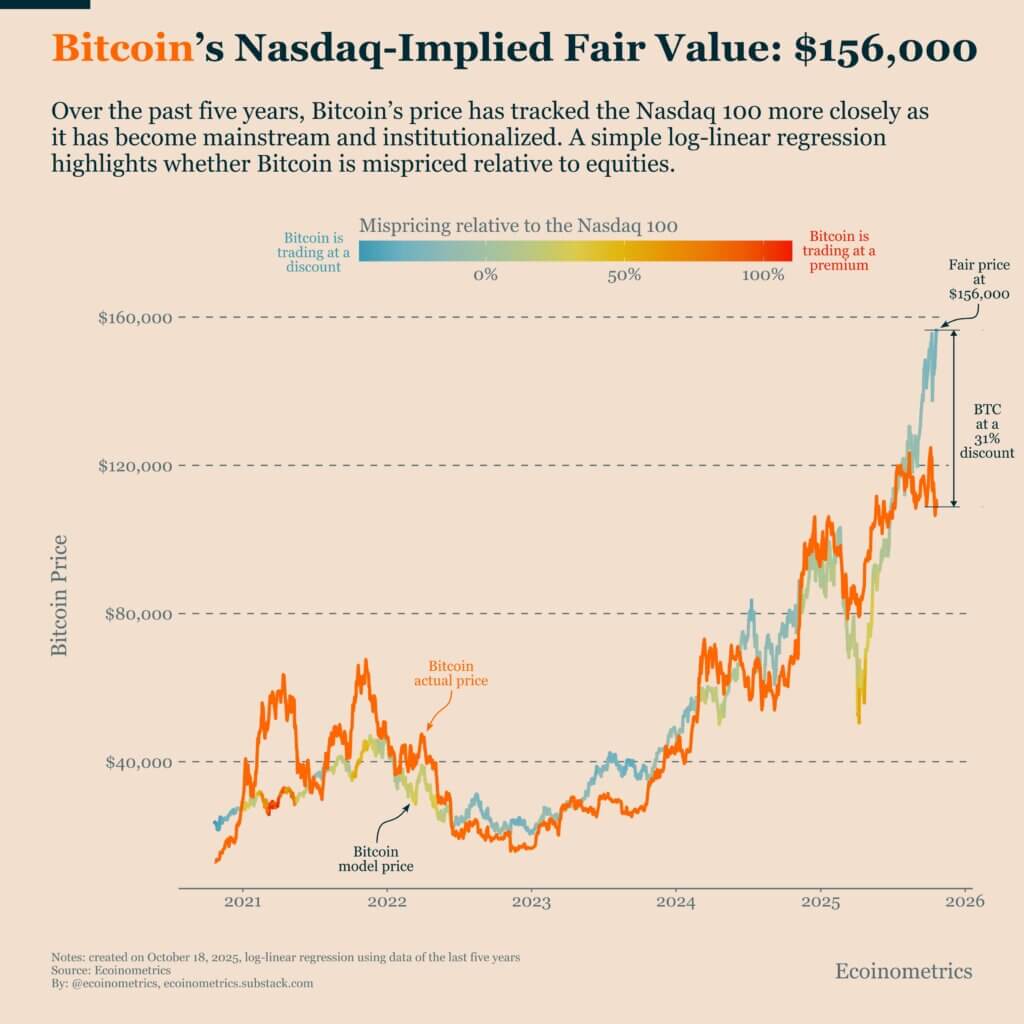

Bitcoin at the moment trades at a couple of 30% low cost in comparison with its truthful worth as implied by the Nasdaq 100. Any high-conviction Bitcoiner already is aware of how low-cost the asset is at the moment, however this ratio proportionately highlights the knocked down BTC value. And it is a divergence that has traditionally implied critical underestimation.

Based mostly on its long-term correlation with technology-focused indexes, Bitcoin’s truthful worth is round $156,000, in comparison with right now’s spot value hovering round $110,000, in response to information from Econometrics.

The final time we noticed such a distinction was in 2023, earlier than the large uptick. In econometrics it’s said that:

“Until you suppose the bull market is over, this hole is more likely to slim as Bitcoin catches up.”

Bitcoin has underperformed tech shares in current weeks, however its correlation with main U.S. indexes stays intact, in response to Bloomberg information. This means that the market is recalibrating quite than collapsing. Bitcoin’s roughly 30% low cost to truthful worth implied by Nasdaq represents one of many largest valuation gaps up to now two years. If threat urge for food returns, that cash may circulation into Bitcoin.

Open curiosity wipeout

The October flash crash worn out greater than $12 billion in open curiosity, making it one of many steepest contractions in Bitcoin derivatives historical past. As a consequence of widespread deleveraging, open curiosity in futures fell from $47 billion to $35 billion.

Many analysts interpret this as a bullish reset. Leverage has been flushed, leaving room for natural spot demand and new ETF inflows. BitMine and Fundstrat’s Tom Lee advised CNBC that whereas “large deleveraging occasions” are nonetheless plaguing the crypto market, with sturdy fundamentals for Bitcoin and Ethereum and open curiosity at the moment at file lows, “we’ll see a rally in crypto by the top of the yr.”

Moreover, open curiosity in choices at the moment exceeds futures by $40 billion, an indication of market sophistication and declining speculative leverage. As Glassnode factors out:

“The Bitcoin derivatives panorama is altering as choice OIs start to compete with futures. The market is shifting in the direction of risk- and volatility-defined methods, which implies choice flows, quite than futures liquidations, may have extra affect in shaping value motion.”

Gold to Bitcoin rotation: Macro reallocation

In the meantime, gold’s file rally seems to be dropping momentum. Bloomberg reported on October 22 that even “hardcore gold bulls” acknowledge the rally has gone too far after the bullion market suffered its steepest weekly decline in additional than a decade.

Analysts advised Reuters earlier this month that the extraordinary rally above $4,000 an oz. is forcing traders to rethink the sustainability of the transfer, with many now turning to high-beta belongings similar to Bitcoin.

Investor Anthony Pompliano stated a “nice rotation” from gold to Bitcoin is imminent, noting that Bitcoin typically lags gold by about 100 days in its efficiency cycle. This quarter’s settings intently match that historic sample. Gold has been outperforming for months, and Bitcoin’s undervaluation relative to equities at the moment seems to be like the right storm for reallocation.

Younger traders’ desire for digitally native belongings, mixed with Bitcoin’s better portability and finite provide, reinforces this structural pattern. As gold pauses and liquidity seeks larger beta shops of worth, Bitcoin is as soon as once more the pure vacation spot.

Uncommon configuration of BTC value for long-term traders

Historical past reveals a chance when BTC value is considerably beneath the truthful worth urged by Nasdaq. The 30% low cost hasn’t occurred in practically two years. With open curiosity cleared, leverage reset, and regular inflows from institutional traders, the scenario resembles an accumulation section quite than a excessive ceiling.

If the bull market narrative holds true, Bitcoin may rapidly shut the valuation hole within the coming months, much like earlier cycles after giant deleveraging occasions. As markets reassess dangers, the rotation from gold to Bitcoin may act as a catalyst to ignite the subsequent rally.