Gold and copper are rising even because the Fed continues to point out endurance in chopping rates of interest. This divergence means that markets have a tendency to cost in liquidity situations forward of formal coverage modifications, moderately than ready for central financial institution approval.

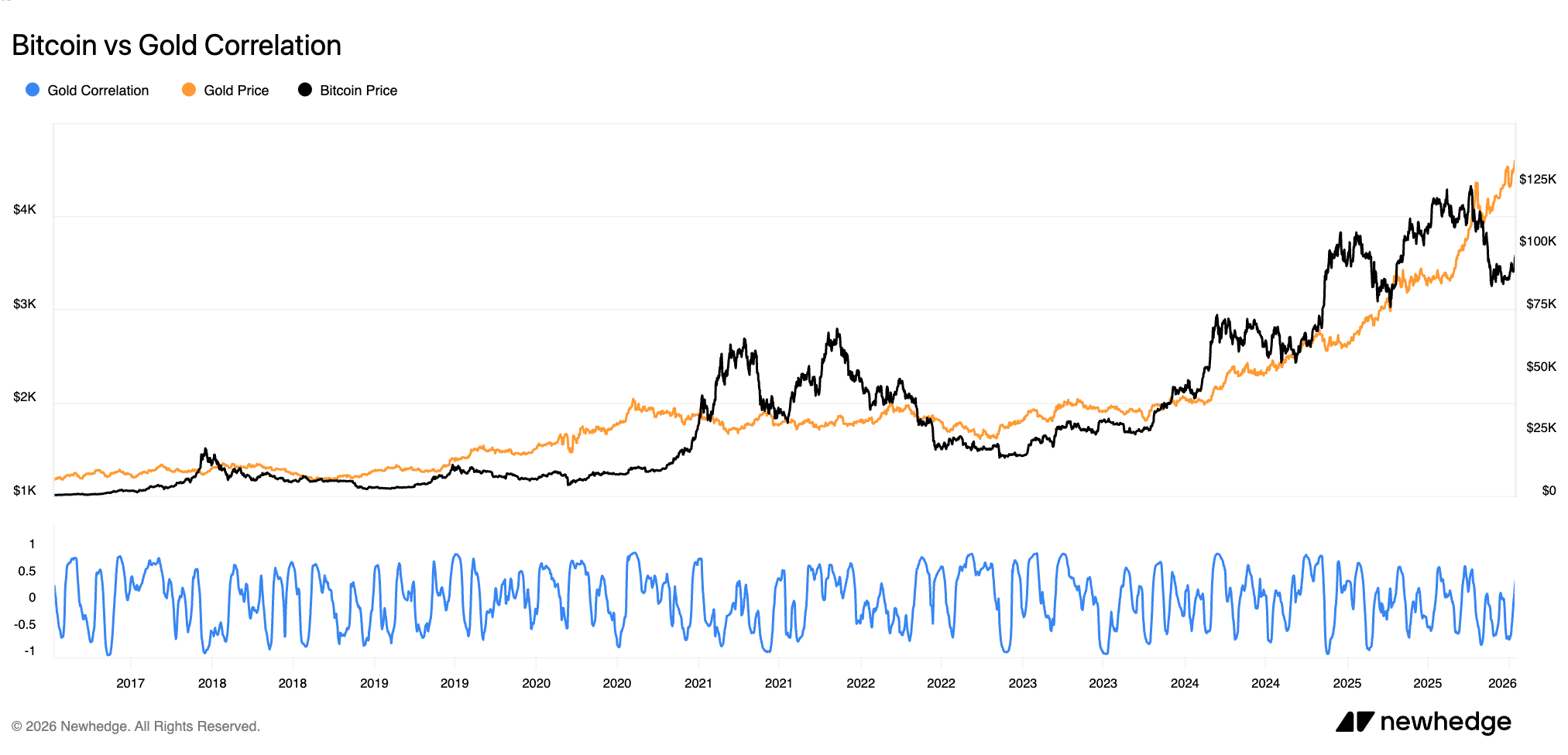

These metals react to modifications in actual yields, funding situations, and expectations, usually within the early phases of an easing cycle. In earlier cycles, Bitcoin reacted late to the identical forces, with its strongest features solely coming after the steel had already repositioned in the direction of easing monetary situations.

The present setup seems to be acquainted. Gold is attracting protection funding as actual returns on money and US Treasuries are compressed, whereas copper is responding to improved credit score availability and expectations for world exercise. Taken collectively, these recommend that markets are adapting to an surroundings the place restrictive insurance policies are reaching their limits, irrespective of how lengthy and cautious the authorities say.

Bitcoin has not but mirrored that change, however historical past has proven that Bitcoin tends to maneuver solely after the underlying liquidity alerts can now not be ignored.

Metals transfer earlier than central banks act

Monetary markets sometimes reprice the state of affairs earlier than policymakers permit a turnaround, particularly when the price of capital begins to shift at a breaking level.

Gold’s habits over a number of cycles clearly exhibits this. LBMA pricing information and World Gold Council evaluation present that gold usually begins to rise months earlier than the primary price lower, as buyers react to the height in actual yields moderately than the lower itself.

In 2001, 2007, and once more in 2019, gold costs rose, reflecting the expectation that holding money would rapidly scale back actual returns, although coverage was nonetheless “formally” restrictive.

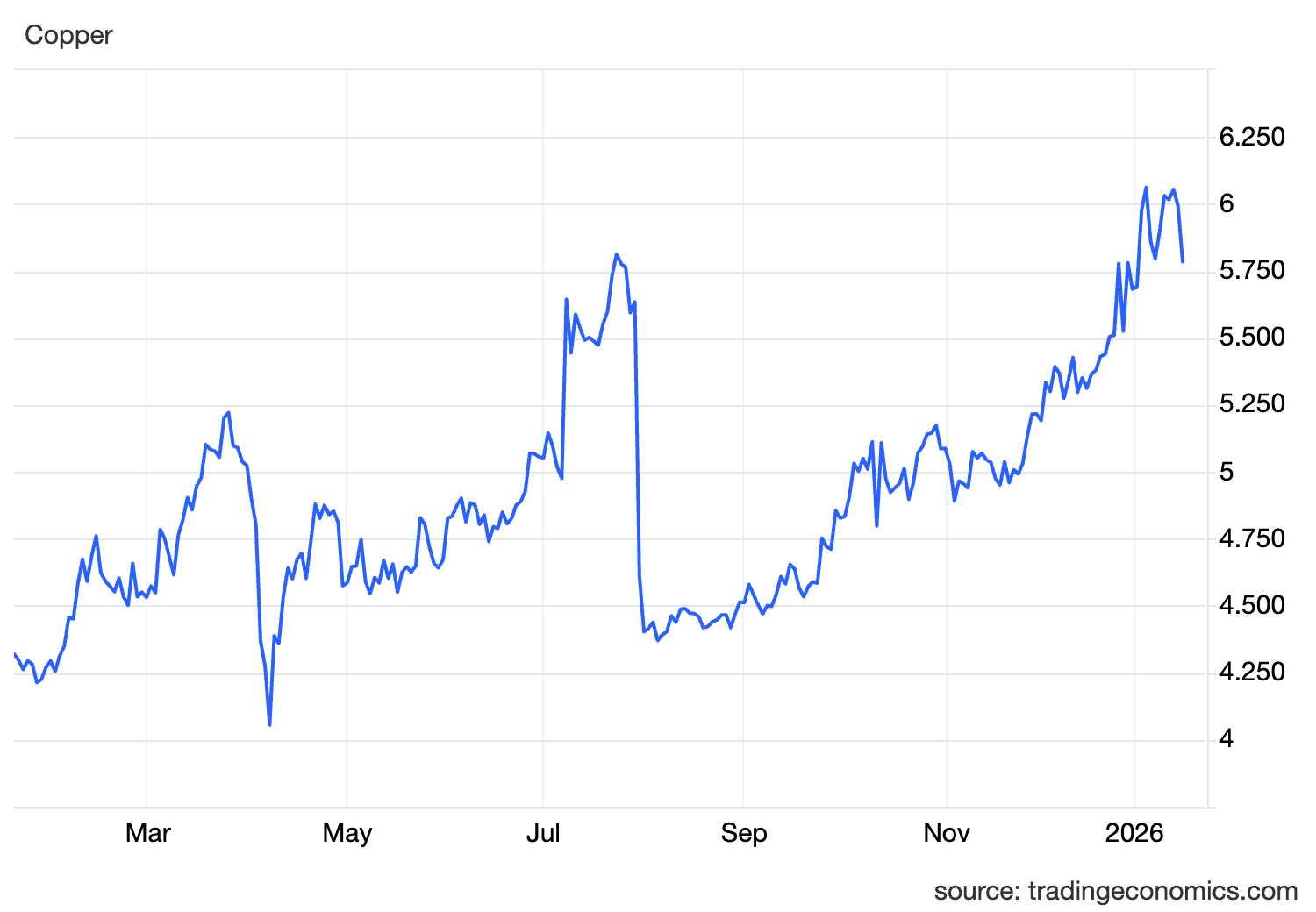

Copper responds to a different set of incentives, which additional strengthens the sign. In contrast to gold, demand for copper is tied to building, manufacturing and funding cycles, making it delicate to credit score availability and financing.

If the worth of copper rises with gold, it merely alerts a defensive stance, suggesting that the market expects easing monetary situations to help actual financial exercise.

Latest actions in CME and LME copper futures present that that’s precisely what has occurred, with costs rising regardless of uneven progress information and central financial institution warning.

This mixture has a big impression available on the market because it reduces the chance of false alerts. Whereas solely gold can rise on concern or geopolitical stress, solely copper can react to provide disruptions.

When each transfer collectively, it often displays a broader adjustment in liquidity expectations, an adjustment that markets are keen to cost in even with out express coverage help.

Actual yields form the cycle greater than coverage headlines

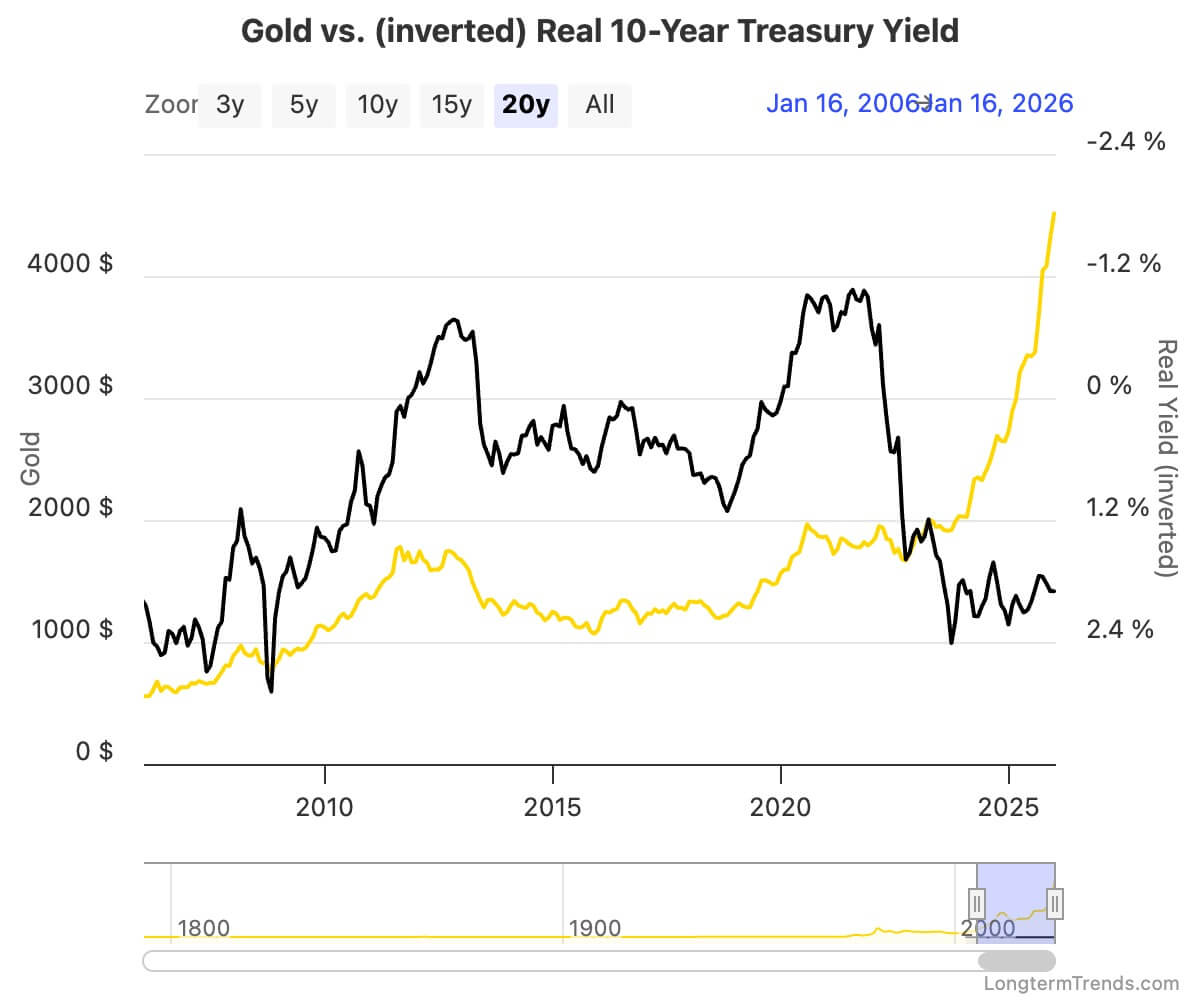

The widespread issue for gold, copper, and finally Bitcoin is the actual yield on long-term authorities bonds, significantly the yield on 10-year U.S. inflation-protected securities. Actual yield represents the return buyers obtain after inflation and acts as the chance price of holding non-yielding or low-yielding belongings.

When these yields peak and start to fall, the relative attractiveness of uncommon belongings will increase, even when coverage charges stay excessive.

U.S. Treasury information exhibits that gold costs have been intently linked to actual yields over time, usually beginning to rise when actual yields reverse, moderately than after rate of interest cuts. As soon as the actual price of return on U.S. Treasuries begins to compress, hawkish messages have hardly ever succeeded in reversing this relationship.

Copper is much less immediately associated, however nonetheless reacts to the identical background. Decrease actual yields are typically accompanied by simpler monetary situations, a weaker greenback, and improved entry to credit score, all of which help industrial demand expectations.

Bitcoin operates inside this similar framework, however is slower to react because the investor base tends to solely react as soon as modifications in liquidity are extra clear. In 2019, Bitcoin’s rally adopted a sustained decline in actual yields and gained momentum because the Fed moved from tightening to easing.

In 2020, this relationship turned extra excessive as actual yields collapsed and liquidity flooded the system, accelerating Bitcoin’s efficiency lengthy after gold had already repositioned itself.

This order explains why Bitcoin seems to be disconnected early within the cycle. This doesn’t correspond to particular person information prints or single price choices, however moderately to the cumulative impression of actual yield compression and liquidity expectations that metals are inclined to mirror early.

Capital turnover explains Bitcoin’s gradual response

The order wherein belongings react throughout mitigation cycles displays several types of capital reallocation strategies. Early within the course of, buyers are inclined to choose belongings that keep their worth with low volatility, which helps demand for gold.

As expectations for credit score easing and improved progress enhance, copper will start to mirror that change by way of greater costs. Bitcoin sometimes absorbs capital after easing is achieved and the market turns into extra assured that liquidity situations help riskier, extra reflective belongings.

This sample was repeated all through the cycle. In 2019, gold’s rally preceded Bitcoin’s breakout, and Bitcoin finally outperformed as soon as rate of interest cuts turned a actuality. In 2020, the timeline was shortened, however the order was comparable, with Bitcoin’s largest features coming after coverage and liquidity responses had already begun.

Bitcoin’s market is small, younger, and vulnerable to marginal flows, so as soon as positioning modifications in its favor, its actions are typically sharper.

For now, Bitcoin remains to be range-bound, whereas metals seem like rallying in worth forward of affirmation. This divergence was usually current early within the easing cycle and resolved solely after the compression in actual yields turned persistent sufficient to vary capital allocation choices extra broadly.

What disables setup

This framework depends on continued easing in actual yields. A sustained reversal in rising actual yields would undermine the rationale for gold’s rally and weaken the rationale for copper, whereas eradicating Bitcoin from the liquidity tailwind that has supported previous cycles.

Accelerating quantitative tightening and a pointy appreciation of the greenback will even tighten monetary situations, placing stress on belongings that depend on easing expectations.

A renewed spike in inflation that forces central banks to delay actual easing might pose comparable dangers, as it will maintain actual yields rising and restrict the scope for liquidity enlargement. Markets can predict coverage modifications, however they can’t maintain these expectations indefinitely if the underlying information contradicts the coverage change.

For now, futures markets proceed to cost in eventual easing, with actual yields on U.S. Treasuries remaining under cycle highs. Metals reply to these alerts. Bitcoin has not but performed so, however its historic motion means that it tends to maneuver solely after liquidity alerts turn into extra sturdy.

If actual yields proceed to compress, metals will probably observe the trail they’re at present on, and Bitcoin will observe swimsuit, and in a a lot larger manner.