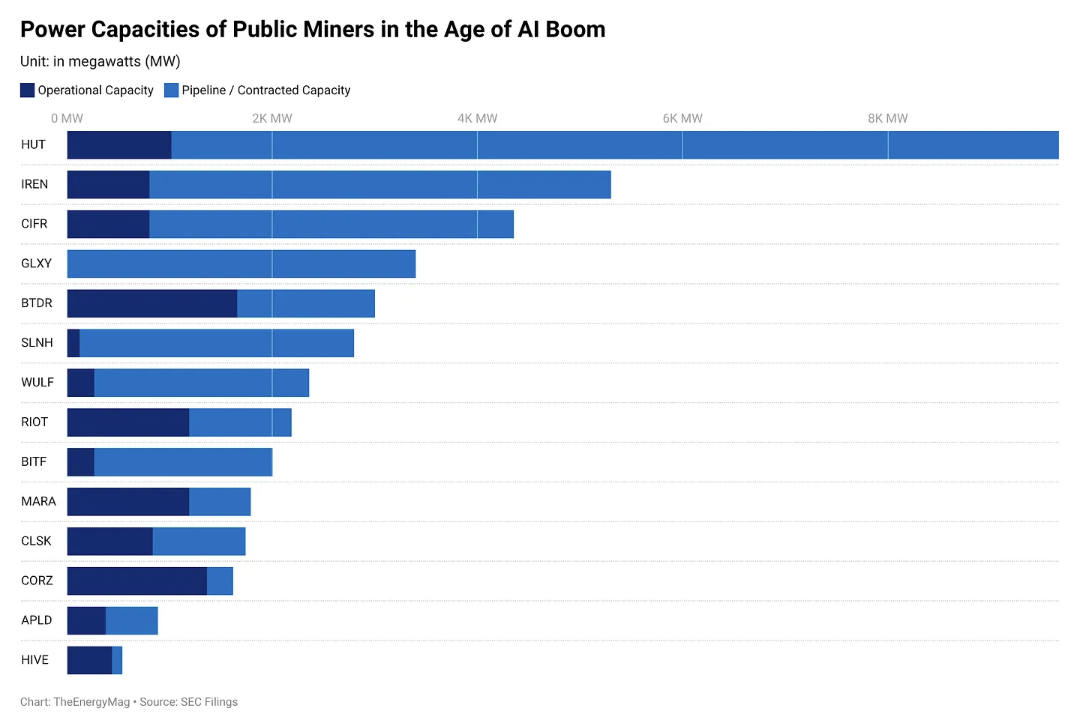

Public Bitcoin miners are planning about 30 gigawatts of latest energy capability geared toward synthetic intelligence workloads as they race to complement shrinking mining margins and reposition for the subsequent progress cycle. That is almost 3 times the 11 gigawatts presently obtainable on-line.

The outcomes, compiled by TheEnergyMag for 14 publicly traded Bitcoin (BTC) miners, spotlight how aggressively the business is pivoting away from conventional hashing energy as hash costs proceed to stoop.

By design, the deliberate growth quantities to what TheEnergyMag described as “the facility infrastructure equal of a small nation.” In actuality, a lot of the 30 GW is sitting in improvement pipelines, interconnection queues, or early-stage plans somewhat than in operational services.

Present and proposed energy capability of public Bitcoin miners. sauce: power mug

The widening hole suggests the competitors is shifting from ASIC effectivity to securing energy, financing, and on-time supply of information facilities.

“It is a megawatt arms race for the AI growth,” TheEnergyMag stated, including that monetization will in the end depend upon whether or not demand for AI is robust sufficient to justify the size of funding.

Associated: The true “supercycle” isn’t cryptocurrencies, however AI infrastructure: Analyst

AI pivot brings early income progress for some miners

The transfer to synthetic intelligence infrastructure displays an more and more hybrid technique amongst present Bitcoin miners, with some already reporting vital income contributions from AI and high-performance computing (HPC) workloads.

One instance is HIVE Digital. The corporate lately posted report quarterly income, pushed partially by its AI and HPC enterprise strains. The corporate reported fourth-quarter income of $93.1 million, up 219% year-over-year, regardless of the decline in Bitcoin costs throughout the identical interval.

Buyers are additionally turning into extra delicate to this modification. Earlier this week, Starboard Worth printed a proposal to Riot Platforms’ administration to speed up the miner’s growth into HPC and AI information facilities.

The diversification efforts come as mining income have taken successful as block rewards have been reduce for the reason that 2024 Bitcoin halving, squeezing margins throughout the business.

The state of affairs has gotten even harder for the reason that fourth quarter, when sturdy promoting strain despatched Bitcoin down from its all-time excessive of over $126,000. Costs briefly fell beneath $60,000 earlier than lastly stabilizing in February.

Regardless of these headwinds, U.S.-based mining firms confirmed resilience early within the 12 months, with manufacturing rebounding after extreme winter storms briefly disrupted operations.

sauce: Julian Moreno

Associated: Paradigm reframes Bitcoin mining as a grid asset somewhat than an power consumption