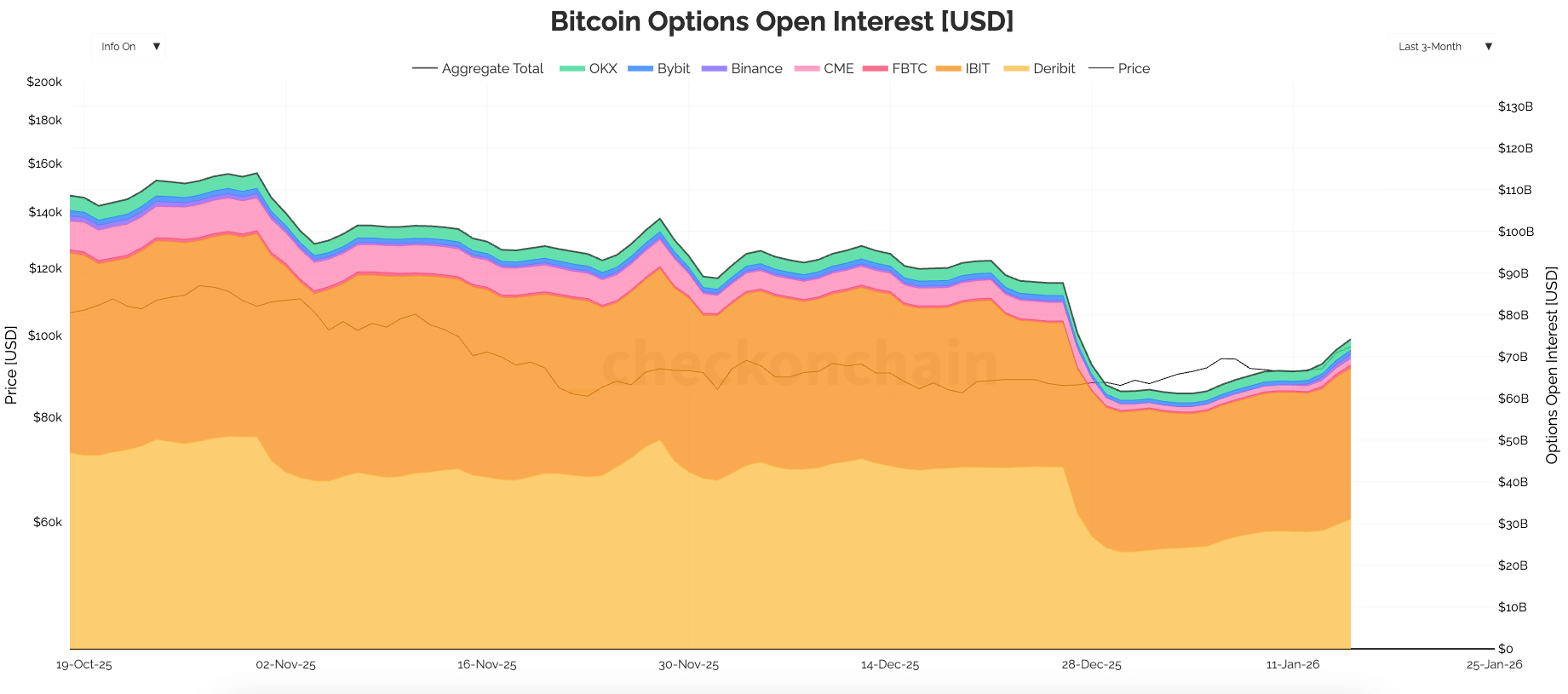

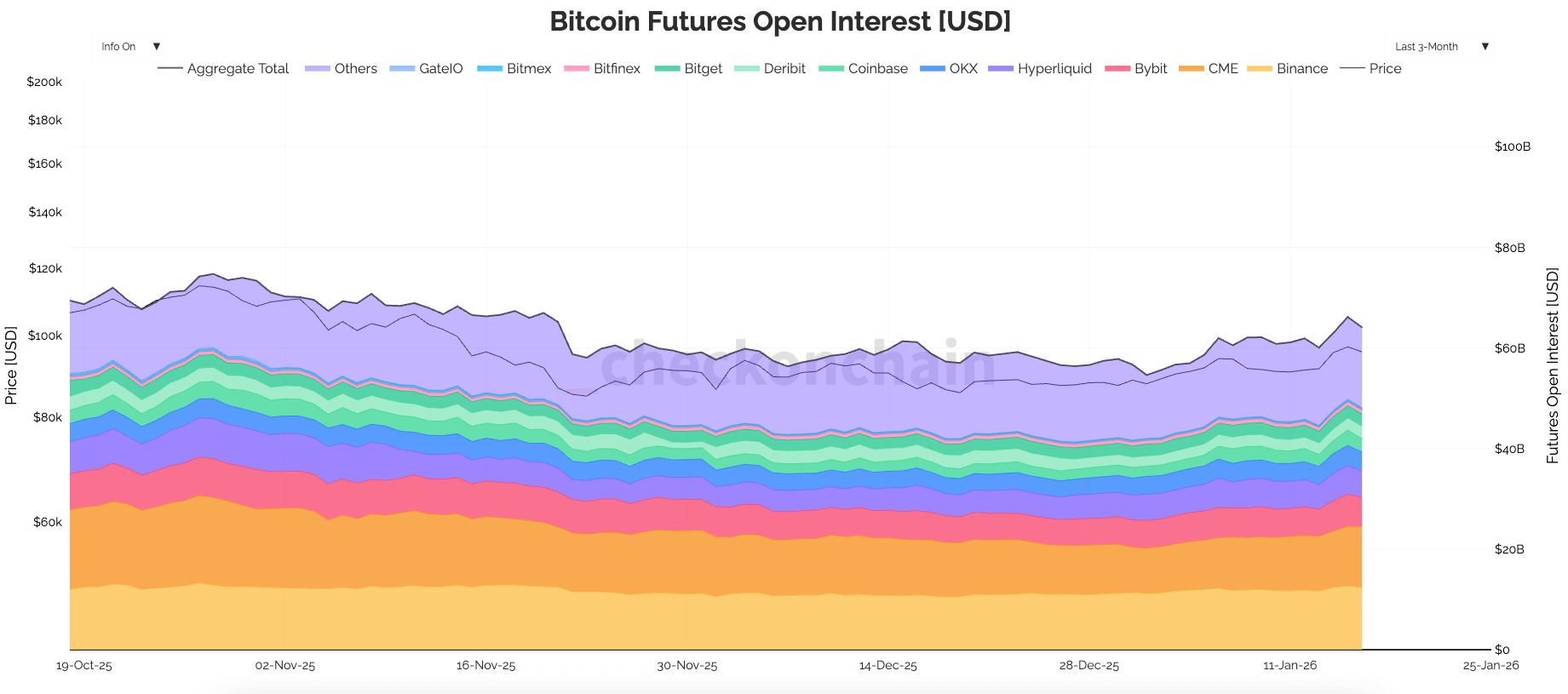

By mid-January, open curiosity in Bitcoin choices had elevated to roughly $74.1 billion, outpacing open curiosity in Bitcoin futures, which was roughly $65.22 billion.

Open curiosity measures place stock quite than buying and selling exercise as a result of it’s the stock of excellent contracts that haven’t been closed or expired. So, when possibility shares outperform futures, we frequently see that the market depends extra on structured exposures resembling hedging, yield overlays, and volatility positioning than uncooked directional leverage.

Futures stay the simplest approach to achieve leveraged publicity to the course of Bitcoin. Nonetheless, choices permit merchants and establishments to form their dangers extra exactly by way of payoff profiles that permit them to restrict losses, revenue on upside, or goal particular volatility outcomes.

This distinction is essential as a result of possibility positions typically stay on the books longer than futures positions, and their persistence can have an effect on how volatility behaves round key train, expiration, and liquidity home windows. Choices outperforming futures is a significant milestone for the market and has clear implications for every day Bitcoin buying and selling.

Why the open curiosity of choices stays larger than that of futures

The Future is constructed for direct publicity and fast repositioning. Merchants put up margin, purchase and promote contracts tied to Bitcoin, and handle liquidation threat, which will increase with funding charges, foundation shifts, and leverage.

Futures positions can develop quickly, however are additionally very delicate to carrying prices. If the funding turns into punitive or foundation commerce funds cease, the place will disappear. Throughout a widespread leverage reset, futures open curiosity quickly declines as quick merchants rush to cut back threat whereas gradual merchants are pressured out.

Choices are likely to behave otherwise as a result of they’re typically used as longer-lived buildings quite than simply leverage. Calls and places convert views into outlined payoff profiles, whereas spreads, collars and lined calls convert spot exposures into managed threat positions.

This creates inventories that may final for weeks or months, as they’re typically related to hedging, systematic yield applications, or volatility methods that run on a schedule. As soon as a place is held till a specified expiration date, the open curiosity turns into sticky by design.

The calendar clearly reveals that. Knowledge from CheckOnChain reveals a big decline in choices open curiosity round late December, adopted by a rebuild into early January, in keeping with the sample of main expirations passing and the market reestablishing threat for the following cycle.

Futures open curiosity over the identical interval seems to be growing extra steadily, reflecting a market the place positions are regularly adjusted, quite than being mechanically settled by expiry. This distinction explains why choices can outperform futures even when costs are risky and confidence seems combined.

As choices open curiosity will increase, the market making layer turns into much more essential. Sellers who mediate possibility flows typically hedge their exposures with spot or futures contracts, which may have an effect on value conduct close to main strikes and into expiration home windows.

In extremely positioned markets, hedging can dampen or speed up the motion, relying on how the publicity is distributed throughout strikes and maturities.

Excessive possibility open curiosity subsequently additionally serves as a map of the place hedging depth might improve, particularly if liquidity turns into skinny or the market gravitates towards crowded ranges.

Break up Markets: Crypto Native Choices vs. Change Traded ETF Choices like IBIT

Bitcoin Choices is not one unified ecosystem with a single participant base. Checkonchain’s choices information by change reveals well-known crypto exchanges alongside a rising phase associated to exchange-traded ETF choices, together with IBIT.

This segmentation ought to develop into rather more essential than it at present is, because it adjustments the rhythm of buying and selling, the mechanics of threat administration, and the dominant methods that drive demand.

The crypto-native choices venue makes use of crypto belongings, serves proprietary buying and selling firms, crypto funds, and complicated retailers, and operates on a steady market that trades all through the weekend. Change-traded ETF choices commerce throughout U.S. market hours and are executed by way of a clearing and settlement framework acquainted to fairness choices merchants.

The result’s a schism through which, regardless that Bitcoin transactions world wide happen 24/7, a larger proportion of volatility threat could also be expressed inside regulated land-based conduits.

Market time alone can reshape and even decide conduct. Whereas a big share of possibility move is concentrated in US time zones, hedging exercise in that timeframe turns into extra synchronized, whereas offshore venues typically lead value discovery throughout after-hours and weekends.

Over time, markets can really feel like shares throughout US hours and like cryptocurrencies outdoors of US hours, even when the underlying asset is identical. For merchants who handle threat throughout a number of exchanges, futures are sometimes the best way to bridge the hole by way of hedging and arbitrage.

Clearing and margin disciplines additionally form participation. Listed choices sit inside the standardized margin and central clearing buildings arrange to be used by many monetary establishments, widening entry for firms unable to carry threat on offshore exchanges.

These members carry established methods resembling lined name applications, colour overlays, and volatility focusing on approaches that exist already in fairness portfolios. When these methods enter Bitcoin by way of ETF choices, this system repeats on a schedule, creating common demand for a selected interval and train, permitting the choice stock to stay elevated.

None of this diminishes the function of crypto-native venues, which stay dominant in steady buying and selling and specialised volatility and foundation methods.

What’s altering is that who’s holding choices threat and why is changing into extra combined, with growing shares reflecting portfolio overlays and structured flows quite than purely speculative positioning. This helps clarify why choices open curiosity stays excessive even during times when futures are delicate to funding, foundation compression, and risk-off deleveraging.

What crossovers imply for volatility, liquidity, and the way merchants learn the market

When choices open curiosity rises above futures, short-term market conduct tends to be extra influenced by positioning geometry and hedging flows. Futures-heavy regimes typically categorical stress by way of funding suggestions loops, foundation fluctuations, and liquidation cascades that may quickly compress open curiosity.

In option-heavy regimes, stress is commonly expressed by way of expiry cycles, train concentrations, and seller hedging, which may dampen or amplify spot actions relying on how publicity is allotted.

Macro information and spots are nonetheless essential, however the path the market takes will rely on the place the choice threat lies and the way sellers hedge it. At giant expirations, intensive strikes may be essential alongside headlines, and after expiration the market typically goes by way of a rebuilding part as merchants re-establish publicity and advance buildings.

The late December decline and January rebuild match that sample, offering a transparent timeline of how inventories have progressed by way of the start of the 12 months.

The sensible level is that by-product positioning is a robust driver of short-term value developments. Monitoring choices open curiosity by venue can assist distinguish offshore volatility positioning from onshore ETF-linked overlays, however futures open curiosity stays a key measure of leverage and foundation choice.

Due to this fact, the identical whole sum can suggest very completely different threat circumstances relying on whether or not the positioning is concentrated in a listed ETF choices program, in a crypto-native volatility construction, or in a futures contract that may shortly unwind.

The headline numbers convey a transparent message about Bitcoin’s new market construction. Roughly $74.1 billion in choices open curiosity vs. roughly $65.22 billion in futures means that whereas extra BTC threat is being saved in merchandise with outlined payoff profiles and repeatable overlay methods, futures stay the first rail for hedging choices publicity by way of directional leverage and delta.

As ETF choices develop into extra liquid and crypto-native venues proceed to dominate steady buying and selling, Bitcoin volatility might more and more replicate the interplay between US market-hour liquidity and 24/7 crypto liquidity.

Crossovers are a snapshot of that hybridization, displaying a market the place positioning, maturity, and hedging mechanisms play a significant function in value actions.