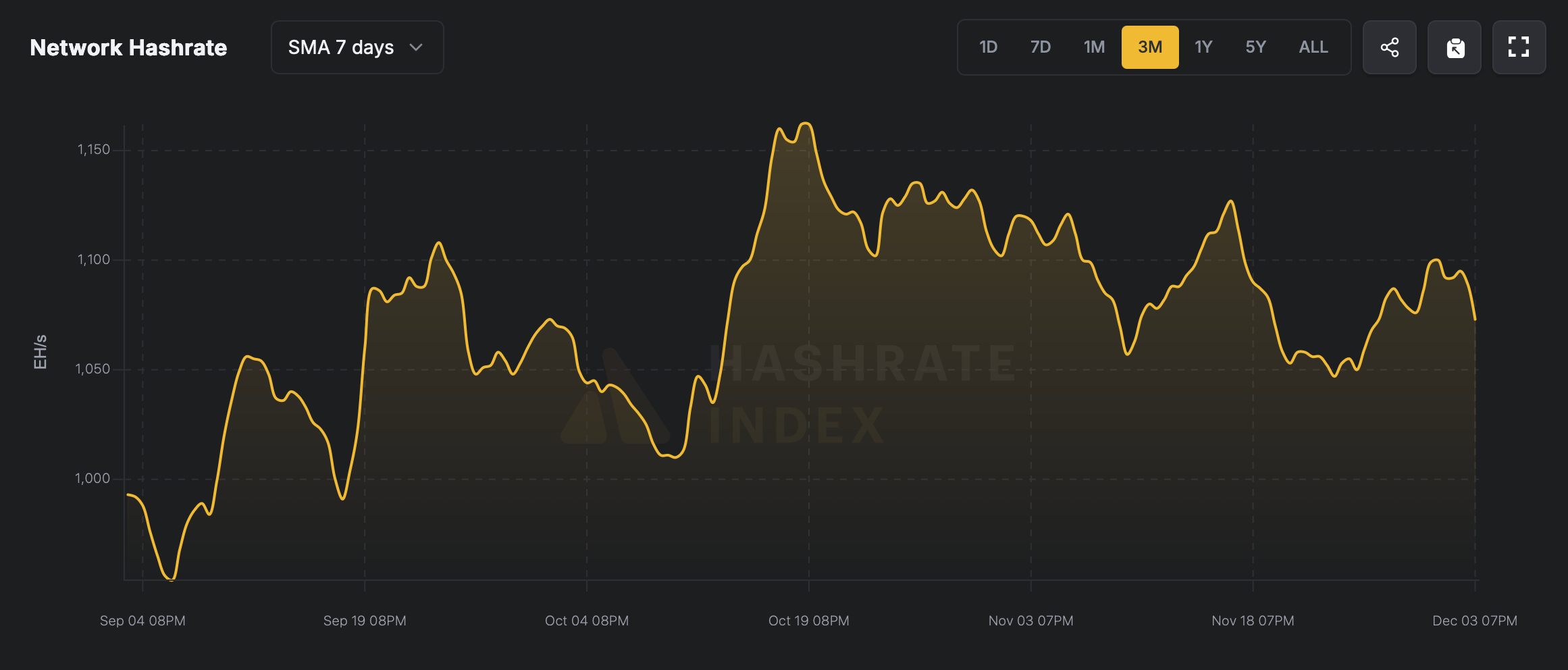

Bitcoin miners are lastly taking a breather as hash worth rises from the basement after hitting a extreme low only a few days in the past that put operations below stress. Regardless of this drop in income, the community’s hashrate has maintained its place, hovering inside a slim band between 1,050 exahashes per second (EH/s) and 1,100 EH/s.

Miners welcome hash worth rebound

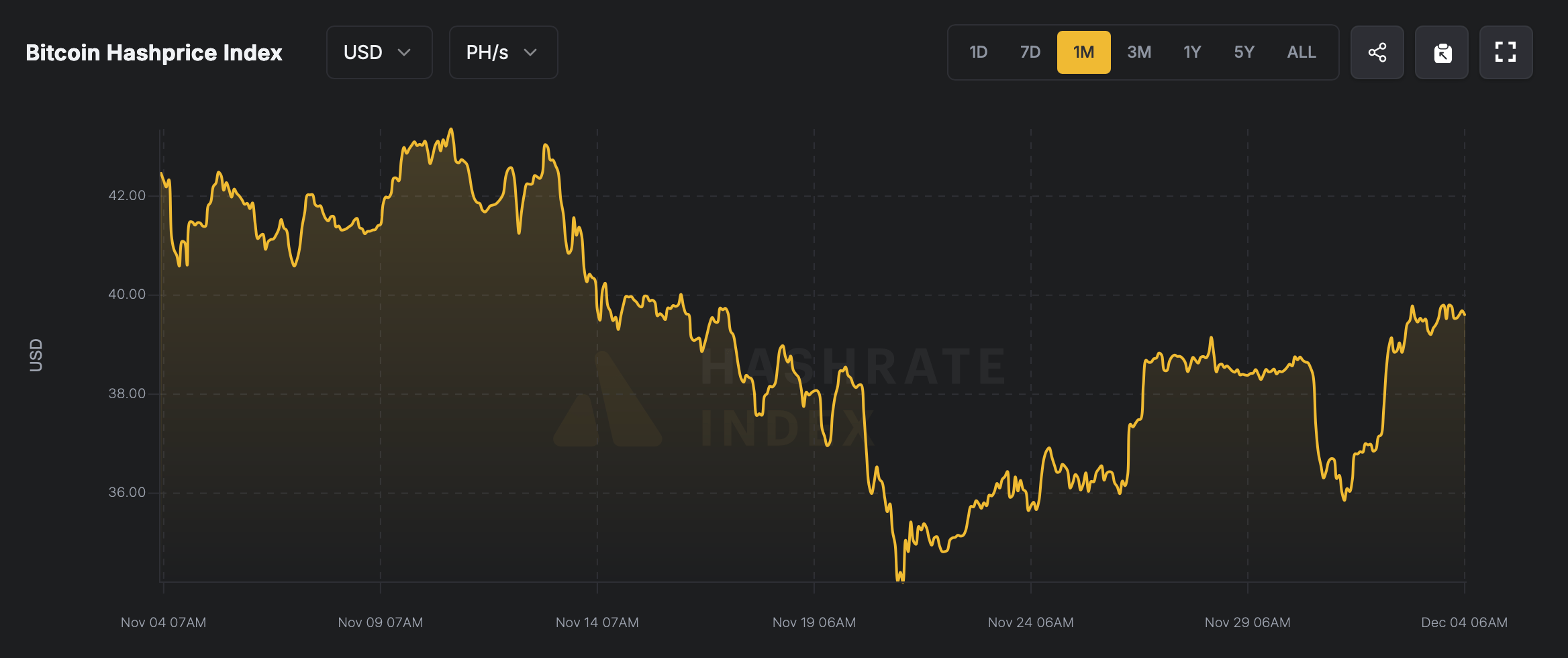

The latest rise in Bitcoin costs has given BTC miners a much-needed breath of contemporary air after weeks of declining earnings. On the final day of November, Hashprice bottomed out at $36.35 per petahash per second (PH/s), based on numbers from hashrateindex.com.

Merely put, hash worth is the sticker worth of 1 petahash of computing energy, which is actually the value {that a} miner expects for all of its output. Only a few days later, on December 1st, the hash worth was nonetheless depressed at $35.85 per petahash. The most recent worth motion over the previous day reversed the situation, with miners pulling in round $39.79 per PH/s because the hash worth inched again in the direction of the $40 zone.

Bitcoin hash worth for the final 30 days.

Regardless of the drop in every day returns, Bitcoin’s total hashrate has remained solidly above the 1 ZettaHash/Second (ZH/s) mark for fairly a while, and has by no means fallen under that threshold in years. Due to that stability, the block spacing has remained comparatively uneventful, so the anticipated issue changes on December eleventh might not be a lot of a aid.

In the mean time, miners nonetheless have about half of the two,016 block issue epoch left, so issues might change, however present estimates point out a modest decline of 1.34%. The block interval was barely behind the goal of 10 minutes, averaging about 10 minutes and eight seconds on Wednesday. If returns enhance, block instances might speed up as hashrate will increase, and issue epoch estimates might simply change accordingly.

Bitcoin hashrate over the previous 3 months.

At right this moment’s hash worth stage, the indicator continues to be 7.98% under its stage from 30 days in the past. On prime of that, November ranked because the fourth weakest month for miner income in 2025. Miners can overcome this predicament in quite a lot of methods, and being publicly traded is a large benefit. Corporations outdoors the civilian realm have relied closely on debt financing to construct up their army this 12 months, with many pivoting deeper into synthetic intelligence (AI) and high-performance computing (HPC) providers.

learn extra: Charles Schwab plans to broaden crypto buying and selling within the first half of 2026

AI and HPC have powered many Bitcoin mining operations by injecting further income streams. Lastly, Bitcoin mining gear continues to stage up, with producers pushing the boundaries of application-specific built-in circuit (ASIC) efficiency. Right now’s machines are able to greater than 0.5 petahash (1,000 terahash per second), and a full 1 PH/s unit is already inside attain.

General, the sector is tottering on slim revenue margins because of a mixture of grit, innovation and borrowed oxygen, however miners are by no means going to face nonetheless. With steady hash costs, diversified income streams, and the horsepower of next-generation ASICs, miners are having fun with some old school luck.

Steadily requested questions ❓

- What’s Hash Worth?Hash worth measures how a lot income miners earn for every petahash (or TH/s or EH/s) of computational energy.

- Why has miner income decreased just lately?Revenues have cooled as Bitcoin costs have weakened and hash costs have fallen to their lowest ranges this 12 months.

- How do miners survive?Many miners have turned to debt financing, AI providers, and high-performance computing (HPC) to extend their incomes.

- Are mining machines changing into extra environment friendly?Sure, producers have been rolling out extra highly effective ASIC rigs all 12 months lengthy, with half-petahash items now frequent, and 1 PH/s fashions additionally on the best way.