Mike McGlone, senior commodities strategist at Bloomberg Intelligence, raises purple flags a few metric that not often will get as a lot consideration because the greenback value however usually tells an even bigger story: how a lot gold one Bitcoin can really purchase.

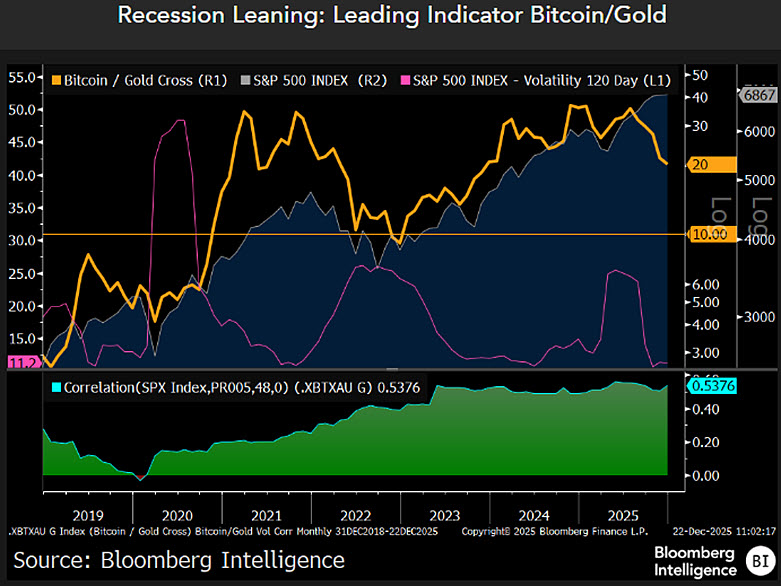

In his newest notes and charts, McGlone stated the stability of danger is ugly, noting that as of Dec. 22, the cross between Bitcoin and gold was near 20x. Primarily, he’s saying that it’s extra probably that Bitcoin’s worth will fall 10 occasions its present worth in 2026 than it’s that it’s going to rise 30 occasions its present worth.

If that occurs, Bitcoin’s buying energy relative to gold might be minimize in half, though the USD chart might not look as dramatic.

McGlone basically says that the Bitcoin-to-gold ratio is appearing as an early warning chart. This ratio tends to return below stress when recession danger will increase, and there is a cause why this ratio now seems subsequent to the S&P 500 and market volatility. The important thing takeaway from this body is that inventory costs, volatility, and the Bitcoin-gold cross are nonetheless transferring collectively greater than folks recognize, with a correlation round 0.5376, that means it is nonetheless a “risk-on, risk-off” bundle.

Bitcoin might be value $50,000 in 2026

Finally, McGlone zooms out to a 2026 outlook for “the place the lows might be,” with core CPI easing towards 1%, oil close to $40, gasoline round $2, and Bitcoin round $50,000.

He would not insist on a date or precise goal, however says that if U.S. shares drop about 10% and proceed to say no with out heading again “north,” these are the type of cycle-level costs that usually seem when the market finally resets.