Publicly traded Bitcoin mining firms had a tough week, with practically each main miner posting double-digit declines because the sector underperformed by a large margin than Bitcoin itself.

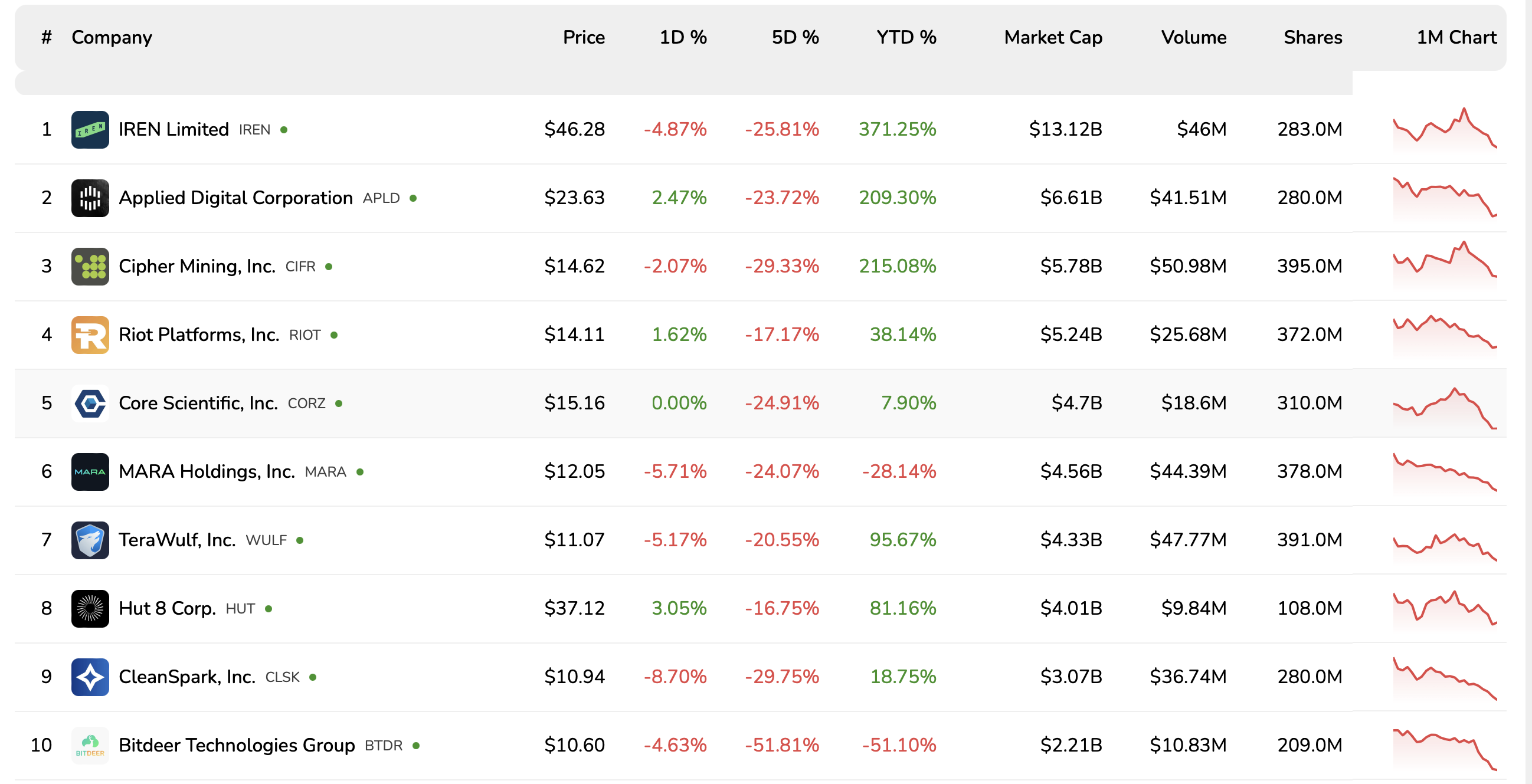

Over the previous 5 enterprise days, firms akin to Cipher, Utilized Digital, Core Scientific, CleanSpark, and Bitdeer have fallen between 23% and 52%, whereas different operators akin to Riot and Hut 8 have suffered losses within the mid-teens.

Bitcoin (BTC) is buying and selling at round $94,400 on the time of writing, down round 9% over the previous seven days.

sauce: bitcoin mining shares

Zooming out, Thursday’s Miner Magazine report confirmed that public mining shares have misplaced greater than $20 billion in market worth over the previous month, and are down about 25% since mid-October, effectively beneath Bitcoin’s decline.

The decline got here regardless of monetary establishments together with Jane Avenue, Constancy and Barclays rising their positions in a number of giant miners.

Regardless of current losses, some mining firms have outperformed Bitcoin on a year-to-date foundation.

IREN, the biggest public Bitcoin miner by market capitalization, is up about 370% because the starting of the 12 months, whereas Cipher Mining is up about 210%. By comparability, Bitcoin itself has solely risen about 1.5% over the identical interval, in keeping with TradingView.

Associated: Bitcoin value growth after US authorities shutdown is not assured: This is why

Bitcoin miners deal with AI and HPC

Though some Bitcoin mining shares have risen considerably because the starting of the 12 months, mining stays an more and more troublesome enterprise. With block rewards halving roughly each 4 years, some miners are adopting new methods to diversify their revenue, whereas others are exiting altogether.

The most important change has been the shift to AI and excessive efficiency computing (HPC), which has led miners to repurpose power-hungry knowledge facilities into extra secure, higher-margin workloads. Many miners take into account HPC integration to be a crucial a part of their enterprise, as their current infrastructure is already optimized for vitality and cooling.

BitFarms shares plunged on Friday after the corporate introduced it might wind down its Bitcoin mining operations over the following two years, beginning with the closure of an 18-megawatt website in Washington because it plans to transform its services into AI and HPC knowledge facilities.

Different miners are selecting a hybrid strategy moderately than withdrawing from Bitcoin mining utterly. In June, Core Scientific signed a $3.5 billion cope with AI cloud supplier CoreWeave to offer 200 megawatts of internet hosting capability for HPC workloads.

In October, CleanSpark inventory soared about 13% in a day after the miner introduced its first foray into AI, and in early November, IREN signed a five-year, $9.7 billion deal to present Microsoft entry to Nvidia GPUs hosted in its knowledge facilities.

journal: How do the world’s main religions view Bitcoin and cryptocurrencies?