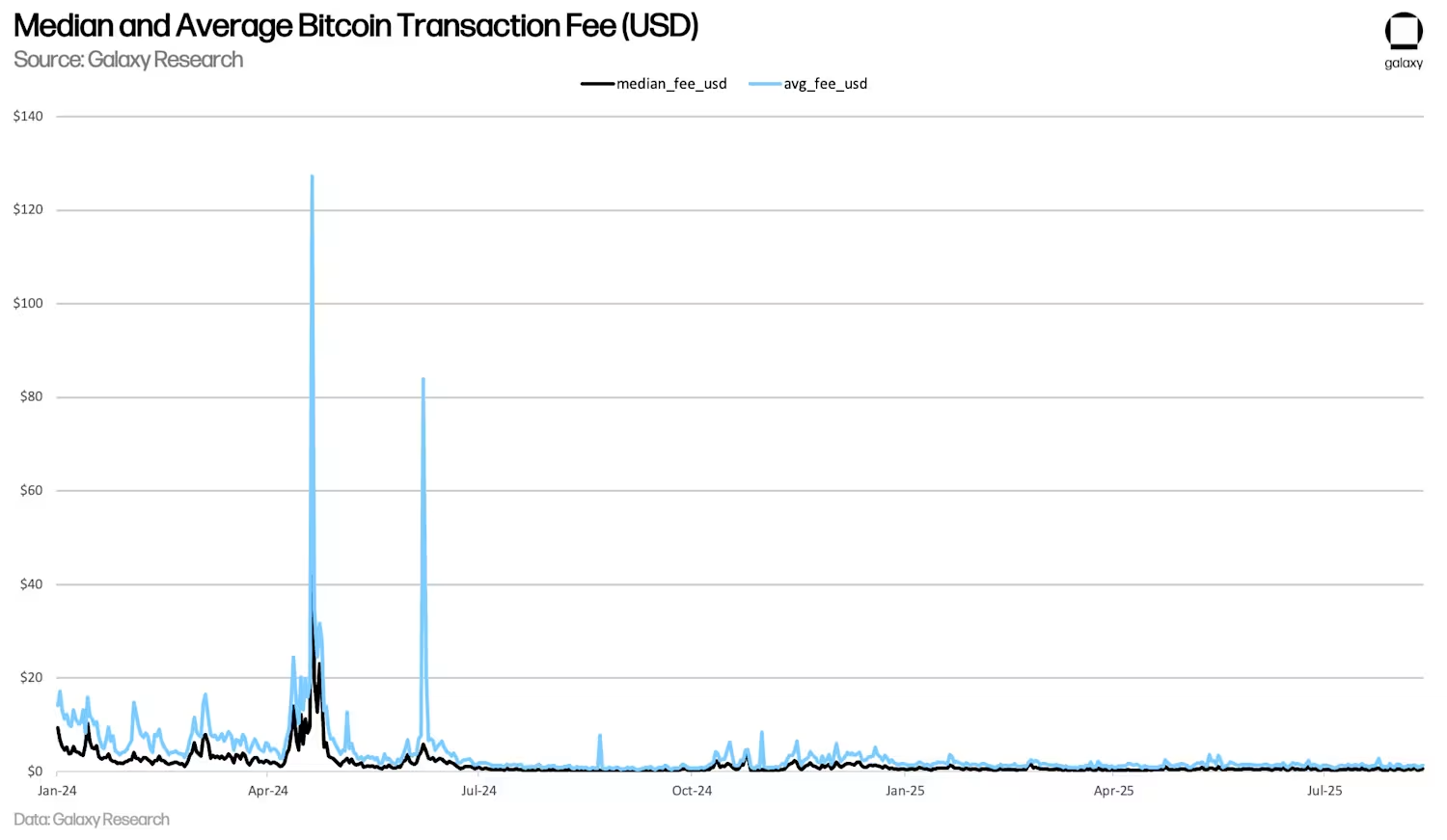

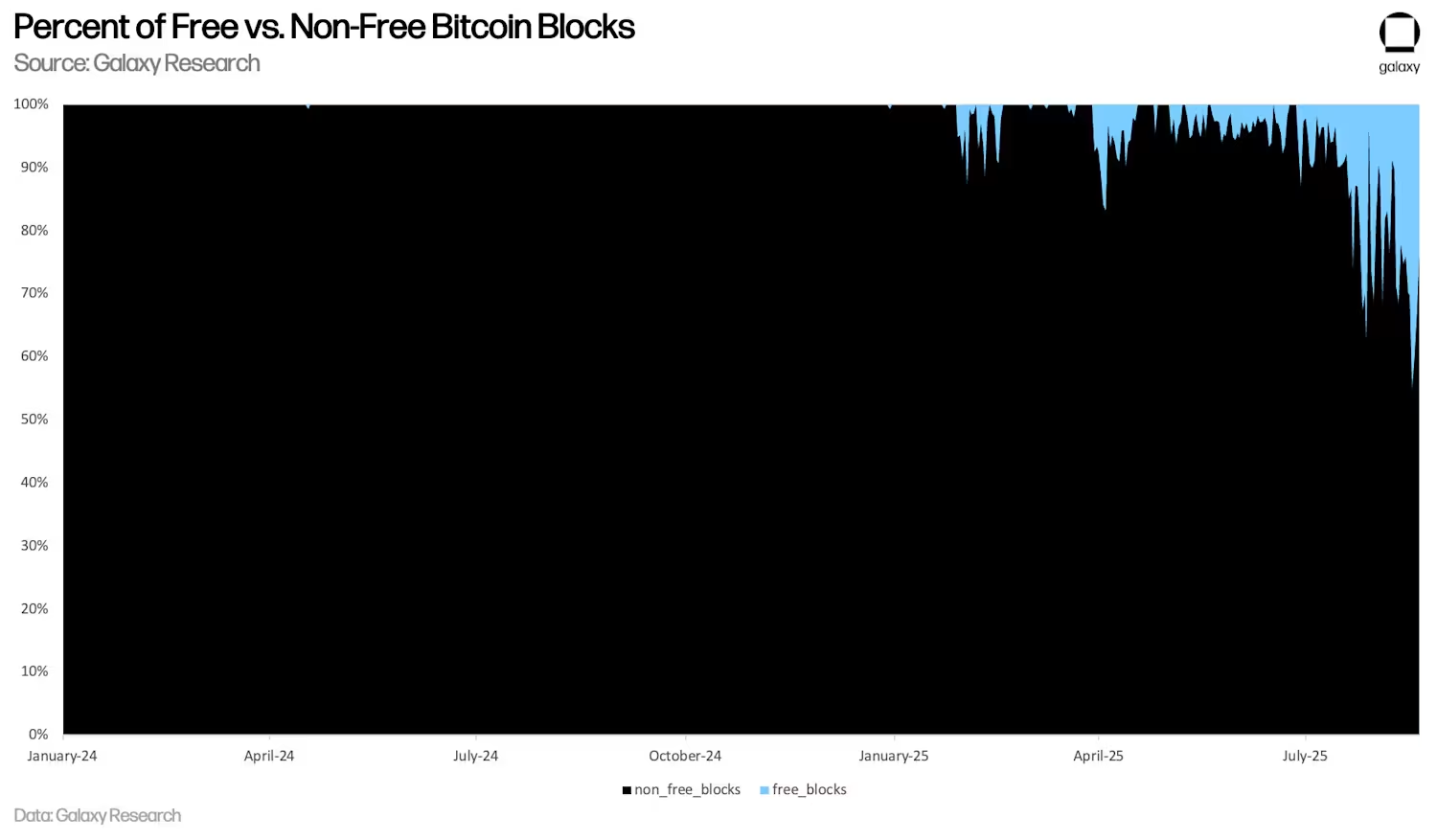

In keeping with a report by Galaxy Digital, Bitcoin Community’s day by day buying and selling charges have collapsed by greater than 80% since April. As of August 2025, virtually 15% of blocks have been “free”, that means that they’re mined with only one Satoshi beneath digital bytes at a minimal of buying and selling charges or none.

Whereas low transaction charges in Bitcoin (BTC) profit customers, it reduces miners’ income and raises issues in regards to the sustainability of the community’s long-term safety mannequin.

Bitcoin’s incentive construction depends on miners being compensated for his or her work by block compensation and transaction charges. Nevertheless, by reducing the rewards to three.125 BTC per block in April 2024, miners are leaning closely in direction of the speed market, which is draining.

Pierre Samaties, chief enterprise officer of the Dfinity Basis, advised Cointelegraph. “If utilization would not develop, its base is skinny and weakens the guarantee. Maintained throughput is important for the system to guard itself.”

Common Bitcoin buying and selling charges. Supply: Galaxy Digital

Associated: Bitcoin 2025 Builder predicts that defi will unlock conventional finance

Bitcoin on-chain exercise stoop

Bitcoin’s on-chain exercise has been considerably slower because the decline in non-financial tendencies like ordinals and runes. The Galaxy report factors out that OP_Return transactions, that are closely used through the 2024 ordinance growth, at the moment account for 20% of day by day quantity from over 60% at peak occasions.

In the meantime, various layer 1, like Solana, has gained the traction of high-frequency use instances akin to MemeCoin and NFTS. Moreover, the rise in Spot Bitcoin ETFs, which at the moment are over 1.3 million btc, has pushed extra BTC quantity off-chains and restricted the transfer to generate charges in any other case.

The Bitcoin price market is versatile by design. Because of this demand will improve quickly and slower exercise will lead to larger charges as costs drop. Nevertheless, as demand continues to shrink, miners could have too few incentives to guard their networks. Galaxy famous that just about 50% of the blocks aren’t full today, and that Mempool’s exercise stays sluggish.

The rise of free blocks on the Bitcoin community. Supply: Galaxy Digital

Towards this background, new hope is being created within the type of BTCFI and Bitcoin native defi. In contrast to Ethereum and Solana Defi, which use sensible contracts in these chains, BTCFI makes use of Bitcoin as its base asset to construct monetary purposes akin to lending, buying and selling, and yield era of layers or protocols that work together immediately with the Bitcoin community.

“All BTCFI actions require Bitcoin switch,” defined Samaty. “Actions drive calculations, calculations devour block area, and area prices.” In different phrases, as BTCFI grows, Onchain exercise and price revenues additionally improve.

Associated: The way forward for defi will not be in Ethereum – it’s in Bitcoin

From digital gold to monetary primitives

Samaties famous that Bitcoin has lengthy been thought-about “digital gold” value greater than its usable belongings. However he thinks it has advanced into one thing extra elementary: monetary primitive.

“Monetary primitives are constructing blocks that builders can use to design flows, instruments and logic,” he stated. “In its position, Bitcoin will grow to be greater than an asset it holds, changing into a programmable element inside the broader monetary system.”

Julian Mezger, chief advertising and marketing officer at Liquidium, stated infrastructure enhancements are setting a stage of change. “For the previous 5 years, we have modified the Bitcoin infrastructure from a easy funds tier to a multi-tiered ecosystem,” he stated. “We’re now seeing the inspiration of true Bitcoin native obligations.”

journal: Bitcoin is “humorous web cash” through the disaster: Tezos co-founder