Bitcoin’s momentum is caught as key traders scale back publicity and institutional inflows shrink. With billions of whales promoting and cautious company buying, the asset faces a essential $110,000 take a look at.

abstract

- The whales have dumped over 100,000 BTC in current weeks, their largest sale since 2022, rising downward strain on costs.

- Establishments’ BTC purchases have slowed, with technique’s month-to-month purchases plummeting from 134,000 in November 2024 to simply 3,700 in August.

- Bitcoin has been built-in between $110,000 and $115,000, with a low pattern sign.

Bitcoin (BTC) is going through strain across the $110,000 mark, indicating a pointy decline in whale accumulation and a weakening of institutional demand.

Bitcoin Zilla’s sale reaches its highest stage since 2022

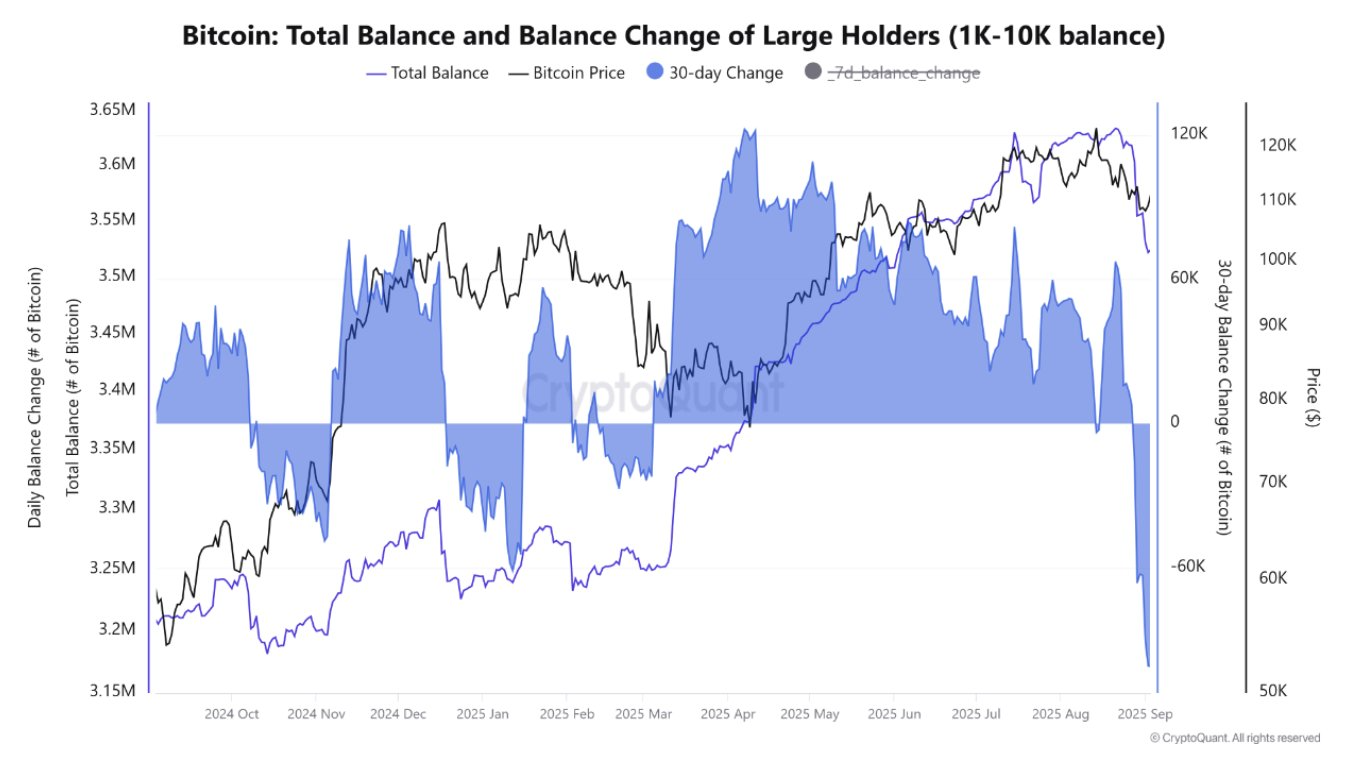

In accordance with crypto analyst Caueconomy, the Bitcoin market has skilled the most important wave of whale promoting since 2022. Within the final 30 days alone, whale reserves have fallen by greater than 100,000 btc, equal to about $11.1 billion at present costs.

Bitcoin Whale Holdings | Supply: Cryptoquant

“This gross sales strain is punishing the worth construction within the brief time period, in the end pushing costs to below $108,000,” CaueConomy stated.

These giant holders seem like decreasing publicity amid rising market uncertainty. CaueConomy additionally stated the present whale portfolio continues to be declining, and it may proceed to weigh Bitcoin within the coming weeks.

You may prefer it too: Bitcoin, altcoin rises as cooling labor markets can’t scare commerce of danger

Along with issues, one other analyst, Martun, revealed on Monday that the long-term holder, one of many largest 241,000 BTC since early 2025, offloaded 241,000 BTC. The dimensions of this sale means that even veteran holders are starting to lock in earnings or scale back danger publicity.

Regardless of file holdings, institutional actions are cooled

One other pattern has additionally been developed to scale back institutional curiosity. At the moment, Bitcoin’s funds maintain a file 840,000 BTC in 2025, however development charges are falling sharply. In accordance with Cryptoquant, Technique, the biggest proprietor with 637,000 BTC, noticed a decline in month-to-month purchases, which amounted to 134,000 BTC in November 2024 and simply 3,700 BTC in August 2025.

Bitcoin purchases by different firms additionally slowed down throughout this era, reaching 14,800 BTC, effectively beneath the height of 66,000 BTC this yr. The variety of transactions continues to be excessive, however the dimension of these purchases has been decreased. The typical transaction dimension for the technique fell to 1,200 BTC, whereas others averaged 343 BTC, a lower of 86% from the early 2025 ranges.

This pattern suggests consideration and probably liquidity constraints. The establishment stays lively, however is hesitant to present market situations regardless of fewer purchases per transaction and the very best headline holdings ever.

Value Motion Sign Vary Binding Transactions When Bulls Lose Steam

Bitcoin trades at $111,134 at press time for every crypto.information market information. The Crypto Market big is over 10% from an all-time excessive of $124,128, and stays within the $110,000 to $115,000 vary. Within the meantime, technical indicators are giving impartial indicators. The ADX (imply directional index) is 16.10, indicating a weaker path alongside the present lateral motion.

BTC Value Chart | Supply: crypto.information

BTC should overcome $115,000 to proceed its bullish pattern with a possible goal of $120,000 or $125,000. Conversely, if you happen to fall beneath $110,000, you may improve your BTC to $105,000 once more.

You may prefer it too: Bitcoin Bull Michael Saylor makes his debut with the Bloomberg Billionaire Index