Bitcoin’s long-standing narrative as “digital gold” is being put to the check as latest Bitcoin worth actions more and more resemble a high-risk development asset fairly than a standard safe-haven asset, in line with new analysis from Grayscale.

Report creator Zach Pandle mentioned on Tuesday that Grayscale remains to be contemplating Bitcoin ($BTC) Attributable to its fastened provide and independence from central banking authorities, it serves as a long-term retailer of worth, though latest market developments counsel in any other case.

“Bitcoin’s short-term worth actions usually are not carefully correlated with gold or different valuable metals,” Pandol wrote, noting that bullion and silver costs are at file highs.

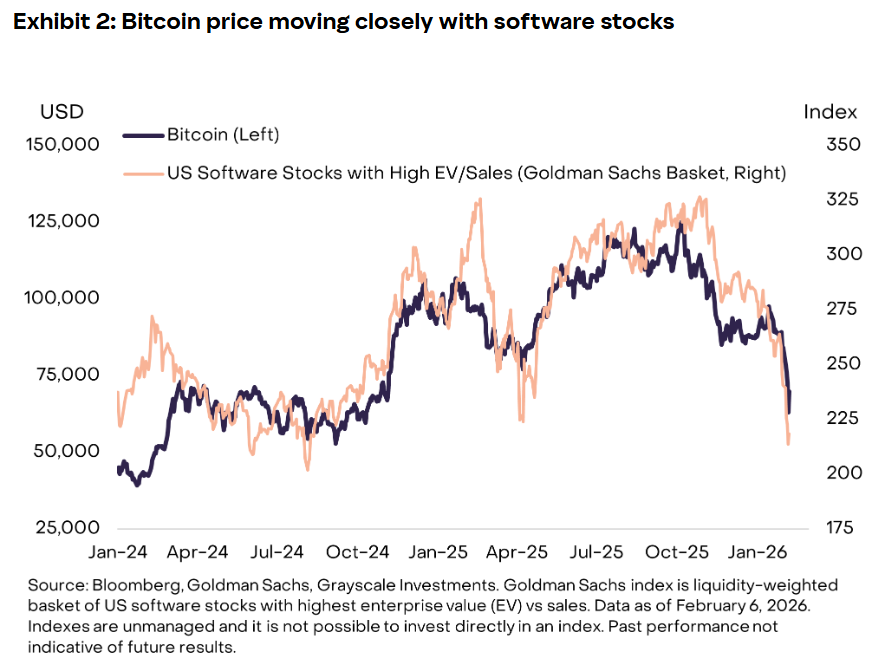

As a substitute, the evaluation discovered that Bitcoin has a powerful correlation with software program shares, particularly since early 2024. The sector has been beneath intense promoting stress just lately amid issues that synthetic intelligence might disrupt or render many software program providers out of date.

Bitcoin’s latest selloff mirrors the collapse in software program shares since early 2026. supply: grey scale

The report means that Bitcoin’s elevated sensitivity to equities and development belongings displays deeper integration into conventional monetary markets, pushed partially by institutional investor participation, exchange-traded fund exercise, and shifts in macroeconomic danger sentiment.

The change comes as Bitcoin has skilled a drawdown of about 50% from its October peak of over $126,000. The decline unfolded in a number of waves, beginning with a historic liquidation occasion in October 2025, adopted by one other sell-off in late November and once more in late January 2026. Grayscale additionally famous that there have been “motivated US sellers” in latest weeks, citing continued worth reductions on Coinbase.

Associated: 2026 Funding Technique for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Belongings

A part of Bitcoin’s continued evolution

Grayscale mentioned Bitcoin’s latest failure to dwell as much as its safe-haven narrative shouldn’t be seen as a setback, however fairly as a part of the asset’s ongoing evolution.

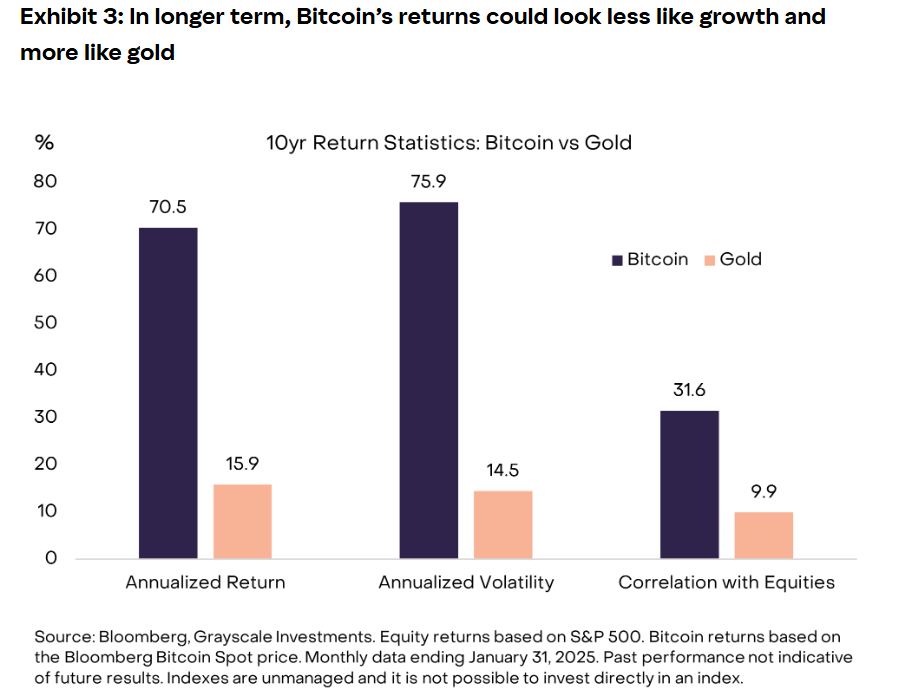

Pandor mentioned it was unrealistic to anticipate Bitcoin to interchange gold as a monetary asset in such a brief time period.

“Gold has been used as cash for 1000’s of years and served because the spine of the worldwide financial system till the early Seventies,” Pandol wrote.

He mentioned that whereas it’s “central to funding principle” that Bitcoin has not but achieved comparable financial standing, it might evolve in that path over time as the worldwide financial system turns into more and more digital by synthetic intelligence, autonomous brokers, and tokenized monetary markets.

Regardless of its latest poor efficiency, Bitcoin’s annualized returns have considerably outperformed gold over the previous decade. Supply: Grayscale

Within the quick time period, Bitcoin’s restoration might rely upon new capital flowing into the market, both by new ETF inflows or the return of retail traders. Market maker Wintermute mentioned latest retail participation has been targeted on AI shares and development tales, limiting near-term demand for crypto belongings.

Associated: Wall Road’s digital forex debate ends with banks’ all-out struggle $BTCstablecoins, tokenized money