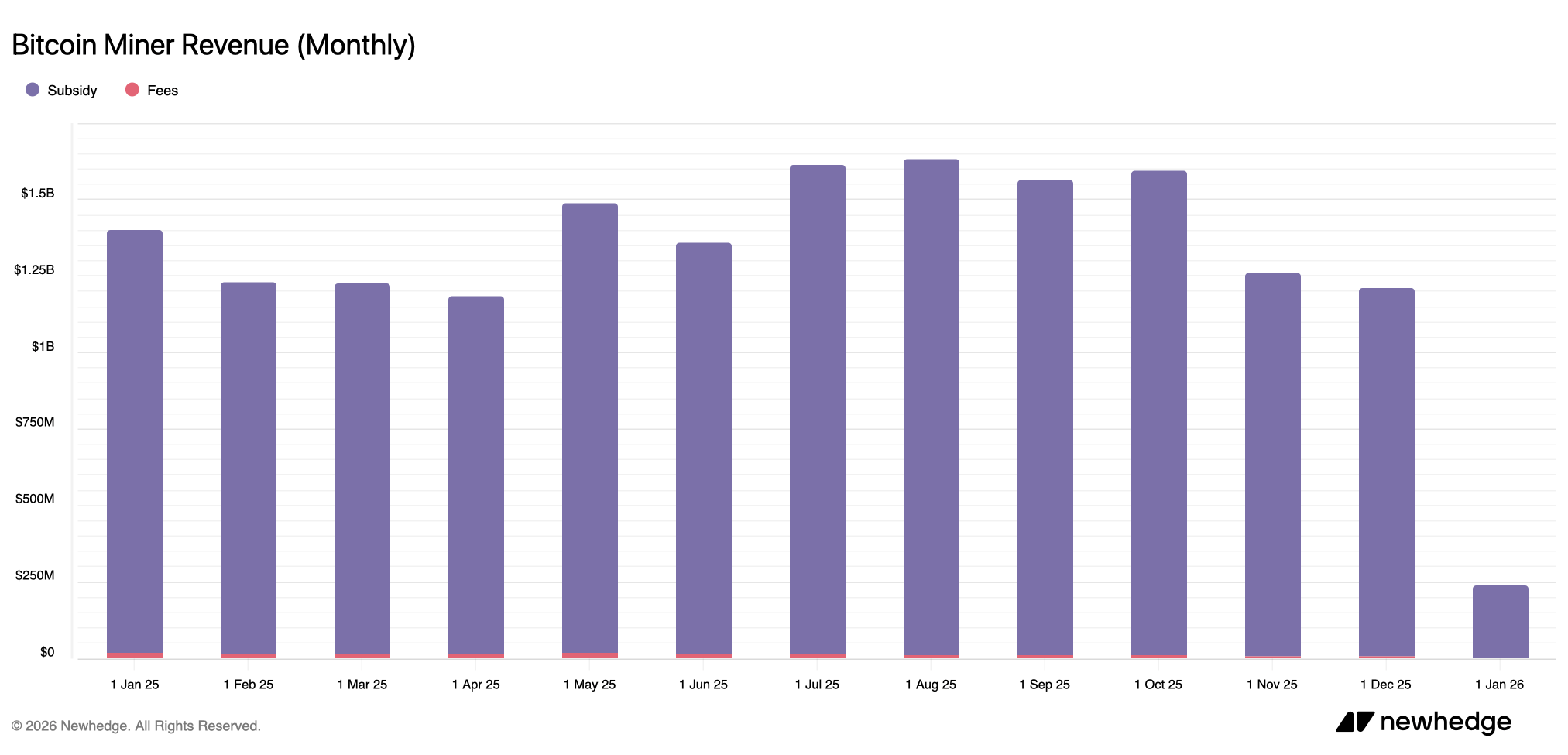

After a lackluster November, Bitcoin miners collected much more modest income within the closing month of 2025, with income reaching round $1.21 billion, the second weakest month-to-month efficiency of the 12 months.

December has been painful for Bitcoin miners, however the worst could also be over

Though the scenario for Bitcoin miners will enhance in 2026, December earnings will nonetheless be That ranks because the second-weakest month of 2025, behind April’s $1.18 billion cumulative whole, in line with newhedge.io statistics. Miner income in November was $1.26 million, down 4.13% from $1.21 billion in December.

December 18, 2025 was the weakest day of the month for HashPrice, the estimated spot worth assigned to sin.At this level, the present price of 1 PH/s was $36.25, one of many lowest hash worth ranges recorded lately.

Regardless of the income squeeze, the community’s hashrate didn’t exceed the 1,000 exahash/second (EH/s) or 1 zetahash/second (ZH/s) threshold till the tip of December. On the finish of the primary week of January 2026, the hashrate will stay at 1,046 EH/s and a brand new problem epoch will arrive inside two days.

Additionally learn: Wall Road powerhouse Morgan Stanley recordsdata for Bitcoin and Solana ETFs

Block occasions will probably be barely longer on common at 10 minutes and eight seconds, and present forecasts recommend problem could ease by 1.4%, though that outlook may change over the following two days.

A slight improve in block occasions and a potential downward adjustment of problem recommend a modest mechanical leisure, however not a basic reset. The reasonable common block time and powerful hashrate are each primarily as a consequence of improved income, with the present hash worth stage sitting at $40.26 per PH/sec.

Spot hash costs have risen 11% since December 18th lows. Nonetheless, on-chain charges nonetheless account for lower than 1% of whole block rewards, and Bitcoin miners rely closely on BTC worth appreciation to extend the worth of their subsidies.

If BTC worth continues to carry robust and hash worth maintains its latest beneficial properties, it may discover extra secure footing in early 2026. Till then, the mining financial system will probably be a check of effectivity, stability sheet energy and endurance.

Steadily requested questions ⛏️

- Why did Bitcoin miners wrestle in December 2025?Income fell to $1.21 billion as hash costs fell to multi-year lows and transaction charges remained minimal.

- What has modified for Bitcoin miners heading into 2026?Hashprice has recovered 11% from its December 18th low, and community hashrate and income metrics have began to enhance.

- How robust is the Bitcoin community regardless of declining miner revenue? The hashrate remained above 1 zettahash per second till late December, indicating continued participation in mining.

- What is going to miners depend on to enhance profitability in early 2026?Miners are nonetheless closely depending on rising BTC costs, and on-chain charges stay lower than 1% of block rewards.