Philip Lane, chief economist on the European Central Financial institution, warned that the majority markets have been being handled as European housekeeping. Though the ECB can stay accommodative in the interim, the Federal Reserve’s “struggle” over its independence obligations might destabilize international markets by means of an increase within the US time period premium and a reassessment of the greenback’s position.

The Lane framework is vital as a result of it reveals the exact transmission channels that matter most to Bitcoin, together with actual yields, greenback liquidity, and the credibility scaffolding that holds the present macro regime collectively.

The instant set off for the cooling was geopolitical. As issues a few U.S. assault on Iran recede, the chance premium for oil has pale, with Brent costs falling to about $63.55 and West Texas Intermediate to about $59.64 on the time of writing, a correction of about 4.5% from their January 14 peak.

This has severed the pipeline from geopolitics to inflation expectations to bonds, at the least briefly.

However Lane’s feedback level to a distinct type of danger: that political strain on the Fed, quite than shocks or the supply of development knowledge, might trigger markets to reprice U.S. belongings on governance quite than fundamentals grounds.

The IMF has warned in current weeks that the Fed’s independence is in danger, saying the erosion could be “credit score adverse.” That is the type of institutional danger that reveals up in time period premiums and international change danger premiums earlier than it reveals up within the headlines.

Time period premium is a portion of long-term yield that compensates buyers for uncertainty and length danger, separate from anticipated future short-term rates of interest.

As of mid-January, the New York Fed’s ACM time period premium stays at about 0.70%, whereas FRED’s 10-year zero-coupon estimate places it at about 0.59%. The nominal yield on the 10-year Treasury notice on January 14th was roughly 4.15%, the actual 10-year TIPS yield on January fifteenth was 1.86%, and the five-year breakeven inflation expectation was 2.36%.

Whereas these are steady measures by trendy requirements, Lane factors out that stability might shortly erode if markets begin pricing in governance reductions for U.S. belongings. Time period premium shocks don’t require the Fed to lift charges, as a result of they happen when confidence declines and long-term rates of interest can rise even when coverage charges stay unchanged.

Common premium channel as low cost fee channel

Bitcoin operates in the identical low cost fee world as shares and period-sensitive belongings.

When the time period premium rises, long-term rates of interest rise, monetary circumstances tighten, and the liquidity premium is compressed. The ECB’s analysis paperwork how the greenback has strengthened following the Fed’s tightening throughout a number of coverage dimensions, making U.S. rates of interest core to international pricing.

Bitcoin’s historic upward torque is pushed by a widening liquidity premium. That’s, when actual yields are low, low cost charges are free, and danger urge for food is excessive.

A time period premium shock reverses that dynamic even when the Fed doesn’t change the federal funds fee. This is the reason Lane’s framework is vital for cryptocurrencies, regardless that he was addressing European policymakers.

The greenback index was round 99.29 as of January 16, close to the decrease finish of its current vary. Nonetheless, Lane’s phrases “reassessing the position of the greenback” open up not one, however two completely different eventualities.

In a basic yield differential regime, rising U.S. yields would trigger the greenback to understand, tightening international liquidity and placing strain on danger belongings similar to Bitcoin. Analysis reveals that since 2020, cryptocurrencies have change into more and more correlated with macro belongings, with some samples exhibiting a adverse relationship with the greenback index.

Nonetheless, within the credit score danger regime, the outcomes are dichotomous. If buyers demand a reduction for the governance dangers of U.S. belongings, time period premiums might rise even when the greenback weakens or rips. In that situation, Bitcoin might commerce like a aid valve or different monetary asset, particularly if inflation expectations rise together with reliability issues.

Moreover, Bitcoin is now buying and selling extra carefully tied to shares, synthetic intelligence narratives, and Fed indicators than in earlier cycles.

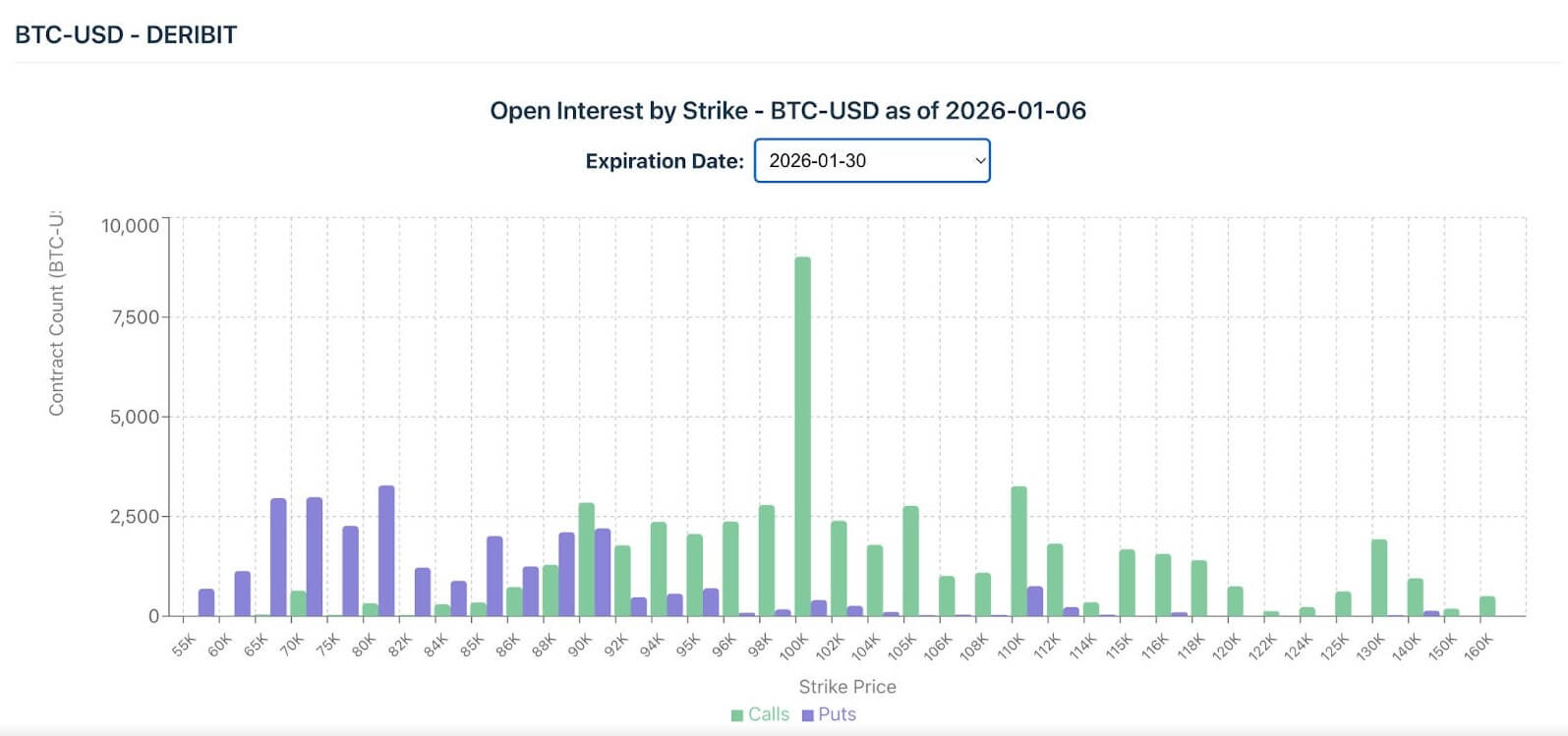

Bitcoin ETFs have returned to web inflows, with web inflows exceeding $1.6 billion in January, in keeping with knowledge from Pharside Buyers. Coin Metrics famous that spot possibility open curiosity is centered on $100,000 in train till expiration in late January.

This positioning construction means macro shocks may be amplified by means of leverage and gamma dynamics, doubtlessly turning Lane’s summary “time period premium” issues into concrete catalysts for volatility.

Stablecoin piping makes greenback danger crypto-native

Nearly all of the transaction layer of cryptocurrencies is run in dollar-denominated stablecoins backed by safe belongings (typically U.S. Treasuries).

Analysis from the Financial institution for Worldwide Settlements hyperlinks stablecoins to cost actions in safe-haven belongings, that means time period premium shocks are usually not only a “macro vibe.” It may well influence stablecoin yields, demand, and on-chain liquidity circumstances.

A rise within the time period premium will increase the price of holding interval, which has implications for stablecoin reserve administration and may change the liquidity obtainable for danger buying and selling. Bitcoin is probably not a direct substitute for Treasury, however it exists inside an ecosystem the place Treasury pricing units the usual for what it means to be “risk-free.”

Markets presently see a roughly 95% likelihood that the Fed will go away rates of interest unchanged at its January assembly, with main banks pushing ahead with anticipated fee cuts to the second half of 2026.

This consensus displays confidence within the continuity of short-term insurance coverage, with fastened time period premiums. However Lane’s warning is forward-looking: If that confidence falters, time period premiums might rise by 25 to 75 foundation factors in a matter of weeks with out altering fund charges.

As a mechanical instance, if the time period premium will increase by 50 foundation factors whereas anticipated short-term rates of interest stay unchanged, the nominal yield on the 10-year might transfer from roughly 4.15% to 4.65%, and the actual yield would reprice accordingly.

Within the case of Bitcoin, this implies more durable circumstances and draw back danger by means of the identical channels that put strain on long-term shares.

The choice situation of a credibility shock leading to a weaker greenback yields a distinct danger profile.

If international buyers diversify away from U.S. belongings for governance causes, the greenback might fall whilst time period premiums rise, and Bitcoin volatility would spike in both course relying on whether or not the yield differential or credit score danger regime prevails.

Whereas educational analysis has debated Bitcoin’s inflation-hedging properties, the dominant channels in most danger regimes stay actual yields and liquidity, not simply breakeven inflation expectations.

Lane’s framework permits for each prospects, which is why “greenback repricing” shouldn’t be a unidirectional wager, however a turning level within the system.

what to see

The guidelines for monitoring this story is easy.

Macro elements embrace the time period premium, 10-year TIPS actual yield, 5-year break-even inflation expectations, and the extent and volatility of the greenback index.

On the crypto facet, spot Bitcoin ETF flows, possibility positioning round key strikes similar to $100,000, and skew adjustments to macro occasions.

These indicators join the dots between Mr. Lane’s warning and Bitcoin worth tendencies with out requiring hypothesis about future Fed coverage selections.

Though Lane’s message was aimed on the European market, the pipes he described are the identical ones that decide Bitcoin’s macro atmosphere. Though the oil premium has pale, the governance dangers he identified stay.

If markets begin pricing in a Fed struggle, the shock won’t be confined to america. That can be transmitted by means of the greenback and the yield curve, and Bitcoin will register its influence earlier than most conventional belongings.