Analysts have gotten more and more cautious of the mind-boggling sums being poured into the recent discipline of synthetic intelligence (AI).

AI bubble fears: Why Bitcoin is falling

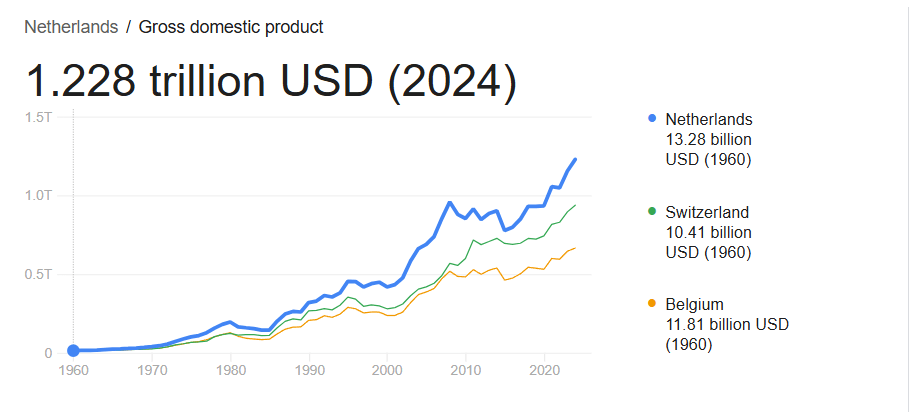

“We’re taking a look at a dedication of about $1.4 trillion over the subsequent eight years,” OpenAI CEO Sam Altman stated final week. This determine is about $200 billion bigger than the gross home product (GDP) of the Netherlands, a rich European nation of 18 million people who was as soon as a world energy.

This comparability encapsulates the extent of hype surrounding AI, with many believing that the trade is at the moment fully engulfed in an ever-expanding bubble that might burst at any second. The following unrest appeared to dampen sentiment in the direction of tech shares and Bitcoin, with the Nasdaq down 0.28% and the cryptocurrency down 2.36% on Wednesday afternoon.

(OpenAI CEO Sam Altman stated the corporate is dedicated to investing $1.4 trillion in computing assets over the subsequent eight years, which is sort of $200 billion greater than the Dutch GDP in 2024 / Supply: World Financial institution)

OpenAI rival Anthropic simply introduced plans to spend $50 billion constructing AI knowledge facilities in New York and Texas in a bid to compete. This follows a wave of different multibillion-dollar AI investments by tech giants Meta, Alphabet, and Microsoft.

learn extra: Inventory costs fall as a result of concern of AI bubble, Bitcoin plummets

However the little secret behind these large investments is within the particulars. The Wall Avenue Journal reported that it had obtained monetary paperwork displaying each privately held firms had been bleeding cash. Anthropic’s bleeding has been much less pronounced, and the corporate is on observe to interrupt even by 2028. Nonetheless, OpenAI would incur a lack of $74 billion in the identical yr. The chance-on sentiment stemming from such predictions might clarify the driving drive behind right now’s declines in each tech shares and Bitcoin.

“In a world the place AI has the potential to make necessary scientific advances, it can sacrifice an enormous quantity of computing energy, however we wish to be prepared for that second,” Altman defined. “We intend to be a really profitable firm, but when we fail, it is our fault.”

Overview of market indicators

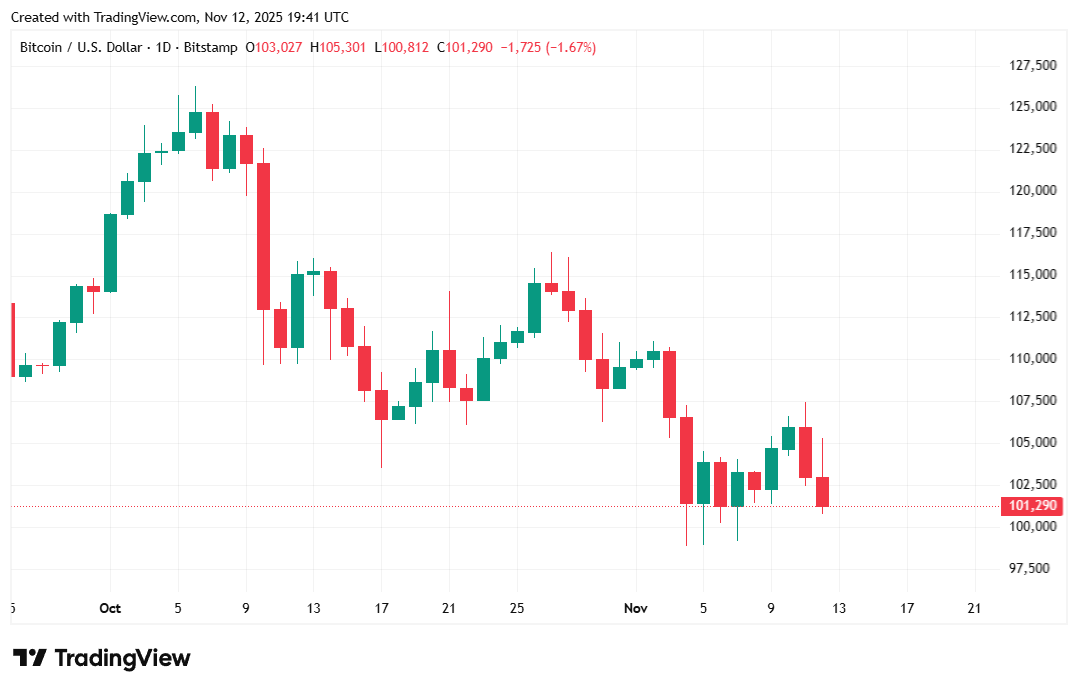

On the time of reporting, Bitcoin was buying and selling at $100,950.39, down 2.36% in 24 hours and down 3.19% on a weekly foundation, in response to knowledge from Coinmarketcap. The digital asset’s worth has fluctuated between $100,836.61 and $105,297.23 since Tuesday.

(BTC Worth/Buying and selling View)

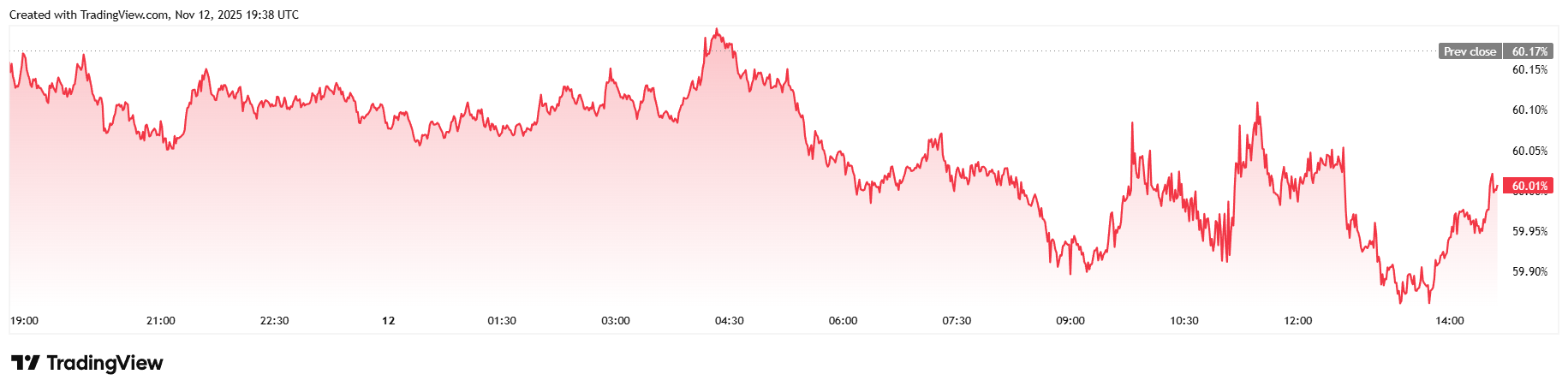

The 24-hour buying and selling quantity was $62.77 billion, down 12.73%. The market capitalization decreased to $2.01 trillion, and Bitcoin’s dominance reached 60%, down 0.28% from yesterday.

(BTC Worth/Buying and selling View)

In keeping with Coinglass, the overall worth of open Bitcoin futures contracts decreased by 3.58% in 24 hours to $66.14 billion. Nonetheless, liquidations elevated to a complete of $186.47 million, with the bulk being lengthy buyers who had been caught off guard by Bitcoin’s decline, dropping $149.53 million in margin. Brief sellers had been largely spared, however essentially the most bearish group misplaced $36.94 million.

Ceaselessly requested questions ⚡

- Why is Bitcoin falling once more?

Investor fears about the potential of an AI bubble and big spending within the sector seem like weighing down each tech shares and Bitcoin. - What prompted the sale?

Stories of predicted large losses for OpenAI and Anthropic have fueled fears that the AI increase might turn into unsustainable. - How a lot cash is flowing into AI?

OpenAI’s Sam Altman stated the corporate has acquired $1.4 trillion in contracts over the subsequent eight years. - How is Bitcoin performing right now?

BTC fell 2.36% to round $101,000 as merchants diminished danger amid AI-induced volatility and weak market sentiment.