Bitcoin, which briefly fell beneath six digits a day earlier, was buying and selling above $103,000 by 11 a.m. ET on Wednesday, however the actual motion is occurring within the derivatives pit.

From futures to choices: Bitcoin derivatives area stays lively

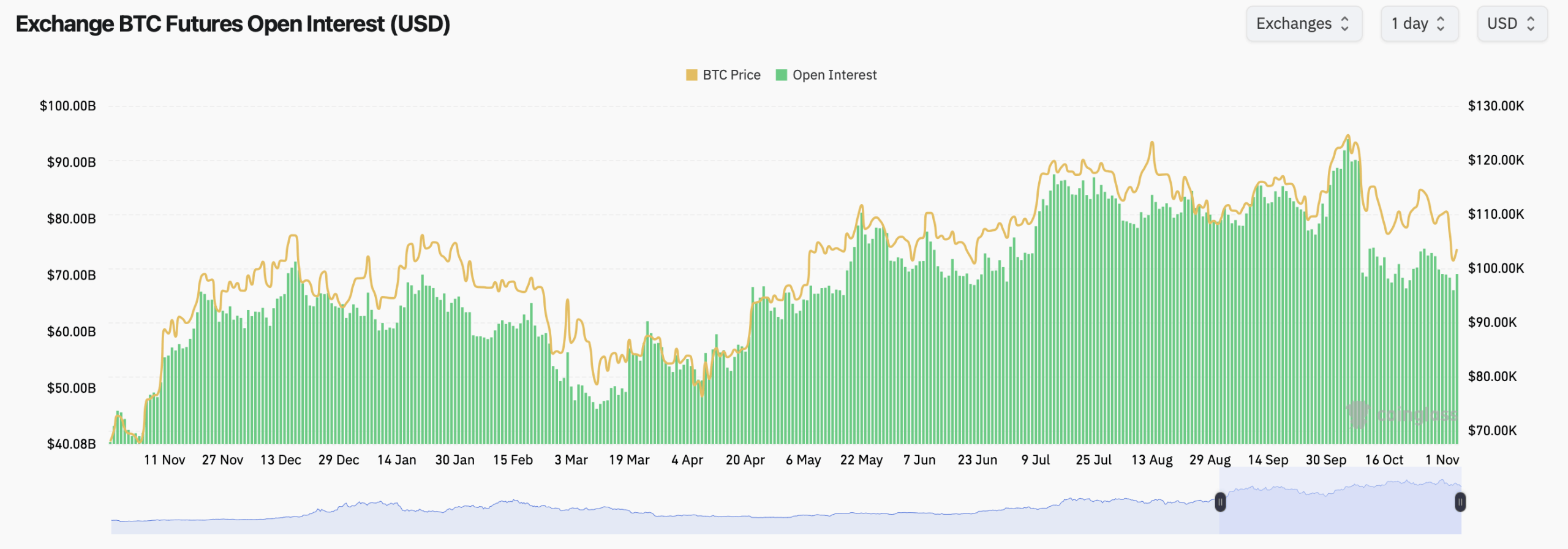

In response to knowledge from Coinglass, whole Bitcoin futures open curiosity (OI) stood at 677,750 BTC, price about $70.24 billion, up 3.47% in 24 hours. CME continues to guide OI with $14.35 billion, intently adopted by Binance with $12.45 billion.

CME’s dominance accounts for 20.42% of the entire futures publicity, whereas Binance accounts for 17.72%. In the meantime, OKX recorded the sharpest rise in 24 hours at 4.12%, indicating contemporary capital inflows. Bybit, Gate, and Kucoin confirmed blended outcomes. Bybit’s OI fell by 2.03%, Gate by 0.42%, and Kucoin by 2.97%.

Bitcoin futures open curiosity as of November 5, 2025, based on Coinglass.com

Nevertheless, MEXC grabbed consideration with an explosive rise in OI of 17.45% on the ultimate day, whereas BingX recorded an increase of 9.32%. These adjustments counsel that smaller venues are attracting short-term leveraged performs as merchants reposition positions following Bitcoin’s weekly spot market decline of seven%.

On the choices facet, Deribit stays dominant and accounts for almost all of Bitcoin choices open curiosity. The whole OI for BTC choices is simply over $50 billion, with calls accounting for 61% and places accounting for 39%. Previous day statistics present that calls account for 60.73% of the quantity, indicating a cautiously bullish bias regardless of latest volatility.

The most well liked bets on Deribit are centered round December’s massive expiration date, with merchants dashing into name choices concentrating on $140,000 per coin, together with massive put positions close to $85,000 and moonshot calls at $200,000. In layman’s phrases, merchants are overlaying all their bases, hedging in opposition to the decline whereas securing a ticket to a potential rocket experience by the top of the 12 months.

Deribit’s most ache stage is round $105,000, whereas Binance’s most ache curve is presently pointing at $110,000. This implies that possibility writers might want Bitcoin to remain shut to those zones to trigger most discomfort to speculators.

In different phrases, the Bitcoin derivatives market continues to be very lively. With CME and Binance dominating the futures market and Deribit working the choices desk, most ache ranges counsel volatility will scale back in direction of mid-November. With re-leveraging and rising open curiosity, merchants are clearly gearing up for Bitcoin’s subsequent massive swing. The query is which solution to go?

Regularly requested questions ❓

- What’s the present futures open curiosity in Bitcoin? Bitcoin futures OI is led by CME and Binance, totaling $70.24 billion throughout exchanges.

- What’s the name to place ratio for BTC choices?Calls accounted for 61% of possibility OI, indicating a barely bullish pattern.

- What are the primary BTC possibility workouts on Deribit?Probably the most lively strikes are $140,000, $120,000, and $85,000.

- What’s Bitcoin’s present most ache stage?On Deribit it is about $105,000 and on Binance it is about $110,000.