Bitcoin fell under $106,000 in early European time on Friday as leveraged merchants as soon as once more confronted heavy losses, with round $1.2 billion in crypto positions worn out previously 24 hours.

In keeping with the info, many of the injury got here from lengthy positions, reflecting how aggressively merchants have been positioning for the rebound earlier this week.

In keeping with CoinGlass, almost 79% of all liquidations have been lengthy trades, affecting greater than 307,000 accounts. The largest hit was a $20.4 million ETH-USD lengthy on HyperLiquid, a decentralized derivatives trade that has quietly turn out to be one of many go-to engines for leveraged buying and selling in cryptocurrencies.

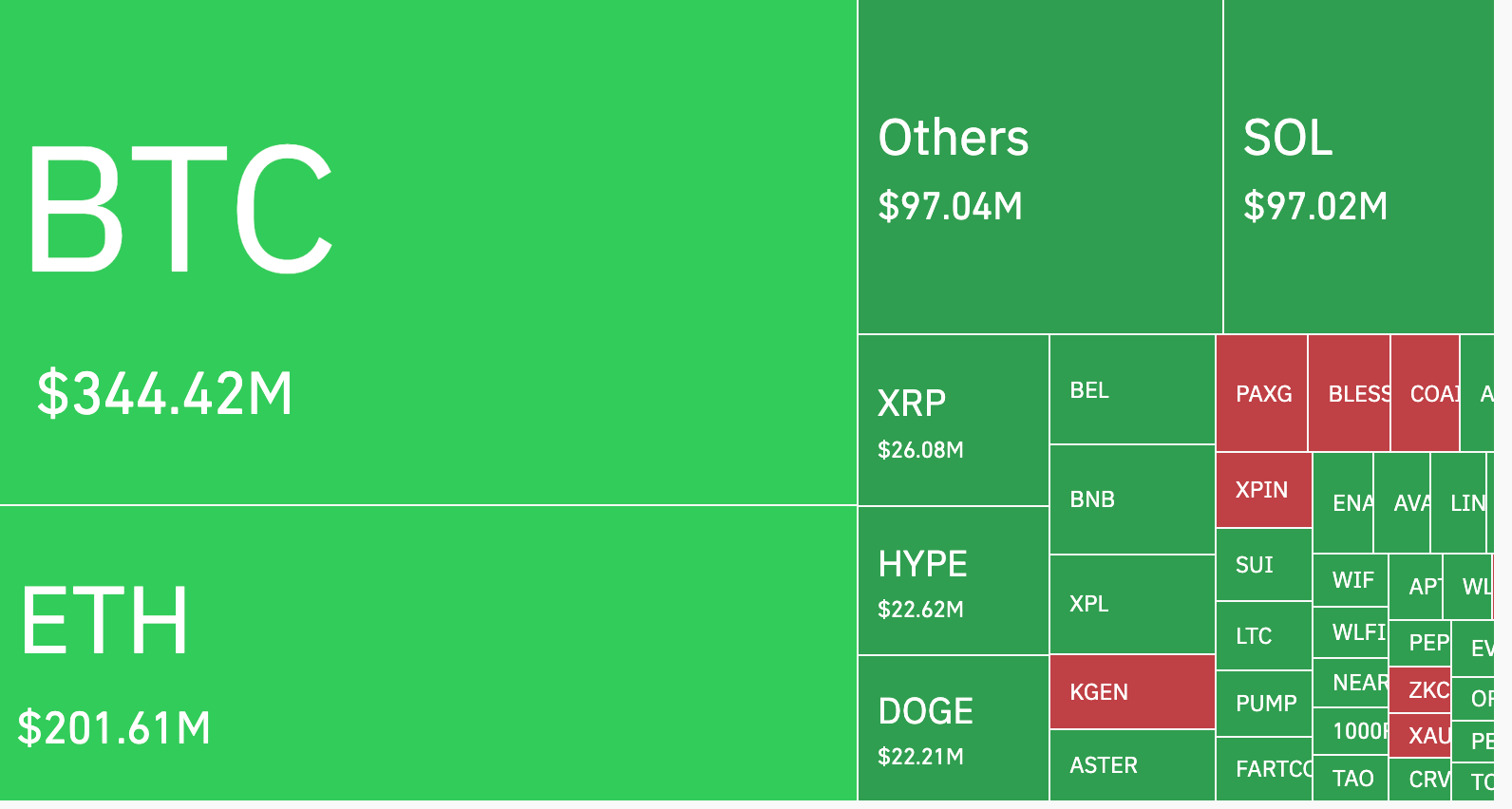

Bitcoin misplaced about $344 million, adopted by Ether with $201 million and Solana. sol$180.48 For $97 million. XRP, doge$0.1823 and different high-beta tokens every noticed tens of hundreds of thousands of {dollars} extra liquidated from their open curiosity.

Throughout exchanges, Hyperliquid had probably the most trades with $391 million, adopted by Bybit with $300 million, Binance with $259 million, and OKX with $99 million. This mix reveals how on-chain exchanges are sitting side-by-side with conventional buying and selling platforms throughout a large market reset.

Liquidations happen when a dealer utilizing borrowed funds to broaden a place is unable to satisfy margin necessities. Merely put, if the market strikes too far to your leveraged wager, your place will probably be pressured closed to forestall additional losses.

These occasions can flip into cascading declines when giant clusters of cease orders are triggered unexpectedly, creating what merchants name a “liquidation loop.”

Such loops are sometimes tracked by liquidation heatmaps and open curiosity information, which may present the place excessive leverage is concentrated available in the market. As worth approaches these zones, merchants will carefully monitor for potential squeeze or unwind occasions that might outline the subsequent directional transfer.

Bitcoin’s decline started late on Thursday, when the value breached the $107,000 stage, triggering a sequence of pressured shutdowns that spilled over into derivatives markets.

This transfer is towards the backdrop of a tense macro setting. The resurgence of U.S.-China tensions is lowering threat urge for food, whereas the sturdy yen and low gold costs are growing uncertainty. Whereas Bitcoin has regained most of its beneficial properties from the start of the week, Ethereum is down about 4% on the day, buying and selling just under $3,900.