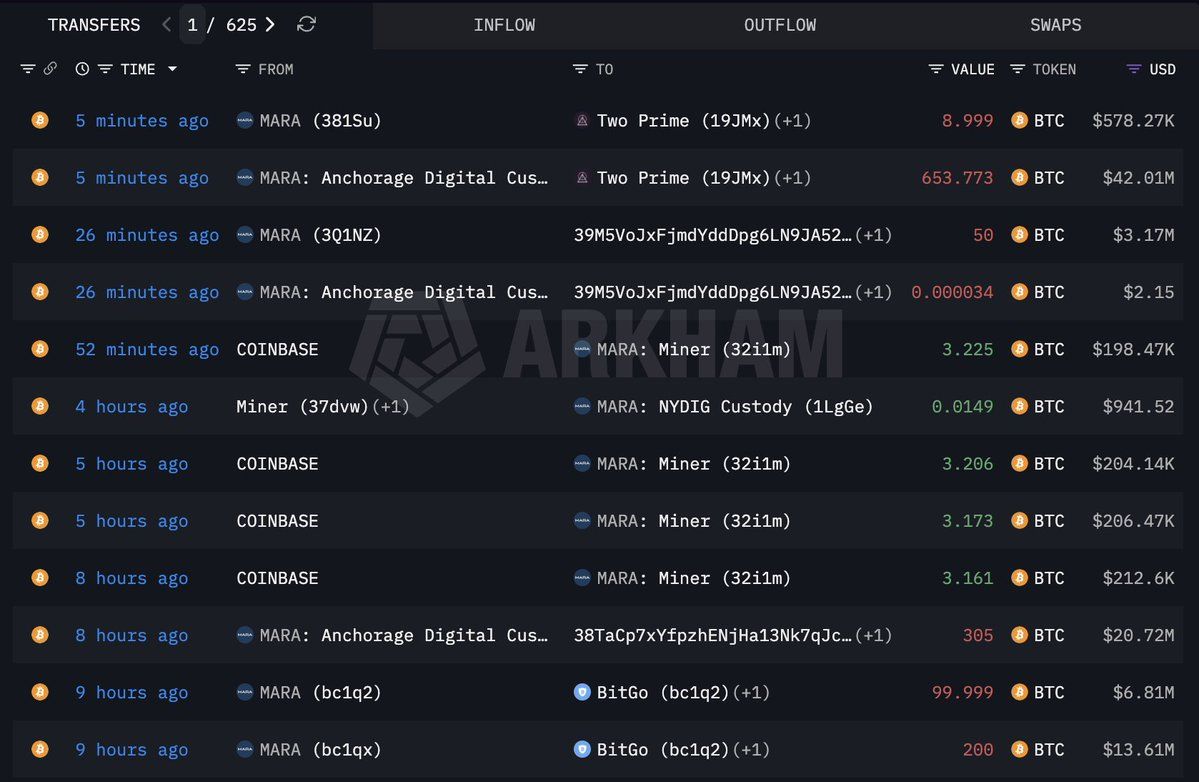

Bitcoin miner MARA strikes 1,318 $BTC On-chain knowledge tracked by Arcam revealed that over the previous 10 hours, transactions with a mixture of buying and selling companions and storage areas resulted in roughly $86.89 million value of harm.

The most important slice went to Two Prime. 1 switch despatched at 653.773 $BTCabout $42.01 million, in Two Prime tagged addresses, together with a smaller $8.999. $BTC Just some minutes later, the cash was replenished with the equal of about $578,000.

200 particular person outgoing transactions had been despatched $BTC and 99.999 $BTC A complete of roughly $20.4 million and an extra $3.05 million in BitGo tagged addresses on the time of switch. $BTC The quantity transferred to the brand new handle is roughly $20.72 million.

Stream is primarily about timing. Cryptocurrency markets have been risky since this week’s liquidation-led sell-off, with merchants looking out for indicators of miners turning into pressured sellers.

Giant scale miner-related transfers might be for day-to-day treasury administration, altering storage areas, shifting collateral, or getting ready for over-the-counter gross sales, however are sometimes learn as provide indicators when markets are skinny.

The Two Prime leg will obtain essentially the most consideration as it’s the credit score and buying and selling counterparty. If Bitcoin is pledged as collateral or included into a method, it doesn’t essentially imply a spot promote.

The transfer comes amid a tricky time for miners, with Bitcoin down practically 50% from its peak worth of greater than $126,000 final 12 months.

As CoinDesk reported on Thursday, Bitcoin is at the moment buying and selling round 20% beneath its estimated common price of manufacturing, growing fiscal stress internationally. $BTC Mining sector.

The common price to mine one Bitcoin is round $87,000, based on Checkonchain knowledge, however the spot worth has fallen in the direction of a weekly low of $60,000.Traditionally, buying and selling beneath the price of manufacturing has been a trademark of bear markets.