The euphoria of October’s report highs has pale, and the commercial spine of the Bitcoin community is dealing with a harsh actuality examine.

Based on crypto slate Based on the information, Bitcoin is at the moment buying and selling round $78,000, which is down greater than 38% from its all-time excessive of greater than $126,000 simply 4 months in the past.

Whereas an off-the-cuff observer may see a normal market correction, the view from contained in the mine is much extra dire. Plummeting costs for flagship digital belongings collide with still-high community difficulties and rising vitality prices, creating an ideal storm for carriers.

Analytics agency CryptoQuant just lately stated that given the present mixture of low costs and hardship, miners’ wages are “extraordinarily low wages” and the P&L Sustainability Index has fallen to 21. That is the bottom determine since late 2024.

Particularly, monetary strains have already taken machines offline, leading to Bitcoin’s complete hashrate falling by round 12% since November final yr, the steepest decline since China’s mining ban in 2021. This leaves the community at its weakest degree since September 2025.

For a system that touts itself because the world’s most safe laptop community, that is greater than only a bear market story. It is a stress check of Bitcoin’s safety mannequin at a second when miners have a higher-paying different.

Bitcoin miner give up calculation

Bitcoin’s safety depends on a easy incentive construction the place the community pays a hard and fast block subsidy and transaction charges to whoever solves the following block.

In October, when the worth was over $126,000, the “safety price range” was sufficient to make up for the inefficiency. However with the worth under $80,000, there isn’t a longer any margin for error.

New numbers from mining pool f2pool present how extreme the income compression has turn out to be.

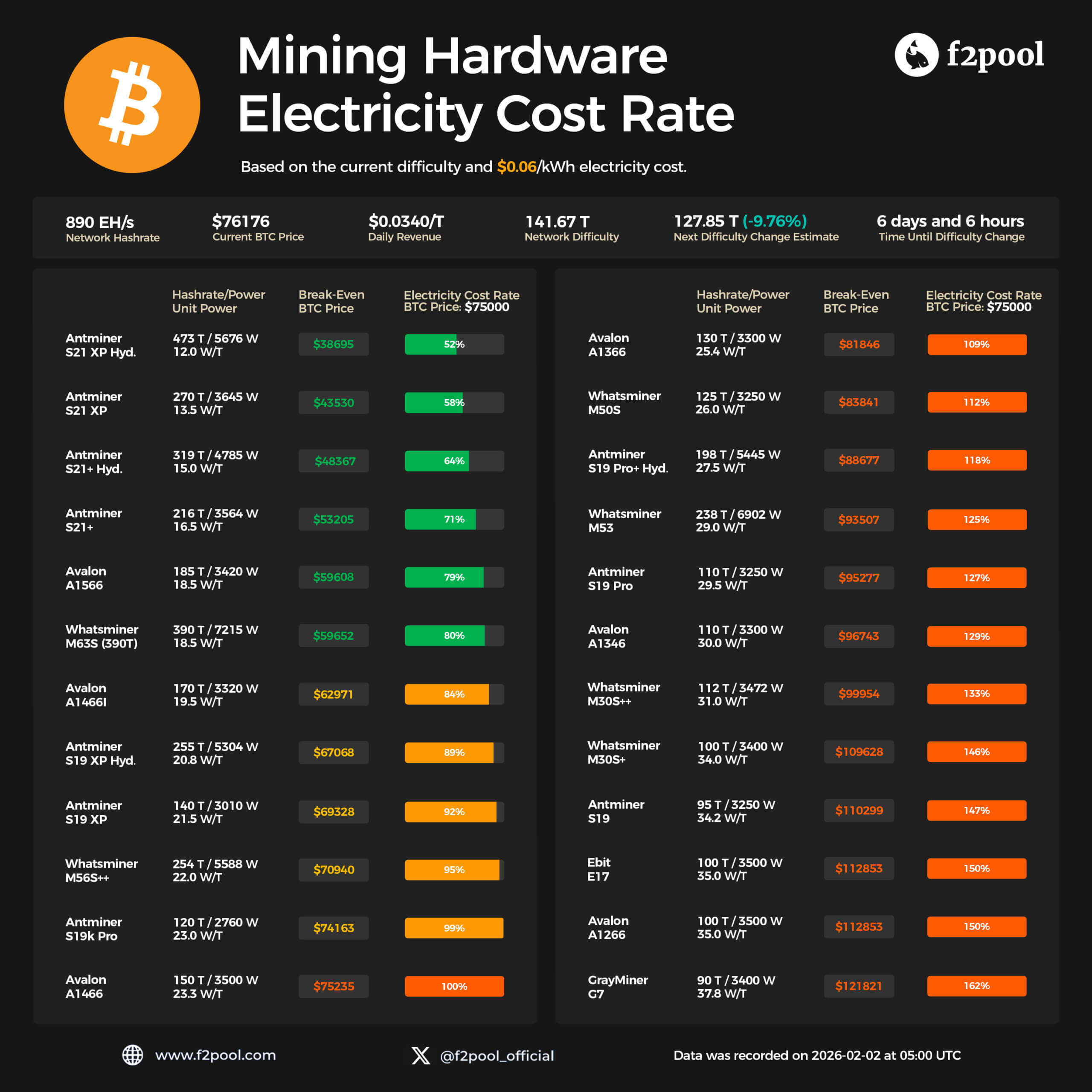

The pool estimates the worth of Bitcoin at round $76,176, the community hash fee at practically 890 exahashes per second (EH/s), and the every day income for miners paying round $0.06 per kilowatt-hour at round $0.034 per terahash, in its Feb. 2 {Hardware} Energy Value Dashboard.

To place this into perspective, Luxor Know-how’s hashrate index hit a spot hash value of practically $39 per petahash per second (PH/s) per day just some months in the past.

This quantity is already skinny by historic requirements earlier than falling in the direction of an all-time low of round $35 as of this writing.

The present f2pool determine is $0.034 per terahash, which equates to $34 per PH/sec, confirming that miners are working on historic flooring.

Mapping these economics to particular person machines reveals why hashrate is declining.

At an influence price of 6 cents, the identical as Bitcoin’s reference value of $75,000, electrical energy accounts for roughly 52% of the income of Bitmain’s newest Antminer S21 These are one of the best numbers obtainable.

When the effectivity curve worsens, the calculation end result turns purple. Mid-generation rigs just like the Antminer S19 XP and Avalon A1466i have electrical energy charges round 92% to 100% of their value vary.

However, older or much less environment friendly fashions, such because the Avalon A1366, Whatsminer M50S, and S19 Professional line, can have electrical energy charges round 109% to 162%.

In layman’s phrases, which means for $75,000 in Bitcoin and mainstream energy costs, an enormous fleet of {hardware} is mining at a money loss, earlier than contemplating debt, internet hosting charges, and overhead prices.

AI escape hatch

This present collapse in earnings is completely different from earlier crypto winters. That is as a result of miners’ distressed belongings, reminiscent of energy contracts and grid connections, have discovered new, deep-pocketed suitors.

The identical infrastructure that permits Bitcoin mining is precisely what hyperscale AI computing requires. And in contrast to the struggling Bitcoin community, AI infrastructure suppliers are prepared to pay.

CoreWeave, a former mining operation, has turn out to be emblematic of this transformation. The corporate pivoted from cryptocurrencies to turn out to be a “neocloud” specializing in AI workloads, and just lately secured a $2 billion fairness funding from Nvidia to speed up its knowledge middle buildout.

In 2025, the corporate sought to accumulate miner Core Scientific in a multibillion-dollar deal that explicitly framed the miner’s websites and energy contracts as prime actual property for GPUs slightly than ASICs.

Different public Bitcoin miners have additionally taken the trace and are making a significant pivot in the direction of AI. For instance, Canadian provider Hut 8 just lately signed a 15-year lease for a 245-megawatt AI knowledge middle at its River Bend campus. The contract worth is claimed to be roughly $7 billion.

This transaction successfully locks in long-term economics which can be considerably completely different from the volatility of mining rewards.

For shareholders, these pivots present an affordable method out of the hemorrhage brought on by a 30% value decline. They’ll change their cyclical Bitcoin earnings for contracted AI money flows that buyers at the moment worth at a premium.

However for the Bitcoin community, this poses a tougher drawback. What if a part of your safety infrastructure finds a enterprise that gives greater rewards?

Bitcoin community safety price range is underneath strain

Jeff Feng, co-founder of Sei Labs, referred to as this era the “largest decline in Bitcoin miners since 2021” and argued that large-scale miners which have shifted their focus to AI calculations are amplifying the decline in Bitcoin.

The primary distinction from earlier cycles is that this a part of the hash won’t merely energy down till the worth recovers. Completely reassigned.

As soon as the 245 MW website is totally reracked for AI underneath a long-term lease, that energy will truly now not be obtainable for future hashrate growth.

Unquestionably, Bitcoin could be very protected from an absolute standpoint. Even after current declines, the price of accumulating sufficient hashing energy to assault a community remains to be important.

Nevertheless, it’s not the rapid collapse that’s of concern, however the path and composition. Because the hashrate regularly decreases, the marginal price of an assault decreases.

As a result of on-line hashing is much less sincere, fewer sources are wanted to seize a disruptive share of the community’s compute, whether or not you hire capability or construct it outright.

This development can be narrowing the pool of stakeholders who’re paid to guard the chain. Management over block manufacturing will turn out to be more and more centralized as older, extra pricey operators exit and solely a small variety of ultra-efficient miners stay worthwhile.

This creates vulnerabilities which can be hidden by the headline hashrate numbers.

Due to this fact, CryptoQuant’s “very low” label is successfully a warning that with right now’s block rewards and charges, a good portion of commercial hashing is working at skinny or unfavourable margins.

This serves as a optimistic indicator of how strong a community’s safety price range truly is in comparison with competing capital and energy utilization.

How do Bitcoin miners survive?

From right here, a miner squeeze can have an effect on Bitcoin’s evolution in a number of alternative ways.

One path is quiet integration. Issue is reset, probably the most environment friendly operators get a bigger share of block era, and hashrate will increase extra slowly than in earlier cycles, however stays massive sufficient that outdoors specialists barely discover it.

For buyers, the principle affect is volatility. It’s because drawdowns in every market slim down the group of miners, leading to elevated promoting and hedging habits.

An alternate path would speed up Bitcoin’s transition to fee-driven safety before the halving schedule alone suggests. If subsidies stay low relative to AI income, the ecosystem might must rely extra on transaction charges to maintain miners totally engaged.

That would imply extra emphasis on high-value funds on the base layer, extra exercise in second-layer methods, and widespread acceptance that block area is a scarce useful resource slightly than an affordable commodity.

The third, extra speculative cross makes the exterior backstop express. Which means that establishments that regularize spot Bitcoin ETFs might finally view safety budgets as one thing that requires intentional help, similar to financial institution capital ratios.

That would take the type of elevated charges for sure transaction lessons, industry-funded incentives for miners, or scrutiny of AI transformations that considerably cut back hashrate in key areas.

Notably, none of those outcomes require breaking Bitcoin’s core design. All of it comes right down to the {industry} deciding how a lot it’s prepared to pay to maintain hashes on the community slightly than on GPU clusters in a extra crowded vitality market.

The f2pool dashboard now supplies a snapshot of that negotiation. The system, which has a computational energy of about 890 exahashes per second and prices about $76,000, pays about 3.5 cents per terahash per day for safety.

Whether or not future vitality investments settle for that fee or demand one thing nearer to AI economics will decide how the mining market finally pivots.