Bitcoin miner outflows surge to 48,000 $BTC However big outflows don’t imply miners capitulate, based on January disclosures from main firms. $BTC mining firm.

In accordance with on-chain knowledge, Bitcoin miners moved 48,774 Bitcoins value $3.2 billion from wallets between February fifth and sixth. Nonetheless, trades don’t routinely replicate miner give up or fast spot market gross sales. This knowledge consists of transfers to exchanges, inside pockets actions, and transfers to different entities. Subsequently, the miner exodus doesn’t imply that Bitcoin miners are releasing their belongings to the general public market because the crypto winter continues.

Pockets linked to Bitcoin miner strikes $48,000 $BTCvalue $3.2 billion in two days

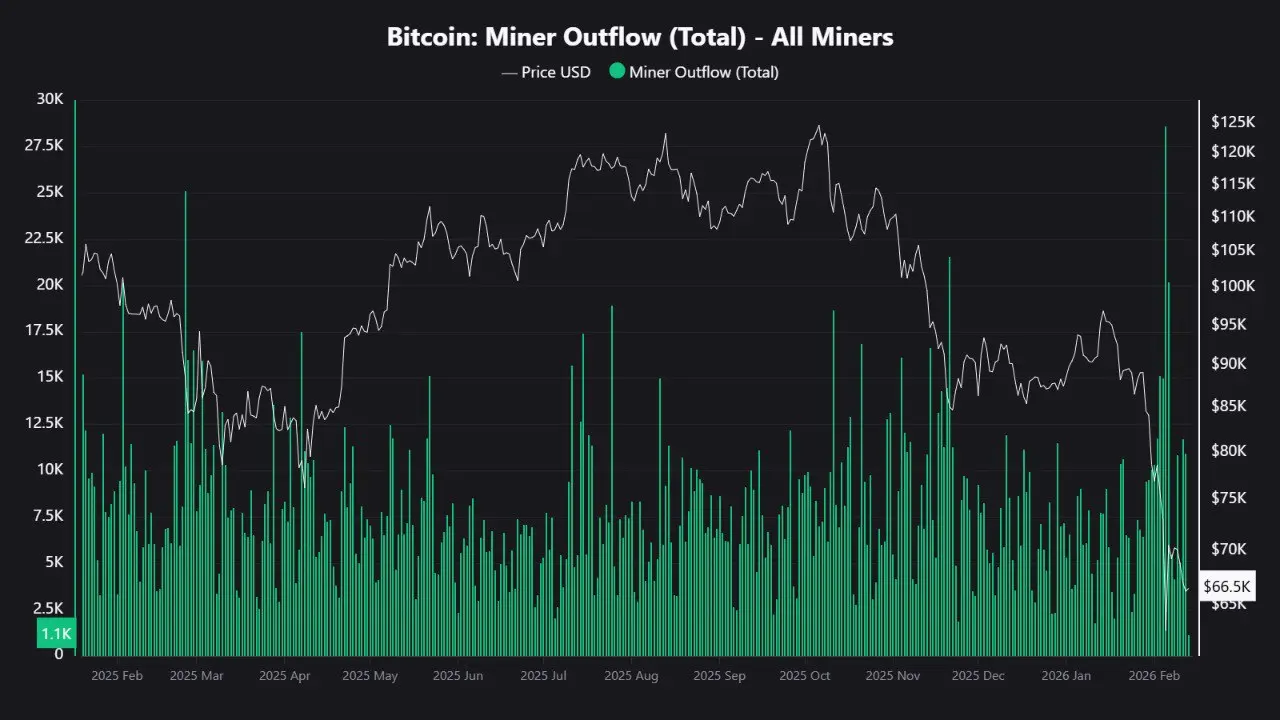

Supply: CryptoQuant Bitcoin Miner Outflow (Whole) All Miners

February fifth, Bitcoin miner leaked spiked as much as 28,605 $BTC The worth is $1.8 billion. This worth represents some of the important day by day transactions associated to miner pockets addresses since November 2024. Wallets linked to miners additionally recorded an extra 20,169. $BTC In accordance with on-chain knowledge, $1.4 billion value of outflows occurred on February sixth, and an identical outflow spiked on November twelfth, 2024.

The spike on February fifth and sixth coincided with Bitcoin’s latest value decline, with belongings reaching $62,000 earlier than recovering to $66,000. Whale buying and selling amid market volatility has garnered a number of consideration and will sign potential promoting strain.

Regardless of on-chain knowledge exhibiting that addresses linked to miners moved massive quantities of Bitcoin over a two-day interval, the listed mining firm’s company paperwork don’t present any sturdy promoting strain from miners. Eight miners have reported a complete of two,377 manufacturing, together with CleanSpark, Bitdeer, Hive Digital Applied sciences, BitFuFu, Canaan, LM Funding America, Cango, and DMG Blockchain Options. $BTC It’s listed within the monetary statements for that month. Nonetheless, this quantity is considerably decrease than the numbers recorded on February fifth and sixth.

Throughout the identical interval, mining firms didn’t promote massive quantities of Bitcoin. complete variety of $BTC CleanSpark, Cango, and DMG’s gross sales matched solely a portion of the minor spills registered on February fifth or sixth. CleanSpark reported mining 573 $BTC and gross sales 158.63 $BTC Throughout January, Kango mined 496.35 $BTC Disclose sale of 550.03 $BTC.

LM funding mined 7.8 $BTC He additionally reported that he didn’t promote any Bitcoin. Different firms like BitDeer, BitFuFu, and Canaan didn’t. disclose of $BTC Nonetheless, primarily based on projections, will probably be tough to reconcile the outflows recorded on February 5 and 6 with the corporate’s data.

Bitcoin miners are dealing with strain from: $BTC value is beneath manufacturing value

The information comes at a tough time for miners. In accordance with knowledge In accordance with Checkonchain, Bitcoin’s value flooring fell beneath the problem regression mannequin representing Bitcoin’s common manufacturing value on January 26 and has remained beneath since then. The information reveals how a lot it prices to provide 1. $BTC is $79,242,000, however $BTC On the time of publishing this text, it’s buying and selling at $66,485,000.

The Royal Authorities of Bhutan $BTC Switch 100 and promote it off $BTC It was despatched to QCP Capital’s WBTC service provider deposit tackle (bc1qt) on Thursday, based on blockchain evaluation agency Arcam. Cryptopolitan reported The motive for the transaction stays unclear. This implies that the federal government is doubtlessly engaged on liquidity administration or making ready to promote right into a liquid market. The Royal Authorities of Bhutan is actively implementing state-led initiatives. $BTC Mining exercise is rising, and the financial system might loosen as a result of elevated promoting strain.

Bitcoin has fallen sharply since hitting a yearly excessive of $97,860 on January 14, based on knowledge from CoinMarketCap. The crypto asset has since fallen greater than 30% amid intense promoting strain.