One factor we hardly ever take into consideration is how dangerous climate impacts the safety of Bitcoin, however dangerous climate occurs pretty recurrently. Snow can pose a reliable danger to Bitcoin miners securing the blockchain.

Snow seems first on climate maps, displaying darkish smears that stretch throughout state strains. And it turns into what you really really feel. Energy strains flapping within the wind, staff on standby, properties attempting to maintain the warmth on.

Behind the extraordinary human sight, there’s one other type of gear. Rows of Bitcoin miners carry out one job when electrical energy is reasonable and plentiful, and will deliberately shut down when the grid is pressured.

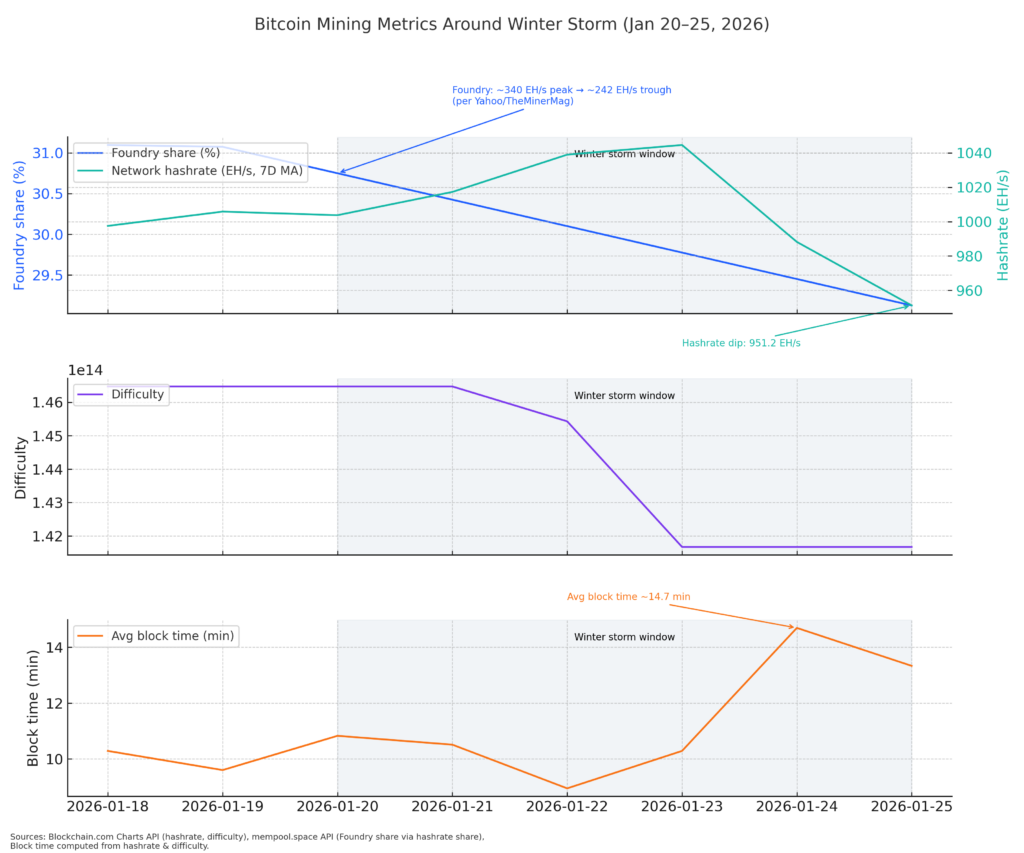

That is the background to 2 occasions that occurred in shut proximity, and it is simple to misinterpret them in case you simply take a look at the headline numbers. A sudden change in Foundry, the biggest Bitcoin mining pool within the US, and a big drop in community hash fee appeared on the charts.

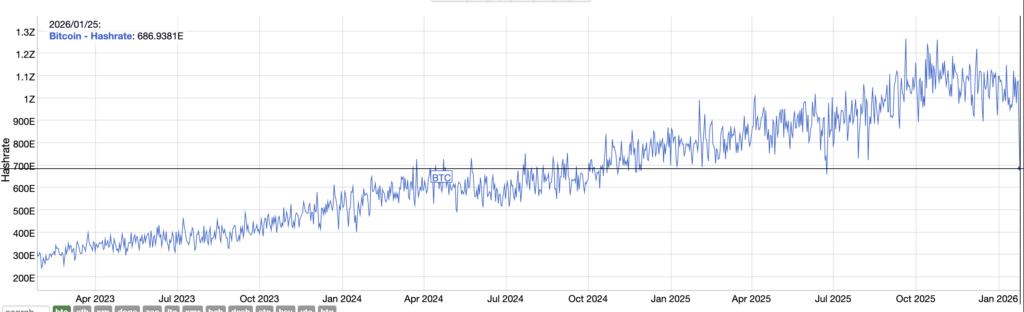

The decline in hashrate that everybody sees

For those who monitor mining knowledge day by day, you have most likely seen the identical factor. Your hashrate instantly seems low, with an enormous crimson share subsequent to it.

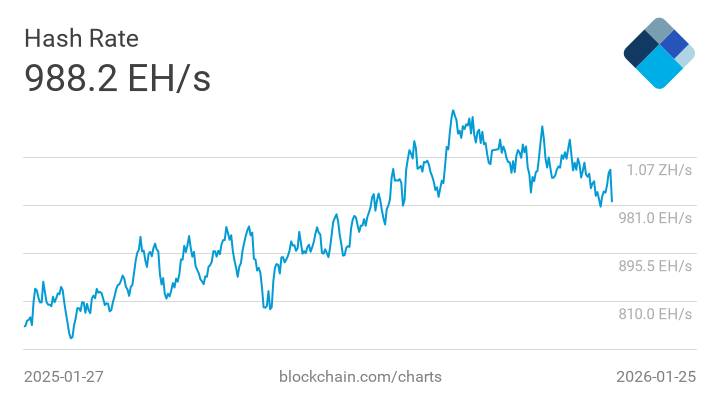

BitInfoCharts is a chart that many individuals are screenshotting and sharing, however as of this writing, we have seen a noticeable lower in day by day estimates over a 24-hour interval. That is the place the “almost 10%” chatter comes from, and the swing may be even greater relying on the precise second you take a look at.

The very first thing to remember is that the “hashrate” on these dashboards isn’t a direct machine learn. That is an estimate drawn from blocks discovered over a time frame.

It sounds educational till you learn the way Bitcoin works. Blocks seem instantly after which dry up, even when nothing adjustments in the true world.

Suppliers like Blockchain.com have lengthy identified that brief time durations may be noisy for that very purpose, and that utilizing 7-day or 14-day averages is commonly much less sensational.

So the drop within the day is a clue. That is not a certainty.

If the dip is actual, you often see it elsewhere. Block occasions could also be prolonged, issue estimates could roll over, and reminiscence swimming pools could start to tighten if there’s demand.

In actual fact, on the day in query, mempool knowledge was displaying a drop in block manufacturing, with the snapshot view of mempool.area displaying common block occasions within the 11 minute vary.

Nonetheless, such a studying alone doesn’t show a particular share decline. However this rhymes with durations when among the mining capability is definitely offline, not simply shuffled between swimming pools.

Storms, Grids, and the Components Folks Overlook

Now add the human half once more. The US is getting into a full-fledged winter regime.

A report from the AP says the extreme storm had widespread results, leaving many purchasers with out energy in some areas.

When a storm like this hits, it is the grid that will get talked about, not Bitcoin. It is simple to see miners as bystanders.

In america, they’re typically included into plots.

Rising industrial-scale mining in locations like Texas operates like an interruptible load. Miner indicators the contract. They are often lowered rapidly, credit may be earned, and grid operators can pull levers when demand spikes.

This idea can be defined in authorities language. The U.S. EIA is discussing large-scale workloads, together with cryptocurrency mining, and is taking part in a voluntary discount settlement with ERCOT.

For corporations, this velocity is now not a hypothetical.

CleanSpark talked about lowering tons of of megawatts throughout a number of websites inside minutes in response to TVA requests, as coated by DataCenterDynamics.

As a result of it is a cliff, it is the type of skill that may seem as a cliff in your chart.

Because of this huge storms and sudden drops in hashrate may be linked, even in case you do not see miners within the snowbank.

Climate drives demand. Demand places stress on the facility grid. Miners both lose energy or select to promote energy again to the grid.

The community looks like there are fewer hashes per second.

There may be additionally one other layer. Grid operators typically telegraph stress home windows.

Stories from Axios warned of the danger of strains throughout techniques together with ERCOT and PJM throughout the storm.

Native reviews additionally point out that emergency measures and backup energy technology are being thought-about, together with a Houston Chronicle report on measures taken throughout the frigid climate.

That is the place it’s worthwhile to floor your story with out exaggerating it. Storms create circumstances for restricted driving and energy outages.

Function reductions and outages could end in a lower within the precise hashrate. Drawdowns can manifest as slower block speeds and decrease day by day hashrate estimates.

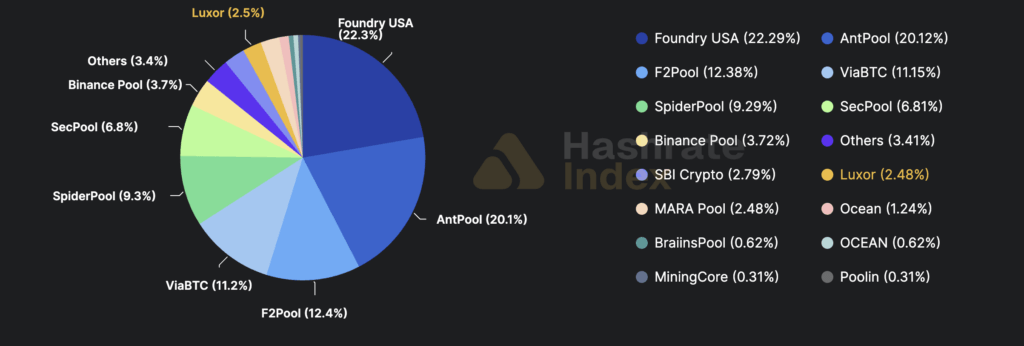

Foundries and why this one pool issues

Foundries are lightning rods in mining discussions as a result of they’re giant corporations related to america and coordinate key elements of block manufacturing.

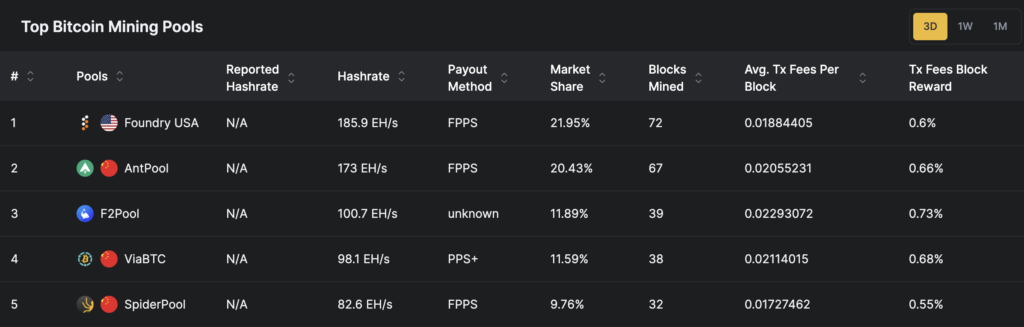

Relying on the lookback window, Foundry’s block share typically stays within the excessive 20s to low 30s. The hashrate index is at the moment round 22% over the previous three days, down from 30% a month in the past.

When Foundry makes a pointy transfer, it begins a dialog that goes past Foundry.

Throughout the latest chilly snap, TheMinerMag reported that Foundry’s hashrate dropped by about 30%, from a peak of about 340 EH/s to about 242 EH/s.

We additionally famous that Luxor has fallen, with over 110 EH/s offline throughout these two swimming pools.

On the time of writing, Foundry’s three-day common market share has fallen to 21.95%, with a hashrate of simply 185.9 EH/s.

That is essential as a result of Foundry can act as a proxy for U.S. mining habits.

When quite a lot of U.S.-based technology capability is concentrated inside the identical climate system, related to the identical energy market logic, and coordinated via a number of main swimming pools, storms do not simply knock on one door.

It knocks down the identical hallway.

essential dangers

That is the place we are able to escape the day by day rush and discover one thing to carry on to.

There are two sorts of focus in mining techniques which are problematic throughout occasions of stress: geographic focus and coordination focus.

Geographic focus implies that many machines are positioned underneath the identical sky and are uncovered to the identical chilly fronts, the identical ice, and the identical grid operator notifications.

Centralized coordination implies that many machines are pointing to the identical pool, so the general public dashboard behaves as if it had been a single organism.

If each are true, the climate will set off a sudden and visual hashrate shock.

Even when the broader community would not lose 30%, the general public sees the massive pool wobbling, and that has its personal penalties.

The technical outcomes are clear. If a miner really goes offline, blocks will decelerate till the issue is adjusted.

The financial impression will rely upon demand. If the blocks are gradual and the reminiscence pool is busy, the costs will enhance.

If the blocks are gradual and the reminiscence pool is quiet, the impression on pricing might be smaller.

The “busy mempool” half will not be assured at the moment.

For mempool.area, the advisable pricing degree is usually set low, permitting the impression of pricing to be framed as conditional on whether or not demand spikes throughout provide shocks.

The impression of the story is even better. Each time giant swimming pools related to the US transfer quickly, individuals start to query resilience, decentralization, and who will really be on the helm of block manufacturing.

Miner habits when lights flicker

There may be another excuse why storms are essential to mines. As a result of the storm intersects with the miners’ steadiness sheets and quiet tales of survival.

When miners cease working for a number of hours or a day, their income decreases and stuck prices proceed to accrue. Administration should determine what to do.

Some miners will monetize the electrical energy market, some will promote Bitcoin, some will do each, and their selections will present up downstream.

Riot’s replace is a helpful instance of how monetary administration is turning into extra energetic.

Based on Riot’s personal launch, Riot revealed that it offered 1,818 BTC in December 2025 for a internet revenue of $161.6 million.

CleanSpark additionally reviews gross sales exercise in its personal updates, and business protection, together with Blockspace, summarizes these numbers.

That is essential as a result of the storm discount interval generally is a money movement occasion.

If miners can earn credit by turning it off, they’ve a cushion. If that isn’t attainable, it could rely much more on bond gross sales.

All of us perceive what occurs when the revenue clock stops, however that is not the case with payments.

Macro layer, why that is repeated again and again

Storms are non permanent. System design is in progress.

Mining is transferring to areas the place energy is considerable, versatile and market-based. That usually means getting nearer to the facility grid, which can be referred to as upon to curtail when demand spikes.

That is a part of the explanation the U.S. mining business has turn out to be so influential and uncovered.

As mentioned on HashrateIndex, feedback from Mining Analytics Store additionally spotlight that winter vitality dynamics and vitality reductions are recurring components behind hashrate weak spot.

JP Morgan’s opinion factors to the opposite aspect of the coin. The thought is that if the hashrate decreases, the remaining miners could turn out to be extra worthwhile.

This creates a perverse incentive loop the place some miners profit from being compelled offline.

Subsequent, we are able to think about long-term forecasts that focus extra on the provision aspect. This implies extra hashrate will come on-line over time, growing competitors for megawatts and growing strain on margins.

For instance, Hashlabs fashions a variety of hashrate outcomes for the tip of 2026, with estimates round 1.7 ZH/s relying on assumptions.

Storms punch tougher in tight margin environments.

In case your miner can afford it, soak up the downtime. When constraints are extreme, discount allowances are totally financial selections.

So does the storm have something to do with a drop in hashrate?

This is the trustworthy model. Sure, that could be true.

You possibly can construct a dependable case with out pretending that each ASIC in America has a meter.

A powerful affiliation seems like this: Storm warnings have been strengthened, energy grid operators are bracing, energy outages are widespread, miners are lowering or dropping energy, community block occasions are rising, issue expectations are falling, day by day hashrate estimates are declining, and huge swimming pools with US publicity are displaying seen declines.

We’ve a number of of those components, together with storm severity and outages from AP, grid stress framing from Axios, and suppression capabilities and incentives from EIA and DataCenterDynamics.

There may be additionally Foundry drawdown at low temperatures.

What we should always keep away from is treating the very best quantity in a 24-hour interval as the whole lot that occurred.

Each day hashrate charts are helpful. They’re additionally straightforward to leap on, and their warnings are documented by Blockchain.com.

What does this imply for on a regular basis holders?

The actual theme is the concept the networks that folks name unstoppable are nonetheless related to the identical chaotic world as everybody else.

Bitcoin works on arithmetic, nevertheless it additionally works on electrical energy. Electrical energy runs on climate, politics, and infrastructure that may fail.

Because the storm heads towards america, households replenish on batteries, energy corporations deploy vehicles, and miners have the pliability to determine whether or not to maintain hashing or cashing in.

Within the midst of all this, the blockchain continues to maneuver, generally slowing down a bit and the chart twitching like a seismograph.

Modifications in foundries are a part of this. This can be a reminder that there’s gravity in regulating mining, that giant swimming pools replicate giant concentrations of energy, and that excessive climate can flip that focus right into a sudden jolt, seen even in your cell phone.

A broader hashrate decline is the opposite half. This can be a network-level pulse test, and it raises questions that even readers who’ve by no means cared about hashrate will perceive.

How susceptible is this technique when the climate will get bizarre?

The place are we going subsequent?

Trying forward, the conclusion is straightforward. Excessive climate has turn out to be a recurring stress check for US mining, and US mining has turn out to be a stress check for Bitcoin’s seen decentralization story.

If miners proceed to lean into the grid program, we are able to count on to see extra short-term cliffs throughout heatwaves and freezes.

If hashrate continues its upward development over time, the cliff might turn out to be sharper if margins are tight. That is the place Treasury’s actions begin to matter, as Riot and others have proven.

The following storm won’t simply be a climate story, it is going to be a techniques story.

That is what makes this attention-grabbing, even when the hashrate line rebounds after a day.