Bitcoin has fallen under the $70,000 degree, a transfer that displays elevated promoting stress and rising uncertainty available in the market. The breach of this psychological threshold intensified volatility and induced short-term contributors to react shortly to downward momentum. Analysts observe that the present setting is outlined much less by macro headlines and extra by inner market constructions, notably the conduct of long-term holders.

In accordance with an perception shared by On-chain Thoughts, the value of Bitcoin alone not often determines the underside of the market. Slightly, vital indicators have a tendency to come back from holder conduct, particularly whether or not long-term traders are beginning to present indicators of stress. Traditionally, these contributors have been the least reactive cohort, usually absorbing volatility relatively than amplifying it via fast promoting.

Nevertheless, the scenario modifications when long-term holders turn out to be uncovered to widespread unrealized losses. This example usually coincides with the later levels of a bear market, when confidence weakens and broader capitulation turns into doable. Though this stage doesn’t assure speedy reversal, it usually signifies ongoing structural exhaustion.

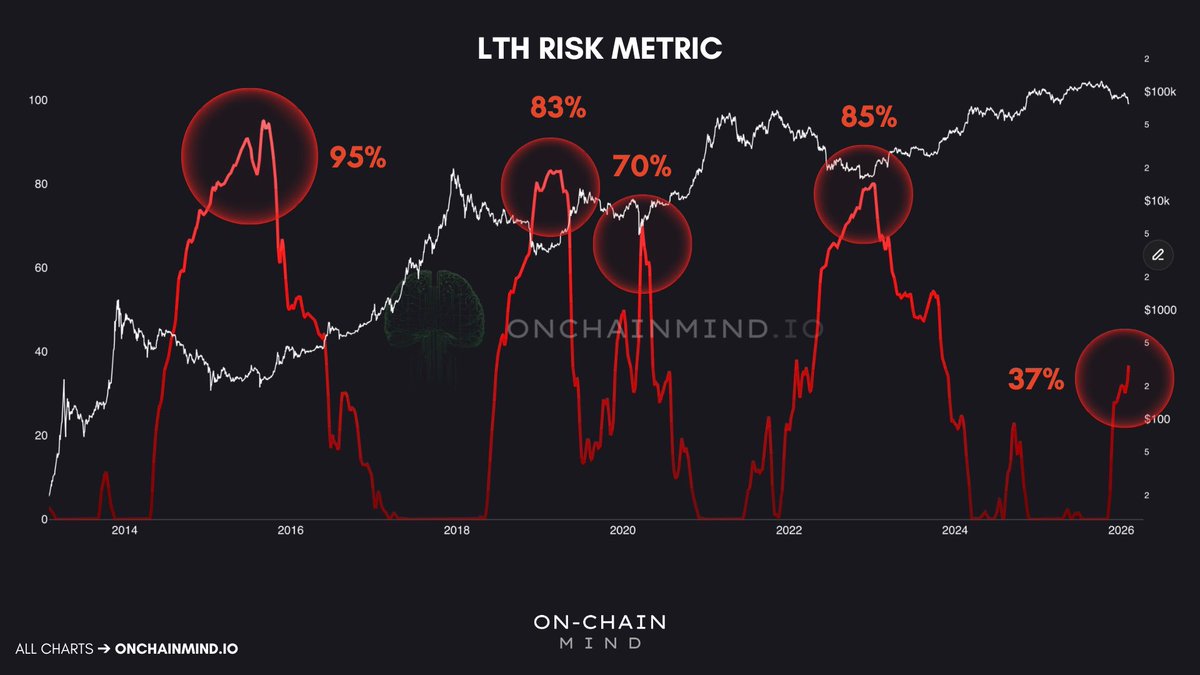

Onchain Thoughts additional highlights that long-term holder threat has traditionally performed a decisive function in figuring out late bear market circumstances. In earlier cycles, there was a transparent peak on this indicator. It was about 95% in 2015, about 83% in 2019, about 70% through the coronavirus crash, and about 85% through the 2022 recession. These spikes usually replicate widespread unrealized losses amongst long-term traders and point out extreme structural stress throughout the community.

Traditionally, when this indicator exceeds the 55-60% vary, the bottoming course of tends to speed up. At these ranges, even most affected person holders start to expertise significant stress, usually coinciding with the ultimate stage of give up. This doesn’t essentially point out a precise value low, however usually precedes stabilization and eventual restoration.

Nevertheless, this indicator is now at a degree near 37%, nicely under the earlier capitulation threshold. This implies that whereas market stress is obvious, circumstances could not but replicate the full-blown depletion that usually accompanies the underside of an endurance cycle. If the sample of reducing peaks continues, a transfer in direction of the 70% space signifies that even robust fingers are underneath a number of stress. This has traditionally been a prerequisite for extra structural and protracted market lows.

Bitcoin’s weekly construction exhibits a transparent deterioration in momentum after a rejection from the $120,000-$125,000 space, with the value presently buying and selling close to the $69,000 zone. The newest breakdown has introduced Bitcoin decisively under the 50-week transferring common (blue) and 100-week transferring common (inexperienced) ranges that served as dynamic assist all through the earlier uptrend. The lack of each indicators indicators a transition from a corrective pullback to a extra structural downtrend part.

The 200-week transferring common (pink) stays nicely under present costs, suggesting that the broader macro development has not but entered deep bear market territory. Nevertheless, the velocity of the decline and the growth of bearish candlesticks point out aggressive dispersion relatively than orderly consolidation. The surge in quantity accompanying the latest draw back value motion strengthens the interpretation of pressured gross sales and liquidation exercise.

From a technical perspective, the $70,000 space has transitioned from assist to resistance after the break. Failure to recuperate this degree shortly will increase the chance of additional draw back exploration, doubtlessly in direction of the sub-$60,000 regional historic demand zone. Conversely, if gross sales volumes decline and stabilize past this area, it might point out vendor exhaustion.

Featured picture from ChatGPT, chart from TradingView.com