With cryptocurrency, analysts scratched their heads making an attempt to establish the perpetrator behind the value motion. In the meantime, the establishment merely took benefit of reductions.

The engine is loaded into BTC as BTC slips under $115k

Bitcoin (BTC) is thought for being unstable, however a 3% retreat on Friday was caught by many surprises. Digital belongings traded inside an unusually wide selection, peaking at $119,535.45, immersed in $114,759.82 over the past 24 hours. Some lamented the volatility, however the company went crypto buying.

In keeping with a press launch launched Friday, electrical automobile (EV) producer Volcon, Inc. (NASDAQ: VLCN) bought 3,183.37 BTC at a mean buy worth of $117,697 per coin. The corporate says it launched its Bitcoin monetary technique final week.

(Volcon manufactures EVs comparable to this utility job automobile (UTV), however lately adopted Bitcoin Treasury Technique. / volcon.com)

“Our monetary technique displays Bitcoin’s conviction as a sturdy long-term worth and a robust Treasury reserve asset,” stated Volcon co-CEO Ryan Lane. “As a seamless aggregator for BTC, we are going to leverage our workforce’s many years of hedge fund expertise to implement artistic methods to decrease the efficient buy worth of BTC.”

And it seems that Volcon is simply beginning out. The corporate stated it might “need to purchase further BTC for $115,000, $116,000 and $117,000.”

One other firm, The Smarter Net, a public British Net Design firm, additionally introduced its buy of Bitcoin on Friday. In keeping with a press launch, the corporate started accepting Bitcoin funds in 2023 and applied its official 10-year BTC acquisition technique in April 2025. Smarter Net bought 225 Bitcoin and at present holds a complete of 1,825 BTC on the Ministry of Finance.

If BTC retreats are all the time rushed by establishments to “purchase DIP” anytime, then as some have assumed, Bitcoin winter days could now be a factor of the previous.

Market Metric Overview

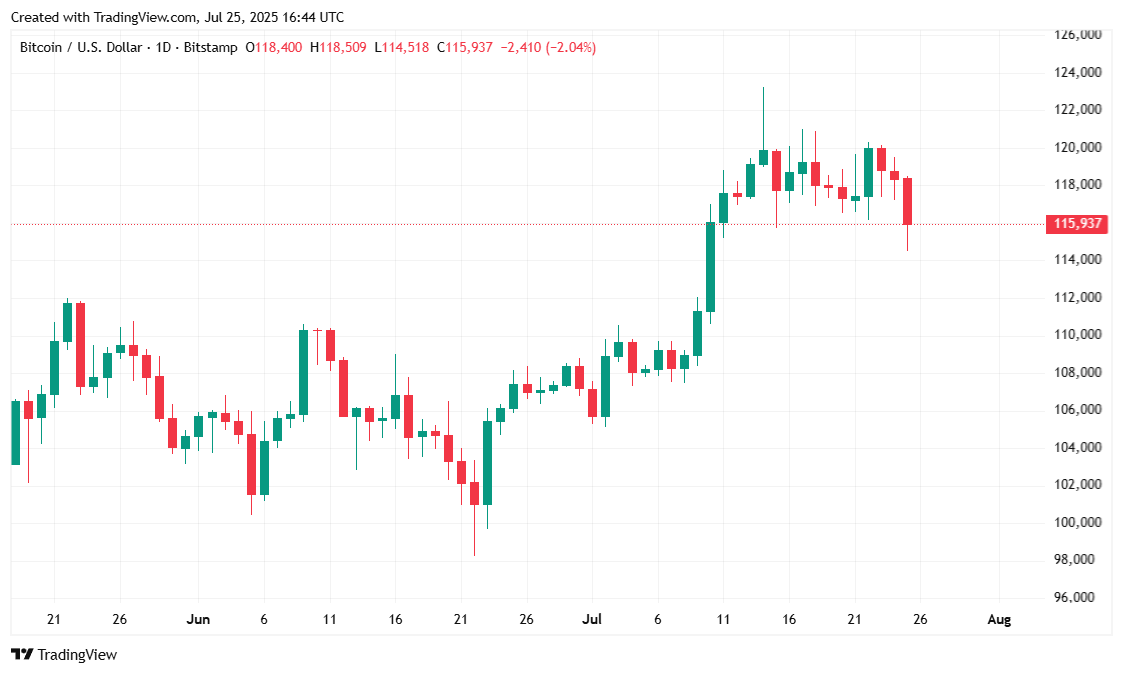

Bitcoin was down 1.72% over seven days, down 115,890 on the time of reporting, down 2.74% over the previous day. As talked about above, the volatility was comparatively excessive, with costs rising between $114,759.82 and $119,472.65.

(BTC Worth/Commerce View)

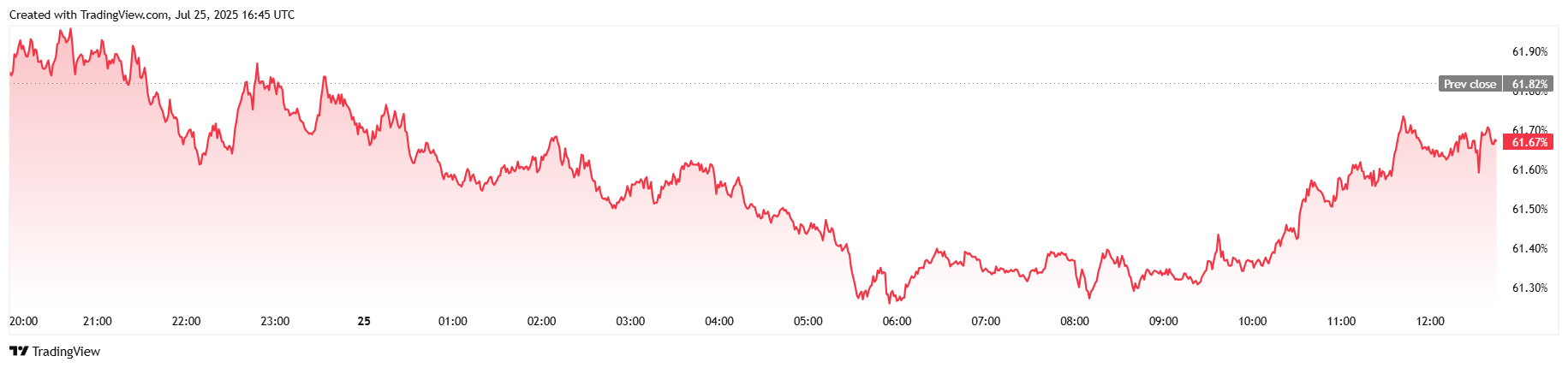

The 24-hour buying and selling quantity rose practically 40% to $1024.2 billion, however Bitcoin’s market capitalization fell 2.65% to $2.3 trillion. The BTC benefit additionally fell by 0.21% to 61.67%.

(BTC dominance/commerce view)

Complete curiosity on Bitcoin futures elevated by 3.86% per day to $875.5 billion, with the full day by day Bitcoin liquidation totaling $16208 million. The long-positioned bull managed that complete and was worn out by an adjustment of $14612 million, whereas the short-positioned bear was liquidated by $15.95 million.