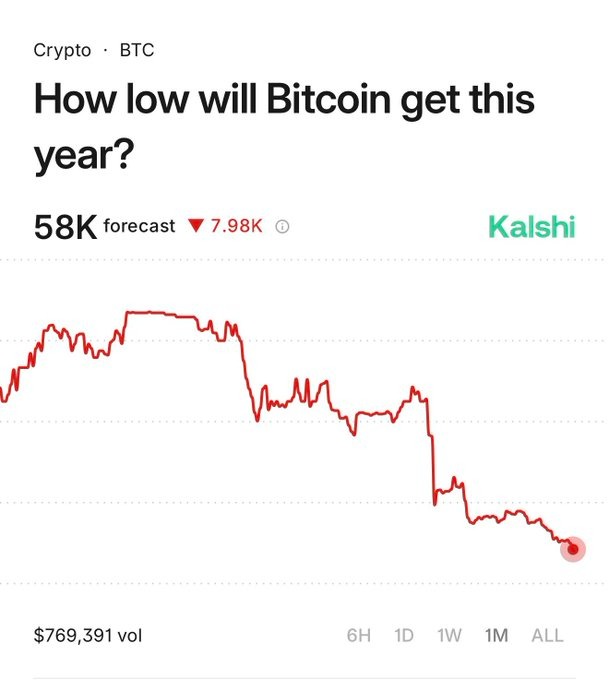

Bitcoin plummeted 15%, fully erasing its post-election positive aspects and plummeting to $60,000.

As the typical manufacturing price of Bitcoin exceeded $87,000, promoting strain elevated amongst miners, forcing a pressured liquidation.

Lengthy merchants suffered a lot of the losses within the sudden selloff, with greater than $2.6 billion in leveraged positions liquidated.

On February sixth, Bitcoin worth plummeted by practically 15%, and the digital forex market crashed, wiping out roughly $350 billion in whole market worth in at some point. Bitcoin’s worth has fallen to $60,030, erasing positive aspects from October’s excessive of round $126,000.

The decline additionally erased the complete “Trump bump” rally from November 2024 as promoting strain mounted from miners, revenue taking, deleveraging and world market issues.

Bitcoin worth decline linked to miner promoting strain

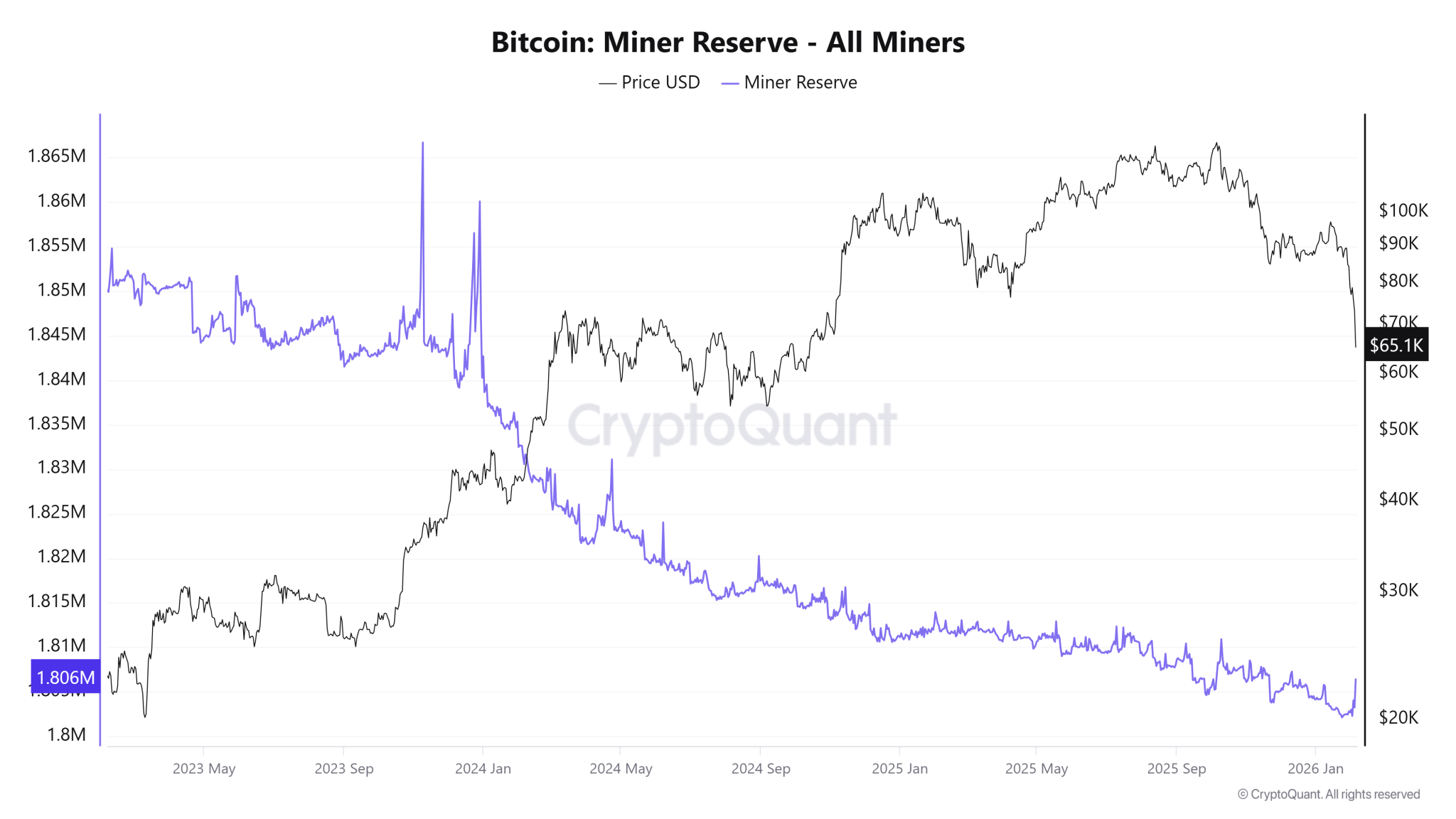

One of many largest pressures is from Bitcoin miners. In line with knowledge, the typical price to mine one Bitcoin is now over $87,000. Bitcoin is presently buying and selling close to $65,000, and plenty of miners are working at a loss. To cowl prices, they’re pressured to promote their holdings.

Bitcoin miners’ reserves have been persistently reducing over the previous few months and presently stand at practically $1.806 million. $BTC. This means that miners are promoting extra cash than they’ve, growing the market provide.

Bitcoin ETF information giant outflows

On the identical time, institutional demand has weakened sharply. Bitcoin exchange-traded funds (ETFs) have as soon as once more seen giant outflows. On February fifth, the Spot Bitcoin ETF recorded internet withdrawals of $258.8 million.

Though this was decrease than the day before today’s $544.9 million outflow, this week’s whole outflows have already exceeded $1.07 billion.

Liquidation provides extra strain $BTC worth

Liquidations additionally performed a giant function within the worth decline. In simply 24 hours, over $2.65 billion price of leveraged crypto positions had been worn out. Roughly 82% of those liquidations had been as a consequence of lengthy merchants who had been betting on larger costs.

The only largest liquidation occurred on Binance, the place $12 million price of BTCUSDT positions had been pressured closed.

Massive loss with Michael Saylor’s technique

Even Bitcoin holders at main firms had been feeling the ache. Michael Saylor’s technique reported unrealized losses of about $9 billion, or 16% of its large Bitcoin holdings. Nonetheless, Thaler urged traders to remain calm and “HODL.”