On January 12, President Donald Trump declared through Reality Social that america would impose 25% tariffs on all international locations doing enterprise with Iran, “efficient instantly.”

Bitcoin (BTC) briefly fell beneath $91,000, however rose above $92,000 inside hours. The liquidation cascade by no means materialized. There isn’t a systematic mitigation. The market absorbed the maximalist-like geopolitical headlines and moved on.

On the time of writing this text, BTC The inventory rose 1.5% up to now 24 hours and was buying and selling close to $94,000.

An identical announcement got here three months earlier when President Trump threatened to impose 100% tariffs on China in October 2025, inflicting over $19 billion in pressured liquidations and sending Bitcoin down over 14% in a matter of days.

This distinction raises a easy query. Why did one tariff headline burst onto the market whereas the opposite barely registered?

The reply just isn’t that merchants are numb to President Trump’s feedback. That’s, the market at the moment evaluates the value of coverage bulletins by means of a filter of credibility. Particularly, the hole between social media posts and enforceable insurance policies.

January twelfth scored low on each reliability and immediacy, and October tenth scored excessive on each, arriving in a market primed to blow up.

reliability hole

The White Home didn’t publish a corresponding govt order similtaneously President Trump’s “Reality Social” announcement. No Federal Register discover was revealed. There isn’t a Customs and Border Safety steering defining what “transactions with Iran” really means or which transactions are topic to the 25% tax.

The report notes that no formal documentation exists and that the authorized foundation is unclear.

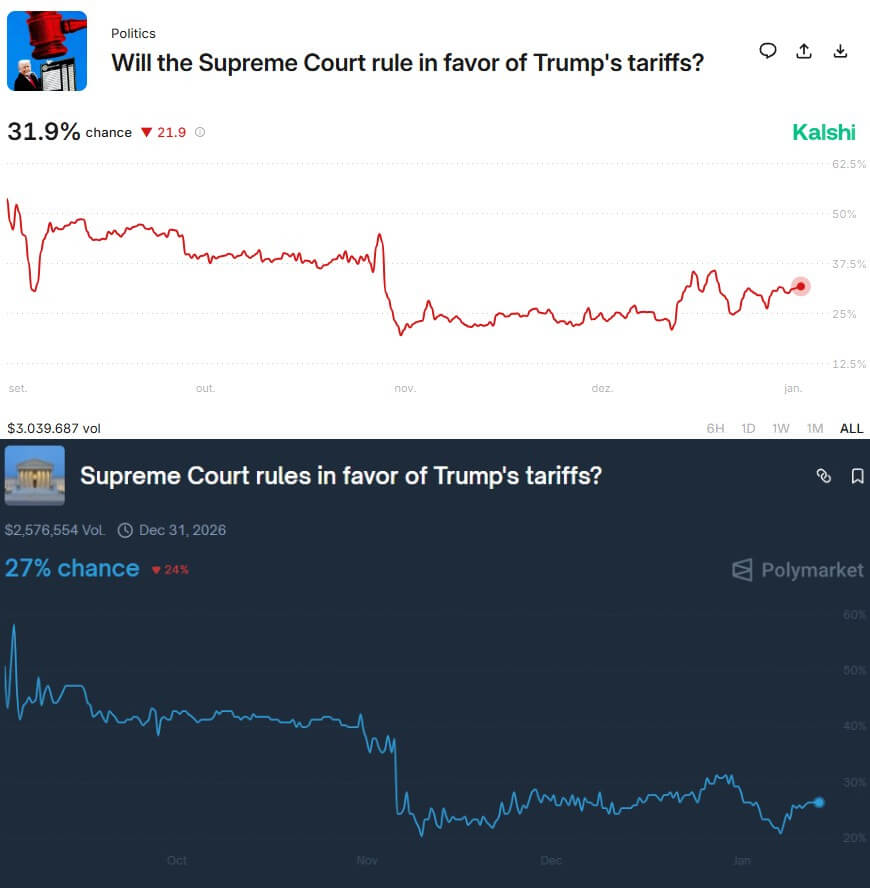

The absence is critical as a result of the Supreme Courtroom is at the moment contemplating whether or not President Trump exceeded his authority to impose tariffs utilizing the Worldwide Emergency Financial Powers Act (IEEPA).

Decrease courts had already dominated that IEEPA tariffs have been extreme, and people choices have been stayed pending the excessive court docket’s determination.

Polymarket odds give the Supreme Courtroom solely a 27% likelihood of upholding the tariff determination, whereas Calci’s odds are barely greater at 31.9%.

Merchants have been already discounting tariff powers earlier than Iran’s announcement was launched. Within the absence of clear enforcement mechanisms or authorized certainty, markets handled this headline as conditional steering fairly than instant coverage.

That is reliability discounting in motion. The specter of tariffs might sound intensive on paper, however commerce it like an possibility till the paperwork and enforcement timelines are clear.

Why was October damaged and January bent?

October tenth was greater than only a headline. This was a reputable macro shock that hit a structurally weak market. President Trump’s announcement of 100% tariffs concentrating on China was accompanied by a transparent geographic scope, an specific commerce conflict framework, and instant asset-to-asset repricing.

Escalation between america and China is acknowledged globally as a threat set off. In distinction, Iran-related commerce restrictions function in a extra ambiguous coverage area, the place current sanctions already prohibit commerce flows.

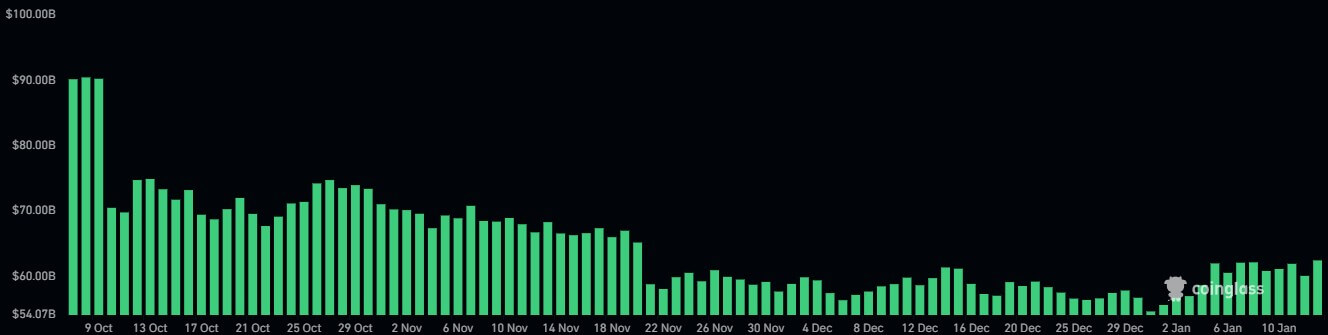

Much more vital was what was written underneath the heading. In early October, open curiosity in perpetual futures rose to near-record ranges, funding charges grew to become persistently constructive, and leveraged positions have been concentrated in a slim vary.

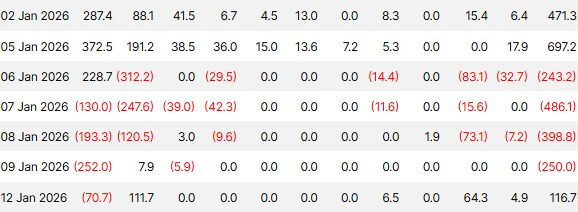

As soon as information of the tariffs broke, they have been pressured to liquidate in addition to reprice their dangers. Bitcoin fell to $104,782 however stabilized after greater than $19 billion in liquidations. That wave of liquidations was a mechanical unwinding attributable to pressured gross sales and evaporation of liquidity, fairly than new details about the basics of cryptocurrencies.

In distinction, the setup on January 12 appeared totally different. Based on CoinGlass knowledge, the present open curiosity stands at roughly $62 billion. Whereas it is a excessive quantity, it’s properly beneath the $90 billion seen earlier than the October 10 washout.

Moreover, funding charges have been hovering in a modest vary of 0.0003-0.0008% per 8-hour interval, properly beneath the congested long-term threshold that amplifies drawdowns.

Deribit not too long ago famous that seven-day at-the-money implied volatility has spiked by about 10 quantity factors, in step with merchants shopping for hedges and re-pricing tail dangers. Nonetheless, the spot was held.

Bitcoin ETFs recorded web inflows of roughly $150 million in January, in line with knowledge from Pharcyde Traders. This means that institutional flows are offsetting headline-driven promoting strain, albeit by a small margin.

The outcome was a dip-and-recovery sample fairly than a cascade. Markets that hedge extra rapidly and keep deeper liquidity don’t transmit geopolitical noise to systemic breaks.

October’s liquidation spiral required each a dependable shock and a market construction able to amplify it. In January, we had neither.

Iran’s commerce efficiency and precise transmission channels

If the specter of tariffs have been to be instantly enforceable, it could be an issue not for Iran itself however for China.

China is by far Iran’s largest buying and selling associate. Based on Reuters, China will import $22 billion of Iranian merchandise in 2022, greater than half of which was oil.

In 2025, China will buy greater than 80% of Iran’s exported crude oil, averaging about 1.38 million barrels per day, equal to about 13.4% of China’s seaborne imports.

In different phrases, any critical try to punish “international locations that do enterprise with Iran” would basically be about China, and Brazil would even be in danger by means of its agricultural exports to Iran.

A part of the explanation the market reductions bulletins is the complexity of execution. There isn’t a clear concentrating on mechanism, no apparent approach to isolate Iran-related transactions with out disrupting broader commerce flows, and no precedent for a way such a regime would work in apply.

An vital transmission route is oil. Brent crude oil is buying and selling round $64 a barrel and West Texas Intermediate is buying and selling round $59.70, with analysts estimating a geopolitical threat premium associated to tensions over Iran at $3 to $4 a barrel.

If this premium persists and causes sustained upward strain on inflation expectations, the true injury to cryptocurrencies will come by means of rate of interest channels resembling greater oil costs, greater inflation expectations, greater actual yields, and decrease threat property.

The vulnerability of cryptocurrencies to geopolitics just isn’t direct, however happens not directly by means of macro-repricing.

A framework for pricing coverage noise

The sample that emerges when evaluating January twelfth and October tenth is simple. Coverage headlines transfer markets after they mix credibility, immediacy, and susceptible positioning.

Decompose the response perform into parts.

October tenth acquired a excessive rating for credibility as a consequence of its clear concentrating on of China and rhetoric of escalating commerce wars. It additionally acquired excessive scores for immediacy to direct tariff threats as a consequence of broad market interpretation, document open curiosity, crowded positioning, and excessive leverage vulnerability as a consequence of low hedging.

In the meantime, the January 12 report acquired a low rating for credibility as a consequence of a scarcity of official documentation. It additionally ranked low when it comes to immediacy and average when it comes to leverage as a consequence of uncertainty within the scope and timing of execution. It is up however not excessive, as we’re seeing lively hedging within the quantity market.

The market’s muted response to January twelfth was not as a consequence of irrational feelings or insensitivity. This was an inexpensive repricing from an enforcement and positioning perspective.

One thing that would flip the script

The present primary state of affairs is that the specter of Iran tariffs stays an unstoppable headline. That is an possibility for merchants to observe, however to not actively value till an implementation mechanism emerges.

Nonetheless, a number of situations can change that calculation.

A proper govt order with a transparent enforcement scope, naming particular sectors and buying and selling companions, and setting a ultimate begin date will vastly enhance each credibility and immediacy.

Markets might want to reassess the tail threat that broad Iran-related tariffs do happen, instantly complicating oil flows and diplomatic relations with China.

If the Supreme Courtroom upholds President Trump’s emergency tariff authority underneath IEEPA, future tariff bulletins would regain credibility even with out full documentation. Conversely, if the courts strike down the system, the specter of tariffs would lose its structural impression, however short-term volatility round refund obligations may trigger confusion amongst property.

If the geopolitical threat premium for oil persists and inflation expectations rise sufficient to push actual yields greater, cryptocurrencies will face declines by means of the rate of interest channel, no matter whether or not Iran tariffs materialize.

The leverage and liquidity dynamics that disrupted markets in October may rapidly restructure if positioning turns into crowded once more and funding charges return to rising territory.

What cryptocurrencies have realized

The lesson of January twelfth just isn’t that cryptocurrencies are proof against geopolitical dangers. That’s, cryptocurrencies at the moment are proof against unenforceable geopolitics, a minimum of till leverage is restored.

Markets that value coverage by means of confidence filters, hedge aggressively, and keep depth can take up headline volatility with out it cascading. You may’t do it in a market that does not have that.

President Trump’s risk of Iran tariffs landed on an tailored construction. Merchants purchased volatility as a substitute of promoting spot. Open curiosity continued to rise, however not by a lot. Institutional flows offset retail anxiousness. The outcome was a decline that recovered inside hours fairly than a wave of liquidations that worsened over days.

Fragility has not disappeared. It is conditional. If confidence will increase, immediacy will increase, and leverage rebuilds to October’s excessive ranges, the subsequent tariff headline or the subsequent macro shock may set off the identical chain response.

Till then, cryptocurrencies will proceed to deal with maximalist bulletins as negotiating positions fairly than viable insurance policies. The Supreme Courtroom will resolve whether or not the low cost is justified.