Bitcoin miners have began February on a shaky word, with revenues declining considerably since mid-January and nicely beneath their 12-month peak in July. As well as, the US winter storm has saved hashrate nicely beneath the excessive ranges seen in October.

Bitcoin miners begin February with revenue indicators flashing crimson

Most individuals are conversant in the winter storm that has hit a number of states in the US, inflicting some mining operations to quickly lose energy to ease the pressure on native energy grids. As of this penning this weekend, the hashrate is round 850 exahashes per second (EH/s) idle. It hasn’t fallen to this low since late June 2025.

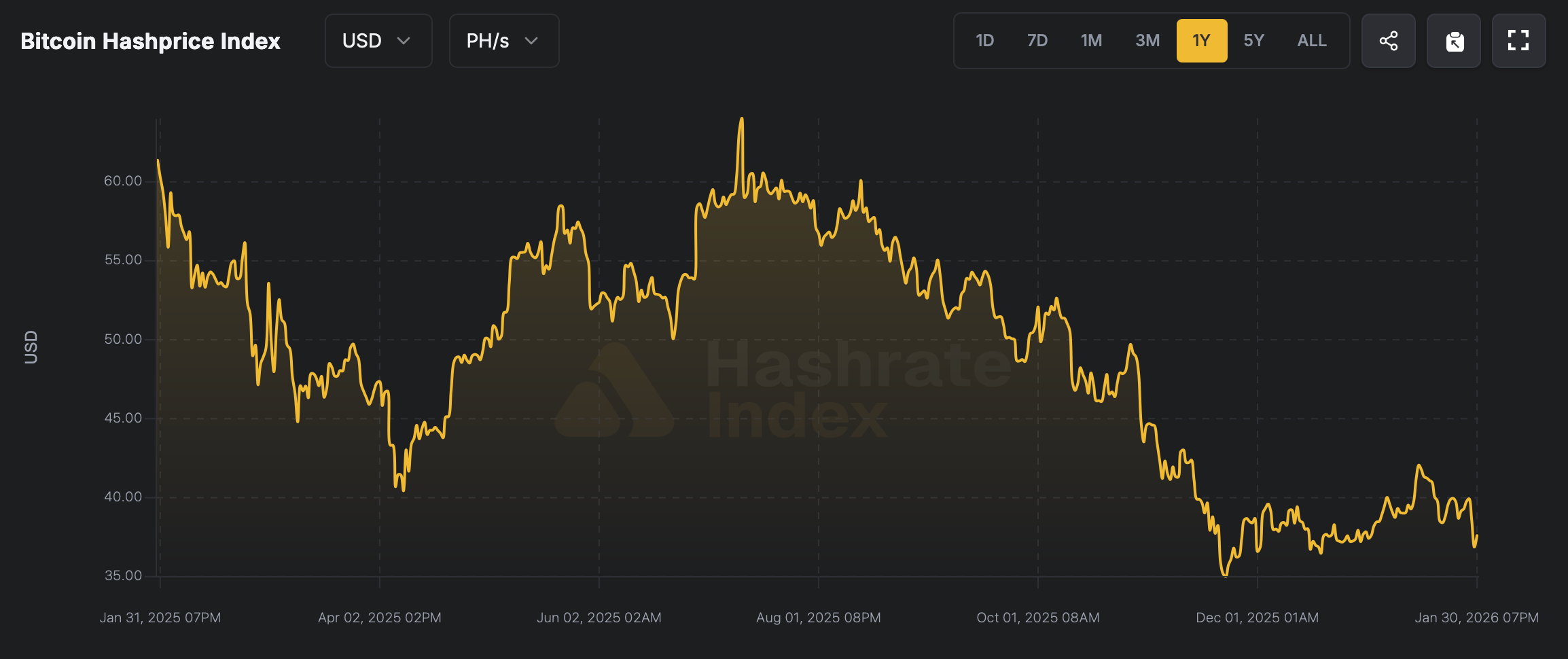

On prime of that, Bitcoin mining firms have been tormented by worth declines to areas not seen since April 2025. This drop has pushed the hash worth, a metric that measures the estimated worth of hashing energy in petahash per second (PH/s), to painfully low ranges. The $35.22 hash worth is not fairly as excessive as $34.99 on November twenty second, nevertheless it’s uncomfortably shut when it comes to consolation.

Bitcoin hash worth on February 1, 2026.

That is the second-lowest return for Bitcoin miners previously 12 months and is roughly 45% beneath the 12-month excessive of $64.03 per PH/s recorded on July 11, 2025. So as to add insult to harm, the highest 13 publicly traded Bitcoin miners by market capitalization all ended Friday with important losses.

Utilized Digital (APLD) was the toughest hit, down 11%, adopted by IREN Restricted (IREN), down 10.19%, and Cipher Mining (CIFR), down 9.83%, with important losses throughout the leaderboard. Taken collectively, all of that is placing extreme stress on miners, and there may be solely a brief listing of things that might doubtlessly ease the squeeze.

learn extra: Latin America Insights: Venezuelan oil flows again to US, El Salvador buys gold

These embrace Bitcoin recovering from its current lows, and at present costs BTC continues to be 37.4% beneath October’s all-time excessive north of $126,000. On-chain charges might also ease some, however they’ve remained lower than 1% of the common block reward for fairly a while. The best and extra dependable supply of aid is more likely to come from the subsequent tough interval, which is shaping as much as be a really significant adjustment.

For now, miners should battle by a chilly, unforgiving interval the place margins are skinny, machines are quiet, and persistence wears skinny block by block. Till costs get better or a reset of hardship supplies a breather, survival will depend upon effectivity, stability sheet self-discipline, and often much less consolation as we wait out the storms brought on by each the climate and the markets.

Continuously requested questions ⛏️

- Why are Bitcoin miners’ earnings lowering now?

Mining income declined as Bitcoin costs fell and hash costs fell to their lowest ranges previously yr. - What’s Hash Worth? Why is it necessary for Bitcoin miners?

HashPrice measures the estimated every day income earned per petahash per second (PH/s) and immediately displays a miner’s profitability. - How far is Bitcoin from its current highs?

Bitcoin is presently about 37% beneath its all-time excessive of $126,000, set in October. - What can enhance Bitcoin miner earnings sooner or later?

A restoration in Bitcoin costs and a downward adjustment in mining issue might assist ease stress on miners’ margins.