In line with a Friday analysis report from Dealer Canaccord Genuity, Iren (Iren) reported fourth quarter outcomes highlighting speedy progress in each Bitcoin mining and the substitute intelligence infrastructure enterprise.

The dealer repeated the acquisition rankings of the inventory, growing its worth goal from $24 to $37, to 60%.

In early buying and selling, shares rose 25% to $28.75.

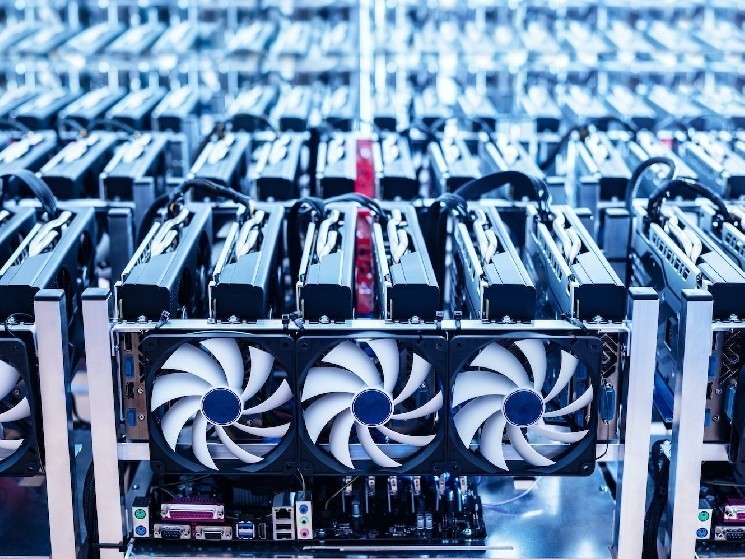

The corporate’s mining unit exceeds $1 billion in annual income occupancy, one in every of 50 capability per second (EH/S) capability, at 15 j/TH, is without doubt one of the best fleets within the trade, working at 3.5 cents/kWh of electrical energy, written by an analyst led by Joseph Vafi. This results in a $36,000 price of mining Bitcoin, which is nicely under market degree.

Bitcoin mining revenues rose 33% in quarter to $187.3 million, whereas adjusted EBITDA rose 46% to $121.9 million.

On the AI facet, Aylen is accelerating growth, the report says. Bitcoin Miner has quadrupled its hashrate, with extra progress anticipated in fiscal 12 months 2025, including one other 3 MW of megawatt capability.

Hashrate refers back to the complete computing energy used to mine and course of transactions on the Proof of Work Blockchain, a proxy for competitors and mining difficulties within the trade.

Canaccord additionally identified Iren’s latest designation as Nvidia (NVDA) most popular associate.

With its protected energy capability of two,910 MW and a number of the trade’s lowest all-in-cash prices, Kanack Code claims that Aylen will turn out to be one of many largest and best publicly listed miners with key choices in high-performance computing.

learn extra: Aylen posts his first annual income on AI cloud progress, increasing mining. Shares are rising