Bitcoin’s US Google search quantity has fallen 11 months low amid a record-breaking surge in gold, with consultants displaying the potential for a pioneer’s capital turnover into crypto.

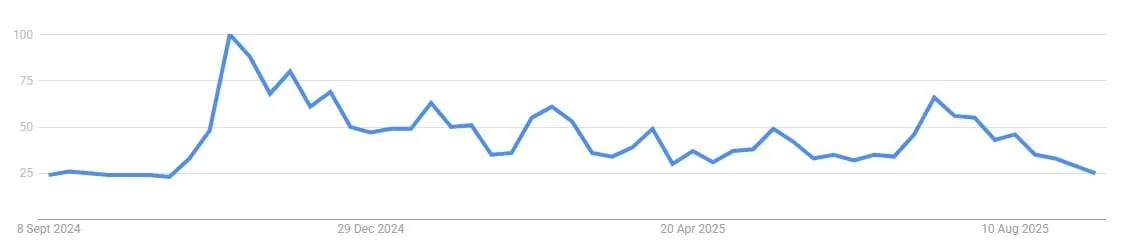

Google Traits information reveals that regardless of robust institutional ETF flows in early 2025, Bitcoin search curiosity fell to the bottom it final noticed in October 2024.

US Google developments “Bitcoin” information. Picture: Google

Efficiency between the 2 belongings displays this totally different pattern, with gold growing by 38% in comparison with 18% of Bitcoin since its launch in 2025.

“This distinction displays a elementary shift in the direction of investor psychology in hypothesis amid growing macroeconomic uncertainty,” mentioned Derek Lim, head of analysis at Kaladan. Decryption.

Bitcoin has been stagnant since Might 2025, buying and selling round $111,565, in response to Coingecko information. In the meantime, Gold reached $3,613.48 in the present day.

MEXC chief analyst Sean Younger mentioned that search curiosity is “cyclical” and pushed by “retail consideration spikes.” Decryption. “Macro drivers just like the expectations of the Fed price reduce, weak point within the greenback, and central financial institution purchases are driving gold to recent data,” he defined.

Lim emphasizes that Bitcoin’s 15% delay is at an all-time excessive in gold terminology, highlighting the sting of treasured metals in a risk-off setting pushed primarily by its “established narrative” and “common acceptance.”

Gold is a report hit: What’s subsequent for Bitcoin?

Analysts have beforehand highlighted the dynamics of lead rugs, the place gold gatherings preceded Bitcoin’s outsized transfer.

“Gold typically strikes first, adopted by Bitcoin outperform,” mentioned Lawrence Lepard, co-founder of Fairness Administration Associates LLC, posted in a tweet in August.

Matthew Sigel, head of Vanek’s digital belongings analysis, reiterated the sentiment in a tweet on Saturday, saying, “All gold gatherings trigger the identical sample: Bitcoin breaks loads.”

All Gold Rally causes the identical sample. Bitcoin will develop. pic.twitter.com/ylzi2baxp8

– Matthew Sigel, Recovering CFA (@matthew_sigel) September 6, 2025

Leopard predicted a gold breakout of over $3,500, “a prelude to Bitcoin of $140,000.”

Specialists are cautiously optimistic. They anticipate that when the macrocatalysts are aligned, the lead lag sample of Bitcoin and Gold will final.

LIM has recognized Fed price reductions as a key set off that may replace its danger attraction and help Bitcoin’s “greater beta traits.”

Younger wants sustained reflection expectations, equivalent to central financial institution gold purchases and alerts on the chain, to “flip marginal allocations from bullion to bitcoin.”

Each see the rotations accelerated with risk-on shifts.

This consensus is bullish for the Bitcoin inflation hedge story, with Lim projecting a goal of $120,000 to $150,000 in 2025 with outliers of $200,000 in rotation eventualities.

Younger initiatives vary from $125,000 to $250,000 for medium bulls, primarily based on ETF developments and insurance policies.

Nevertheless, Lepard expects $250,000 together with $10,000 in Fiat Erosion, putting Bitcoin because the “escape hatch” of the expansion cycle.

Numerous forecast market merchants have been launched DecryptionMother or father firm Dastan is just not optimistic. Virtually 60% anticipate gold to surpass Bitcoin in 2025.