In line with TheMinerMag, the Bitcoin mining trade is getting into what’s believed to be the deepest recession in its 15-year historical past, with even main publicly traded operators struggling to interrupt whilst mining revenues collapse and debt will increase.

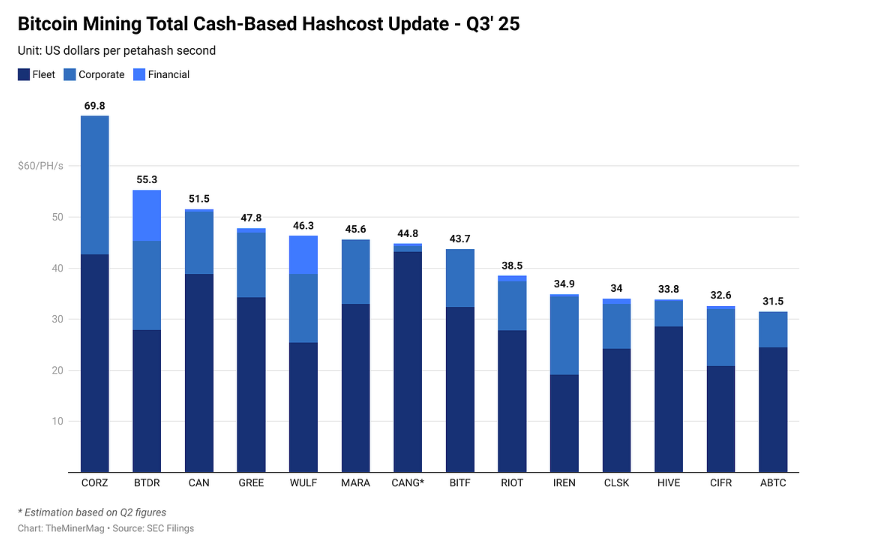

TheMinerMag mentioned in its newest report that miners are working within the “hardest margin surroundings in historical past” as hash costs (income per unit of computing energy) have fallen from a median of about $55/petahash/second (PH/s) within the third quarter to about $35/petahash/second (PH/s). The journal characterizes this stage as a structural low reasonably than a short lived dip.

This deterioration adopted a pointy correction in Bitcoin (BTC) costs, which fell from a report excessive of round $126,000 in October to lower than $80,000 in November.

Beneath these circumstances, value per hash has emerged as an apparent metric for miners. This highlights how effectively miners convert energy and capital into uncooked computational output, and divulges the rising hole between the typical operator and solely probably the most environment friendly survivors.

Information reveals that new generations of mining machines are at present taking greater than 1,000 days to recoup their prices, elevating considerations on condition that Bitcoin’s subsequent halving is roughly 850 days away.

Bitcoin mining prices throughout main publicly traded miners. Supply: TheMinerMag

TheMinerMag mentioned “steadiness sheets are reacting” to the deteriorating financial situations and pointed to CleanSpark’s current choice to totally repay its Bitcoin-backed credit score line with Coinbase as an indication of the trade’s broader shift in the direction of deleveraging and preserving liquidity.

Associated: 13 years after the primary halving, Bitcoin mining appears to be like quite a bit completely different in 2025

Bitcoin mining shares plummet

The autumn in Bitcoin costs and the ensuing strain on hashrate coincided with broader declines throughout conventional markets, delivering a one-two punch to publicly traded mining corporations.

MinerMag’s third quarter report notes “the sharpest decline in mining shares since mid-October,” with losses accelerating throughout the sector.

12 months-to-date efficiency of MARA inventory. sauce: Yahoo Finance

MARA Holdings (MARA) has been the toughest hit, falling about 50% from its October 15 closing excessive. CleanSpark (CLSK) is down 37% and Riot Platforms (RIOT) is down 32% over the identical interval. HIVE Digital Applied sciences (HIVE) inventory suffered the steepest decline, falling 54% from its October excessive.

journal: Bitcoin’s long-term safety finances concern: Rapid disaster or FUD?