Bitcoin mining firms and synthetic intelligence information facilities are more and more competing for entry to low-cost and sustainable power, and will renew institutional funding within the mining sector over the following decade.

In response to a July 31 analysis report from Bitcoin mining infrastructure supplier Gomining Establishment, AI information facilities with deep capital reserves are starting to outperform energy infrastructure miners.

Nonetheless, in response to Jeremy Dreier, Managing Director and Chief Enterprise Growth Director at Gomining Institutional, the flexibleness of Bitcoin mining firms permits them to achieve a bonus over AI services and develop to extra grid places.

This rising battle for power will result in a brand new wave of institutional investments in Bitcoin mining over the following decade, mentioned Dreier at Cointelegraph’s Chain Response Each day X Area Present on Thursday.

“Within the subsequent 5 to 10 years, we can be seeing a brand new heyday of Bitcoin mining because of this new battle with AI, as a result of precise institutional capital is within the house.”

Institutional Capital has already flowed into the US Spot Bitcoin Alternate-Traded Funds (ETFS), with Dreier calling mining funding the “subsequent step” for these traders.

The hidden battle between Bitcoin Miner and AI (feat. Gomining) #chainReaction https://t.co/zlymxlkzfr

– Cointelegraph (@cointelegraph) August 13, 2025

Establishments need cheaper “virgin” bitcoin

Institutional capital rotation into Bitcoin mining firms may very well be the following logical step as firms and finance firms investing in Bitcoin ETFs try to accumulate low-cost Bitcoin for his or her steadiness sheets.

Associated: Bitcoin simply flips Google’s market capitalization as traders exceed $124K

Extra establishments are investigating the opportunity of getting cheaper “virgin” Bitcoin as an alternative of paying spot costs in alternate, Dreyer mentioned. “The (facility) desires to get a real, new, newly created Bitcoin, cheaper than it will get from the market.”

Drier informed CointeLegraph, growing numbers of companies are asking about Bitcoin mining infrastructure providers from Gomming to get low-cost Bitcoin for its steadiness sheet.

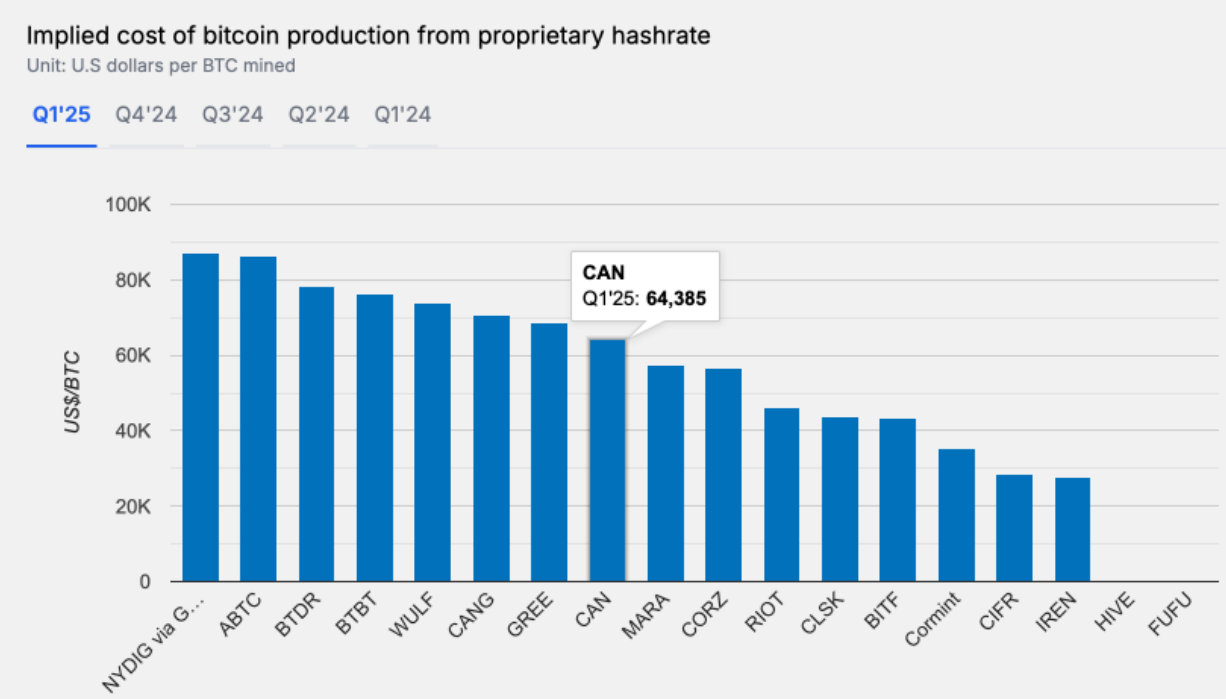

The implicit price of Bitcoin manufacturing. Supply: Theminermag

Bitcoin mining averaged $64,000 within the first quarter of 2025, and is predicted to exceed $70,000 by the tip of the yr, in response to a analysis report from Theminermag.

Associated: Bitmine is a big goal that may earn 24.5b as Sharplink boosts Ether Battle Chest

The battle for energy between miners and AI information facilities has diversified operations to profit from this pattern.

For instance, Riot Platforms has halted plans to develop its Bitcoin mining operations in Corsicana, Texas, and as an alternative discover AI alternatives on the identical web site.

Iris Vitality has introduced a strategic pivot for the AI cloud enterprise, and in response to a report from Gomining Institutional, it has self-imposed caps on the enlargement of its mining fleet, indicating a “main re-shuffle of priorities.”

However Dreyer foreshadowed many public miners who “leapt into the AI bandwagon,” and “begins shortly again to investing in Bitcoin mining.”

Others are doubling the improvements in Bitcoin mining. With a deal with Bitcoin, Fintech Firm Block Inc. has launched a brand new cryptocurrency mining system designed to extend the lifespan of mining rigs and cut back operational prices, flashing potential boosts for miners struggling to keep up their services.

https://www.youtube.com/watch?v=20zfedqdkl8

journal: Altcoin Season 2025 is just about right here…however the guidelines have modified