Bitcoin mining crossed a historic threshold in late 2025. In line with a current report from GoMining, the community has entered the ZetaHash period, with computing energy exceeding 1 ZetaHash per second.

However whereas hashrate soared to report ranges, miner profitability went in the other way. In consequence, the mining trade might be bigger, extra industrialized, and extra uncovered to cost threat than at any level on this cycle.

Bitcoin mining has entered a brand new regime.

In our 2025 Bitcoin Mining Market Overview, we examine:

🔹 How has the mining financial system modified over time?

🔹 What Relentless Hash Value Strain Reveals In regards to the Sector

🔹Why scale, energy technique, and capital construction are extra essential than cycles now… pic.twitter.com/bh5GJM5WaE— GoMining Institutional (@GoMiningInst) January 28, 2026

Hash charge reaches report excessive as mining scale expands

This report reveals that Bitcoin’s community has been maintained for a very long time 1 ZH/s on common for 7 daysindicating a structural change relatively than a brief spike.

This progress displays aggressive {hardware} upgrades, new information facilities, and growth of business operations. Mining is not dominated by marginal gamers. It now resembles vitality infrastructure.

In consequence, competitors for block rewards is growing.

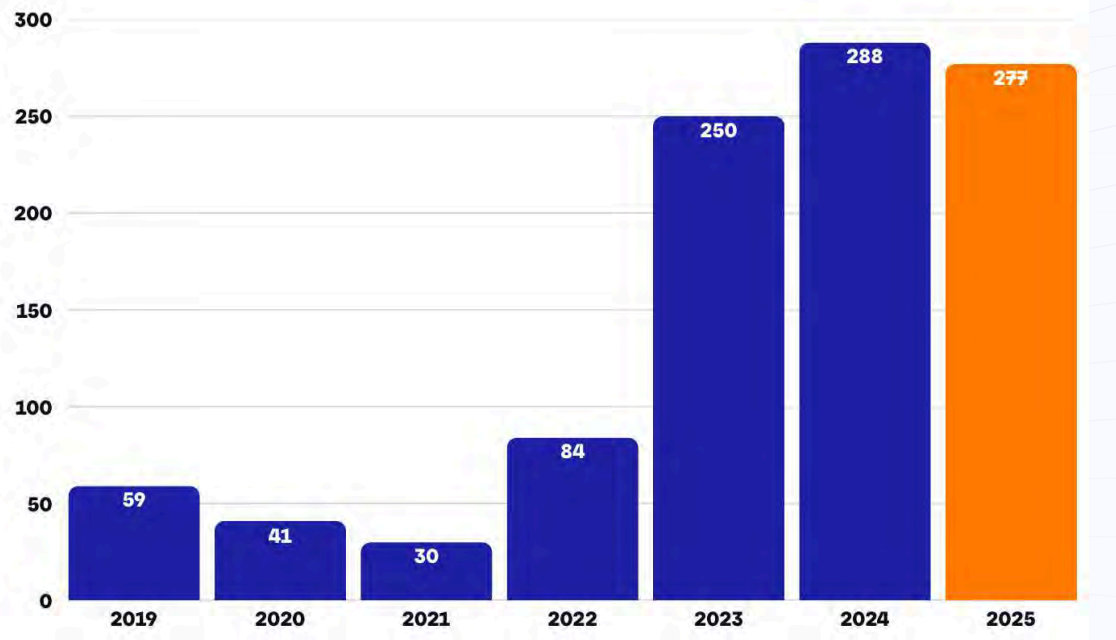

Annual improve in community hashrate. Supply: GoMining

Regardless of community progress, income per miner is reducing

Whereas hashrate expands, Income per unit of compute fell into one of many narrowest ranges on report.

The report highlights that Miners’ incomes are more and more depending on bitcoin value and the problem of being alone. Different buffers, equivalent to rising transaction charges and better block subsidies that after cushioned margin stress, are additionally fading.

This compression signifies that miners function on thinner margins regardless that they’re placing in additional capital and energy.

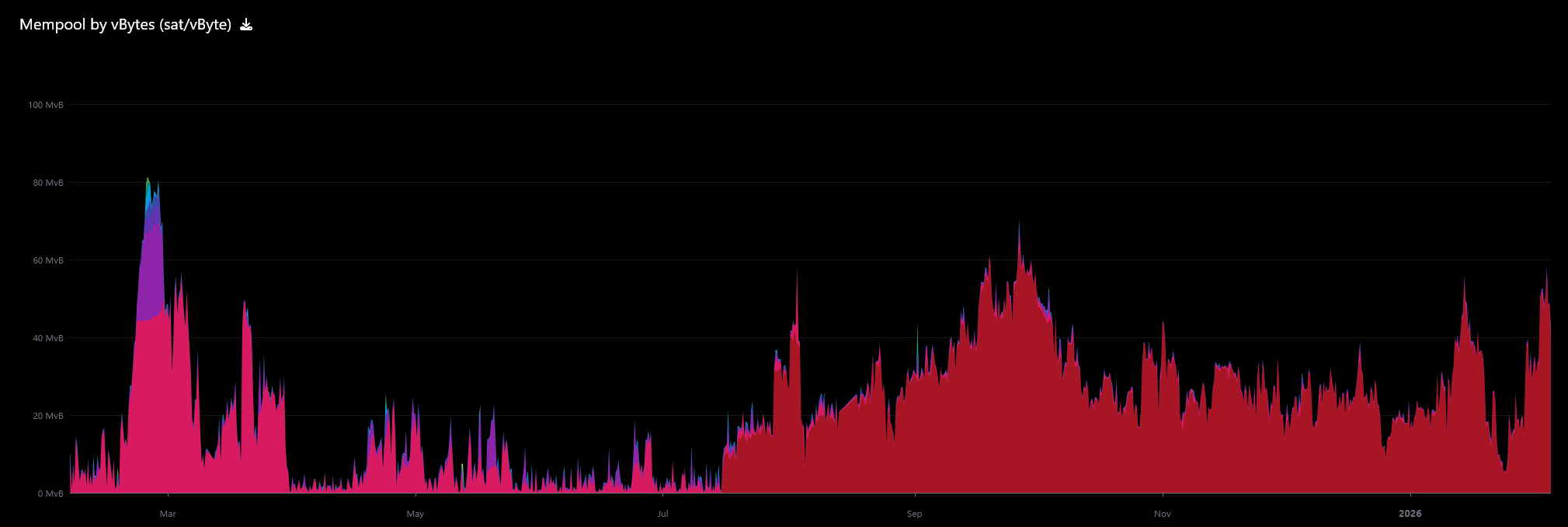

In line with GoMining, the affect was seen in Menpur. For the primary time since April 2023, Bitcoin’s reminiscence pool was fully cleared a number of instances in 2025.

Mempool was cleared a number of instances in 2025. Supply: Mempool.area

Because of this the Bitcoin community was so quiet that transactions had been settled shortly, even with the bottom potential charges.

In consequence, miners obtained nearly nothing from charges and needed to rely nearly fully on the worth of Bitcoin and block subsidies for his or her earnings.

Transaction charges will hardly be diminished after the halving

The stress worsened because of the post-half-life state of affairs.

With the block subsidy diminished, 3.125 $BTCbuying and selling charges couldn’t offset the loss in income. The report notes that the charges are structured as follows: Lower than 1% of complete block reward for many of 2025.

In consequence, the miner’s financial system grew to become immediately uncovered to Bitcoin value fluctuations, lowering inside stabilizing measures.

All through 2025, transaction charges accounted for lower than 1% of complete block rewards. Supply: GoMining

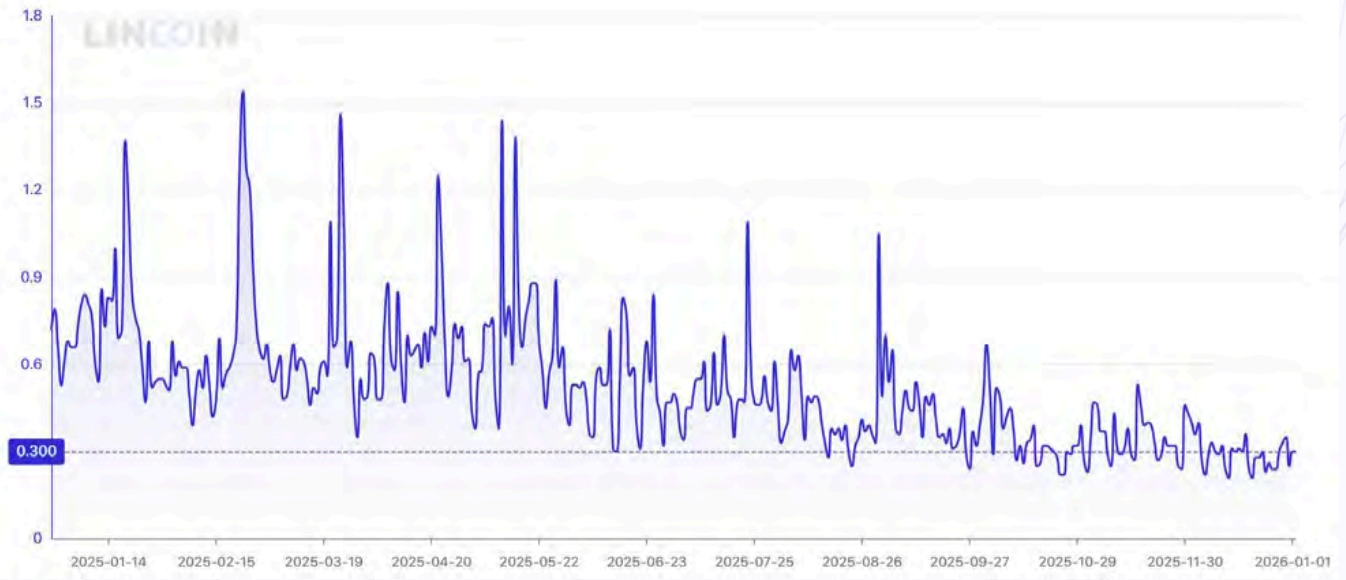

Hashprice hits lows as revenue margins proceed to come back below stress

This squeeze was clearly seen within the hashprice, or the each day income earned per unit of hashrate.

Hash value has fallen to a close to all-time low, based on stories $35 per day per PH in November The decline continued into the top of the 12 months. Completed the quarter close to $38That is effectively beneath the historic common.

This leaves little room for operational error.

Bitcoin hash costs have continued to fall over the previous 12 months. Supply: GoMining

Shutdown costs flip value ranges into financial triggers

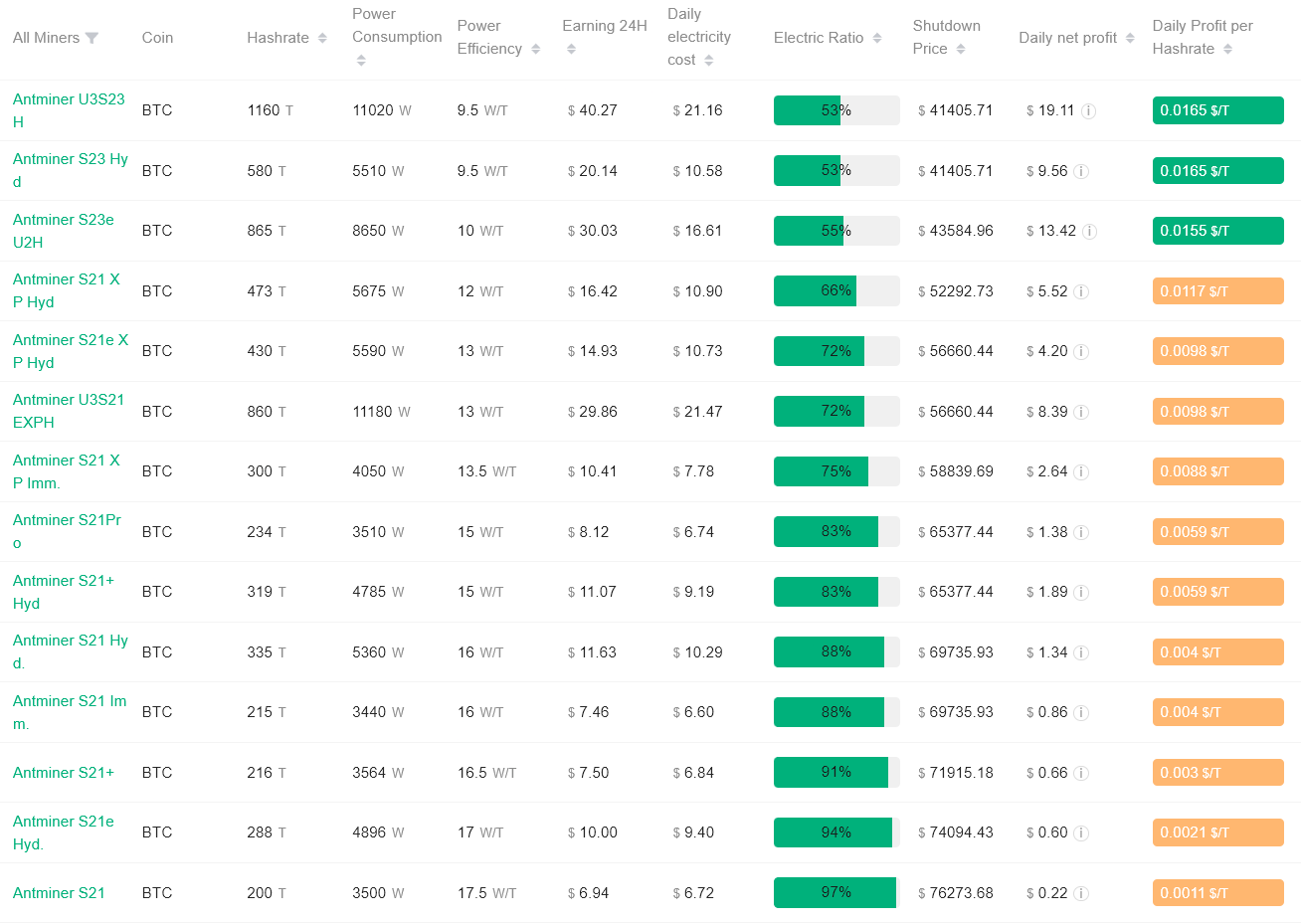

These findings are in shut settlement with current information on. Miner shutdown value.

With the present difficulties and electrical energy prices, $0.08 per kWhbroadly used S21 collection miners are near breaking even at between $69,000 and $74,000 per transaction. $BTC. Beneath this vary, many companies cease producing working income.

Extra environment friendly high-end machines are nonetheless viable at a lot decrease costs. However mid-level minors face rapid stress.

Most Bitcoin miners have a shutdown value of lower than $70,000. Supply: Antpur

Why that is essential for Bitcoin value proper now

This doesn’t create a value flooring. The market could commerce beneath the break-even level for mining.

Nonetheless, it creates behavioral threshold. If Bitcoin falls beneath a key cease stage, weaker miners could promote reserves, shut down tools, or cut back publicity.

Such actions may improve volatility in a market already strained by tight liquidity.

Bitcoin mining is extra highly effective and industrial than ever earlier than. Nonetheless, that scale comes with sensitivity. As hashrate will increase and costs lower, Value is extra essential, not much lessfor minor stability.

It makes the extent like this $70,000 It makes financial sense not as a result of the graph says so, however as a result of the price construction of the community says so.

The article “Bitcoin mining enters the Zetahash period as profitability tightens” was first revealed on BeInCrypto.