With a 24-hour buying and selling vary of $89,596 to $91,924 and a present worth of $90,617, Bitcoin’s Saturday buying and selling introduced extra yawns than roars. Its market capitalization of $1.8 trillion and buying and selling quantity of $32.66 billion recommend there’s nonetheless loads of curiosity. However curiosity just isn’t momentum, and momentum is what’s lacking.

Bitcoin chart outlook

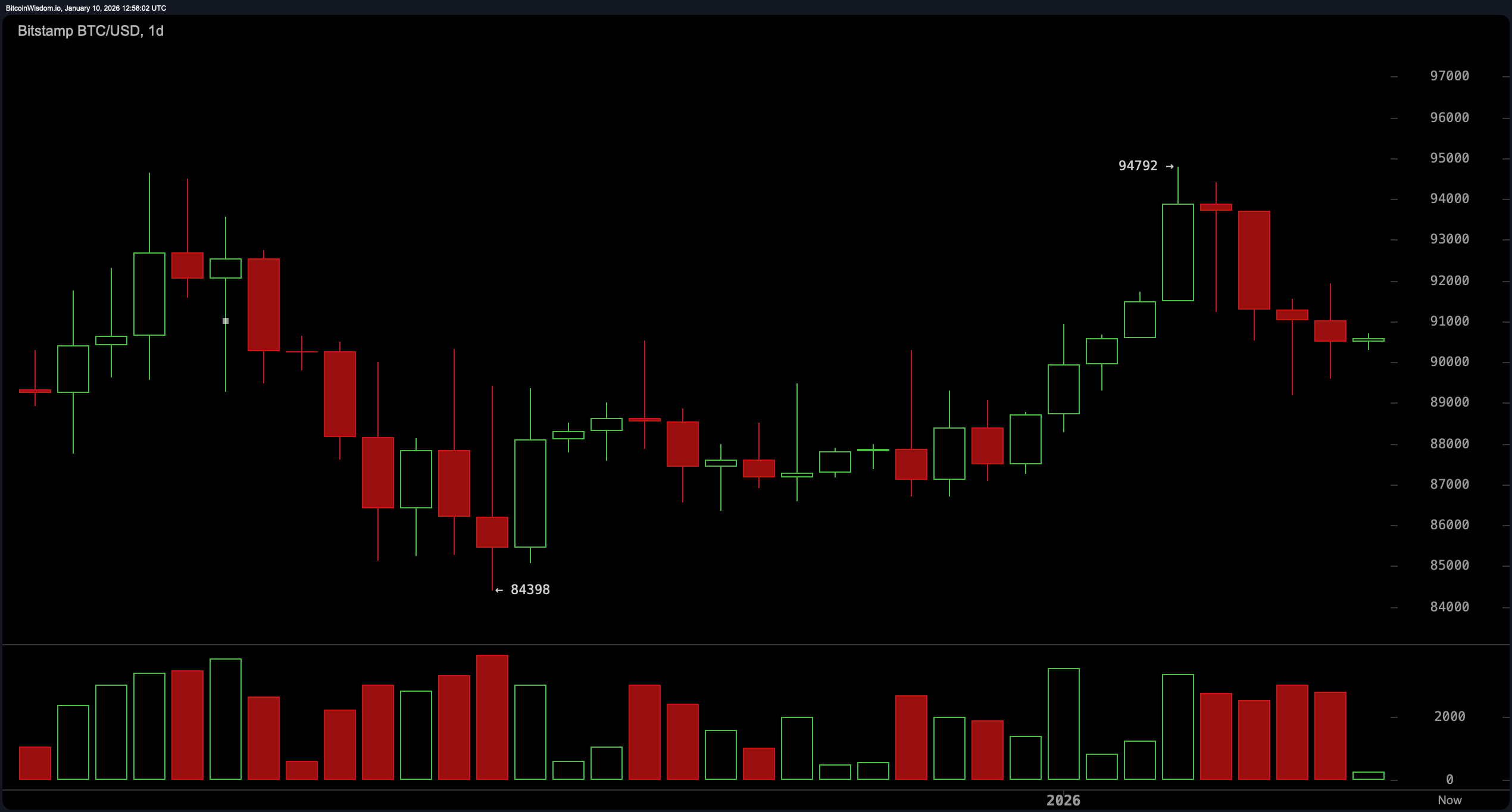

Trying on the day by day chart, it appears prefer it’s the tip of a dash. Bitcoin rose from $84,398 to $94,792 earlier than instantly dropping momentum. The latest three-day pullback has introduced the worth again right into a holding sample round $91,000. Notably, the drop in quantity throughout this exit was unusually massive and a traditional signal of bearish strain, regardless of the comparatively small day by day candlesticks.

That candle, someplace between hesitation and fatigue, suggests a traditional second of indecision. Merchants maintaining a tally of this body ought to see a robust shut above $92,000, ideally driving the quantity and driving shotgun, earlier than we get one other check of the resistance ceiling at $94,000 to $95,000.

BTC/USD 1-day chart by way of Bitstamp for January 10, 2026.

Trying on the 4-hour chart, optimism begins to fade. Bitcoin is buying and selling sideways within the $90,000 to $91,000 vary, and the worth construction suggests a possible bearish flag, a consolidation after a decline quite than an invite to the social gathering. Inexperienced Candle’s quantity is extraordinarily low, indicating both an absence of enthusiasm or a gross miscalculation on the a part of consumers. A decisive break under $90,000 might open the door to a retest of the $88,500 to $89,000 assist zone, particularly if quantity helps a decline.

BTC/USD 4-hour chart by way of Bitstamp on January 10, 2026.

The hourly chart tells the story of a market caught in a revolving door. Bitcoin stays throughout the $90,500 to $91,500 vary, and intraday breakout makes an attempt have been rapidly rejected, with a push to $91,924 failing. Quantity right here has been equally lackluster and volatility has subsided. This atmosphere is appropriate just for agile scalpers as there are tiny alternatives lurking between recognized assist and resistance ranges. Nevertheless, lack of perception makes overstaying an costly gamble in any commerce.

BTC/USD 1 hour chart by way of Bitstamp on January 10, 2026.

Oscillator measurements mirror this ambivalence. The Relative Energy Index (RSI) is 52, the Stochastic is 50, and the Commodity Channel Index (CCI) is 45, all flash impartial. The Common Directional Index (ADX) confirms the shortage of pattern power at 24, whereas the Superior Oscillator is meandering round 1,941 with no clear sign. The momentum indicator at 3,101 and the transferring common convergence divergence (MACD) degree at 509 are the one voices leaning bullish, however with out affirmation from different indicators, they really feel extra like hope than certainty.

It has been a tug-of-war throughout in terms of transferring averages (MAs). Brief-term and medium-term exponential transferring averages (EMAs) and easy transferring averages (SMAs) are divided into uptrends and downtrends. The ten-day EMA and SMA are each flashing purple, whereas the 20-day and 30-day averages are leaning inexperienced. Lengthy-term indicators are decisively bearish. The 100-day and 200-day EMA and SMA are all deep in purple territory, suggesting that the macro pattern continues to be cooling regardless of short-term stabilization. It is a sideways shuffle, and the chart is asking for persistence quite than prediction till Bitcoin climbs above $92,000 or dips under $90,000.

Bullish verdict:

If Bitcoin can regain $92,000 with conviction and quantity, short-term momentum might return and pave the best way for a retest of the $94,000 to $95,000 vary. Help from the medium-term transferring averages and bullish alerts from momentum indicators and the transferring common convergence divergence (MACD) present some tailwind, assuming the bulls can keep awake.

Bear verdict:

Bitcoin is liable to falling under the $90,000 mark as the worth motion will get caught under a serious resistance degree, probably leading to a bear flag on the 4-hour chart. Weak upside quantity and bearish strain from the long-term transferring common recommend that the latest uptrend is easing, and a draw back in the direction of $88,500 might be on the menu once more.

Ceaselessly requested questions ❓

- What’s the present worth of Bitcoin?As of 8:45 a.m. Japanese Time, Saturday, January 10, 2026, the worth of Bitcoin is $90,617.

- Is Bitcoin in an uptrend or a downtrend? Bitcoin is at present consolidating after a latest uptrend, and there are indicators of indecision within the quick time period.

- What’s the buying and selling vary for Bitcoin as we speak?Costs for twenty-four hours vary from $89,596 to $91,924.

- What are the necessary Bitcoin assist and resistance ranges?Help is situated close to $90,000 and resistance is situated close to $92,000 to $95,000.