Coinbase Bitcoin ($BTC) Worth has been under competing exchanges this week, and the hole continues to widen.

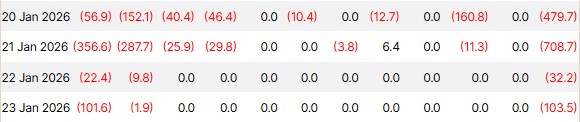

CoinGlass on January twenty sixth reported its Coinbase Bitcoin Premium Index, which tracks value differentials with Coinbase. $BTC/USD and Binance $BTC/$USDThas turned considerably detrimental, indicating that Bitcoin is buying and selling at a reduction within the largest venues within the US in comparison with its offshore opponents.

The transfer comes because the U.S. Spot Bitcoin ETF recorded $1.1 billion in outflows final week and broader danger urge for food has weakened, elevating questions on whether or not there are cracks in U.S. institutional demand or if one thing extra sinister is occurring within the crypto market’s plumbing.

The reply might be each, and the excellence is essential as a result of persistent reductions reveal greater than sentiment and reveal constraints akin to how liquidity strikes between venues, how ETF flows translate to identify execution, and whether or not arbitrage infrastructure can preserve market connectivity throughout instances of stress.

Sign definition

CoinGlass paperwork the premium index as the value distinction between Coinbase Professional and Binance, with a detrimental worth which means Bitcoin is cheaper on Coinbase than on Binance.

The index is just not a pure demand gauge because it measures the unfold between USD and USD venues. $USDTIntroducing mechanical results on account of stablecoin deviations, funding circumstances, and offshore leverage dynamics, – a nominal venue.

In our baseline interpretation, a widening detrimental premium is handled as proof of comparatively stronger promoting stress or weaker bidding depth in US-related venues in comparison with offshore markets.

Nevertheless, value divergences between exchanges can final for days or perhaps weeks even in liquid markets, reflecting pure segmentation fairly than pure demand and provide adjustments.

Analysis on cryptocurrency value formation has repeatedly documented massive gaps brought on by switch frictions, compliance obstacles, credit score restrictions, and stock constraints that stop rapid decision of arbitrage disruptions.

The query, as all the time, is just not whether or not there’s a selloff, however fairly why cross-venue arbitrage has failed to shut the hole and what that reveals about stresses in funding, cost infrastructure, or danger urge for food.

etf piping channel

If a US spot Bitcoin ETF data web outflows, licensed contributors and market makers could alter hedging and liquidity provision, which may result in web promoting of spot gross sales and lowered bid depth.

Coinbase serves as the first liquidity venue for US institutional crypto infrastructure, dealing with custody for over 80% of Bitcoin ETF issuers, and BlackRock documentation refers to Coinbase Prime as an affiliate of the iShares Bitcoin Belief administrator.

This built-in position signifies that ETF redemption exercise can undergo a Coinbase-linked execution path extra instantly than via an offshore venue.

Over the previous week, massive sums of cash have been outflowed from U.S.-traded Bitcoin ETFs over a number of days, totaling greater than $1.3 billion, in keeping with information from Pharcyde Traders.

The timing correlation is suggestive however not conclusive, as most US spot Bitcoin ETFs use money creation and redemptions fairly than pure in-kind transfers, which introduces a delay between the ETF’s share flows and spot executions.

This sample is much like the signs of stability sheet tightening.

When ETF flows develop into unstable and macro danger urge for food weakens, U.S.-linked liquidity suppliers increase their bids quicker than offshore deleveraging, creating a short lived however persistent low cost.

The premium is a real-time measure of whether or not an establishment’s demand is maintaining with its provide. And now there are indications that the U.S. bid is backtracking.

USD-$USDT plumbing channel

A second mechanical issue is launched into the index construction. As a result of Coinbase trades in opposition to USD and Binance trades in opposition to USD. $USDT, $USDT/USD charge impacts the premium calculated even when spot demand is identical throughout venues.

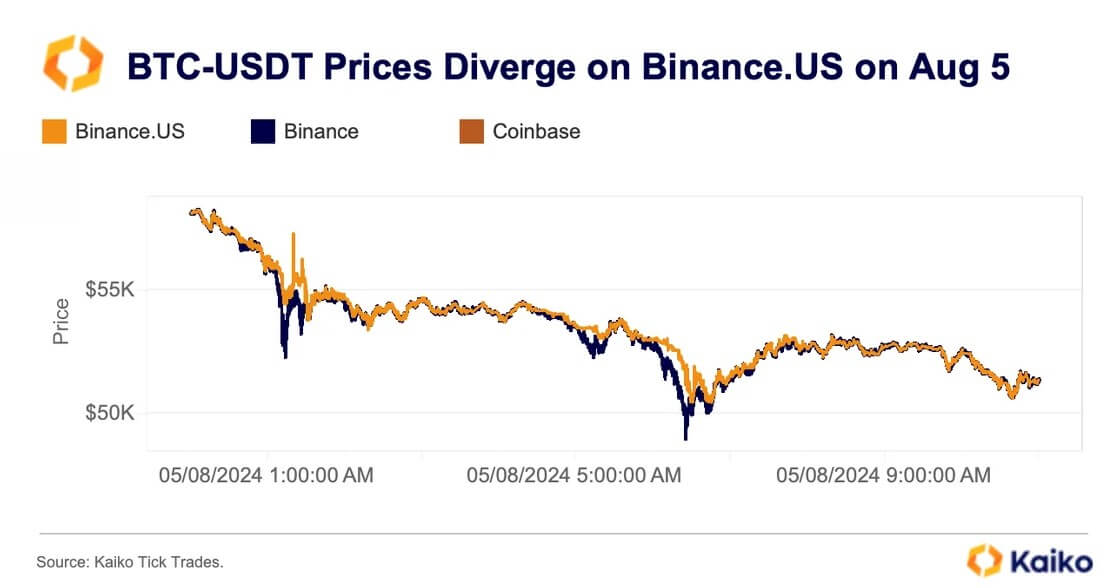

Kaiko recorded the next episode. $USDT When the market is harassed by stablecoin provide constraints, offshore funding circumstances, or per-market foundation dynamics, it shortly flips between low cost and premium.

if $USDT When traded above parity, $BTC/$USDT Even when there isn’t any extra promoting on Coinbase itself, the value will visually look greater and Coinbase’s low cost will mechanically worsen.

The perpetual swap market additional exacerbates this impact. The funding charge is mechanically linked to the spot perp base calculation. When funding turns into detrimental or compressed, the connection between the US greenback and funds deteriorates. $USDT Venues can develop into disjointed as merchants alter hedges by venue primarily based on margin necessities and collateral preferences.

This channel doesn’t disable request interpretation, however fairly complicates it. The widening of the low cost could concurrently replicate spot promoting stress within the US and microstructural stress in offshore stablecoins.

By-product stress and arbitrage constraints

When CME Bitcoin futures foundation compresses and perpetual swap funds go detrimental or flat, spot turns into the quickest hedging leg for merchants to unwind their positions.

CF Benchmark notes that CME foundation is strongly tied to adjustments in sentiment and momentum regimes, and foundation compression typically coincides with risk-off actions.

If each foundation and premium worsen on the similar time, their alignment would point out a broader risk-averse atmosphere fairly than an remoted weak spot in america.

In a frictionless market, the Coinbase low cost ought to entice shopping for on Coinbase and offshore arbitrage till the hole closes.

Sustained growth means one thing is constraining that stream, akin to stability sheet constraints, compliance frictions, switch prices, volatility danger, or just arbitrage funds being deployed elsewhere.

Tutorial analysis on cryptocurrency arbitrage has documented repeated important deviations and significant market segmentation, with decrease liquidity, tighter danger limits, and value differentials that persist longer throughout downturns.

The open peak examine discusses dislocations on account of fragmentation flaring in periods of stress, noting that order e-book depth can skinny out asymmetrically throughout the venue.

As Coinbase’s bidding depth shrinks in comparison with Binance, the low cost will proceed as massive measurement executions develop into prohibitively costly or dangerous, even when arbitrageurs acknowledge the chance.

Essentially the most actionable sign is just not that there’s a selloff, however that market connectivity is reducing.

When institutional flows flip detrimental, funding alerts deteriorate, and arbitrage can’t fill the hole, this mix signifies actual stress fairly than routine volatility.

Three future eventualities

The primary foreseeable situation is a reversal the place ETF flows stabilize or flip optimistic, danger urge for food recovers, and the premium common returns to zero.

This path depends upon macro stabilization and new institutional investor urge for food, which we see day by day in aggregator information. As soon as outflows cease and inflows resume, returns and reductions on arbitrage capital will naturally compress.

The second situation entails persistence, with ETFs persevering with to bleed and premiums remaining detrimental because the macro atmosphere stays risk-off.

The rally shall be fragile as US bidding depth won’t ever absolutely get better and there shall be resistance at greater value ranges. This regime favors affected person sellers over momentum consumers and retains volatility excessive.

Microstructural shock situation: $USDT/USD is quickly disrupted, funding regimes all of the sudden change, and venue-specific occasions create new frictions.

Premiums shall be noisy and extremely unstable on account of offshore stablecoin dynamics fairly than spot flows, making them tough to interpret as pure demand alerts.

broader implications

Coinbase Low cost Enlargement acts as a dashboard of signs fairly than a single analysis.

This displays US-related web shorts and weak bids when ETF flows are detrimental, but in addition displays the US greenback versus the US greenback.$USDT Plumbing stress and constrained arbitrage capability.

All three dynamics are strengthened throughout risk-off regimes, making the premium a mixed sign of institutional investor urge for food, stablecoin microstructural well being, and market connectivity.

Trying forward, the query is whether or not arbitrage infrastructure can reply to adjustments in institutional flows. If arbitrage continues to be constrained and ETFs proceed to bleed whereas funding circumstances tighten, reductions will develop into a number one indicator of liquidity fragmentation fairly than a lagging indicator of sentiment.

This distinction is essential as a result of fragmentation persists over lengthy intervals of time and is much less predictable to resolve than easy provide and demand imbalances.

For now, the widening hole means that U.S. stability sheets are tightening quicker than the unwinding of offshore leverage and that market plumbing is struggling to synchronize costs.

Whereas this mix doesn’t assure additional declines, it does point out that the infrastructure mandatory to soak up promoting stress or maintain good points is working beneath stress. And as soon as stress is embedded available in the market microstructure, it tends to stay even after headlines enhance.