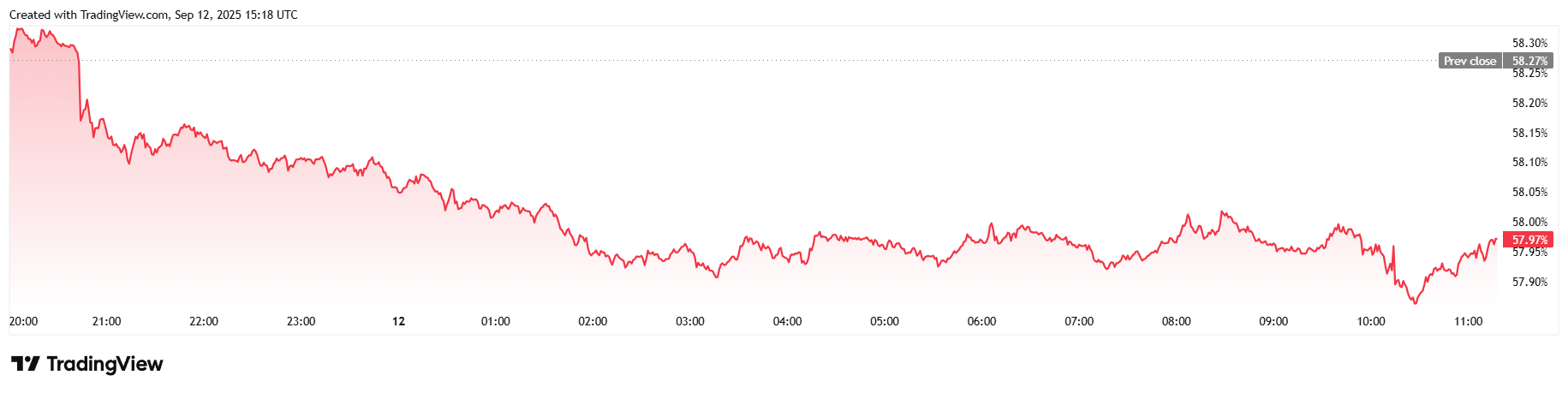

The 24-hour buying and selling quantity has been virtually flat, down simply 0.93% immersion since Thursday to $466.5 billion. Market capitalization rose 0.53% to $2.29 trillion, whereas Bitcoin’s dominance fell 0.52% to 57.98% in 24 hours.

(Bitcoin management/commerce view)

In line with Coinglass information, complete open presents of Bitcoin futures had been flat for the day, up 0.07% to $8500 billion. Nonetheless, as a result of Bitcoin lodging rally, the liquidation of $688 million from yesterday and yesterday jumped to $608.58 million yesterday. The Longs bought a lot fewer hits, considerably reducing $6.68 million in liquidation.