Bitcoin traded close to $67,000 on Thursday, stabilizing after a session that coincided with wild swings in prediction market odds on the Readability Act.

abstract

- Bitcoin traded close to $67,000 as CLARITY Act polymarket odds fluctuated from 90% to 55%, highlighting regulatory uncertainty.

- The CLARITY Act goals to outline oversight between the SEC and the CFTC, doubtlessly decreasing ambiguity and rising the company’s credibility within the digital forex market.

- Technically, $BTC Though the bearish momentum is weakening, the $70,000-$75,000 space has change into a serious resistance stage, and it’s consolidating between $65,000 and $70,000.

On Polymarket, the likelihood of approval of the CLARITY Act rose to 90% at one level earlier within the day, however has plummeted to about 55% at press time, reflecting uncertainty over the invoice’s future.

The CLARITY Act is a U.S. digital forex market construction invoice that goals to outline regulatory oversight between the SEC and the CFTC. The regulation goals to offer clearer guidelines concerning digital property, token classification, and alternate compliance.

If handed, this might cut back regulatory ambiguity, enhance institutional participation, and enhance long-term capital flows to the crypto sector.

You might also like: Ethereum plans main improve in 2026 as value dangers falling once more

Bitcoin value outlook: momentum secure after sharp drop

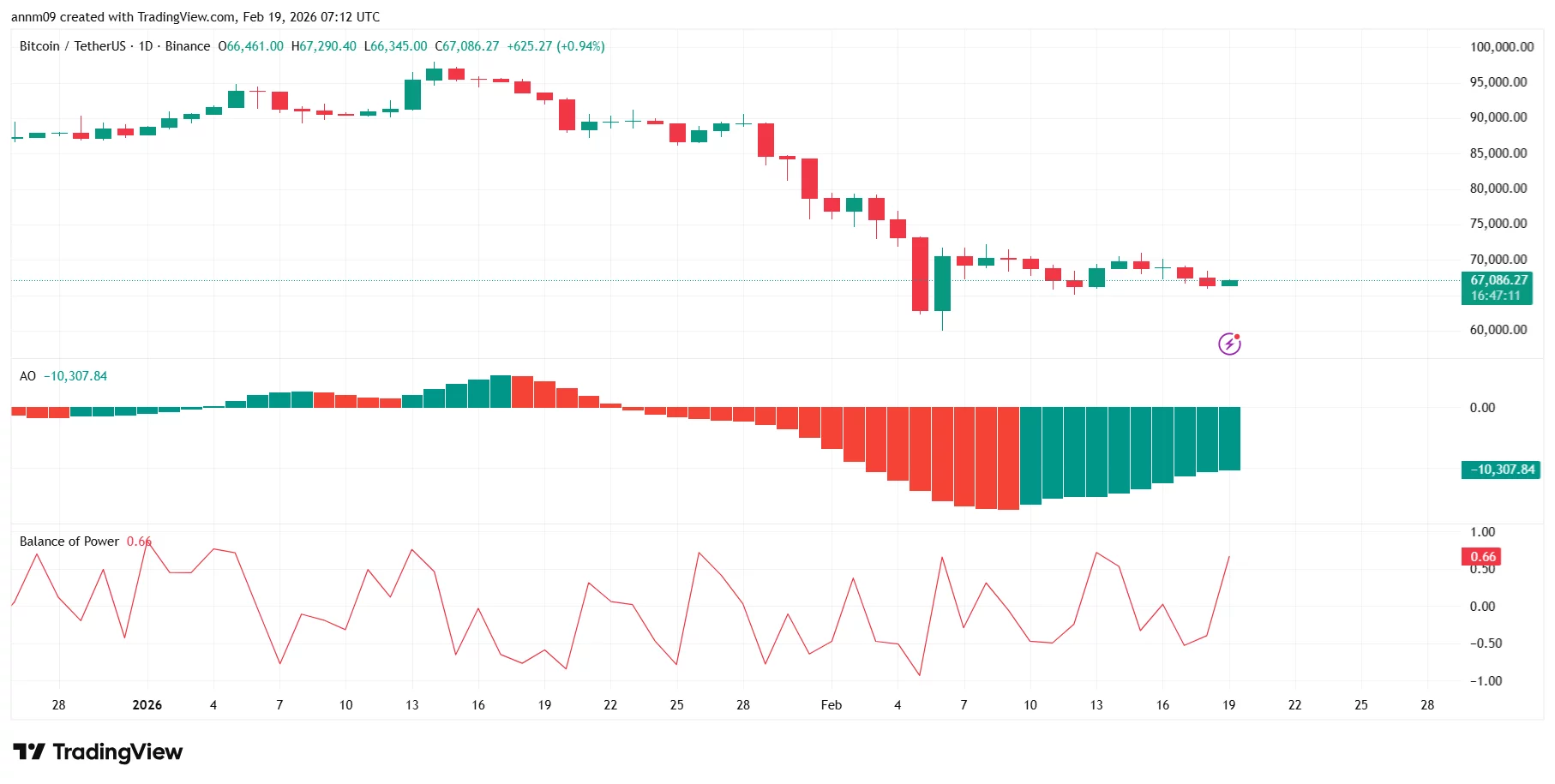

On the day by day chart, Bitcoin continues to be in a broad-based short-term downtrend after plummeting from the mid-$90,000 space earlier this yr. Value motion exhibits a collection of decrease highs and decrease lows earlier than stabilizing within the mid-$60,000 vary.

Bitcoin value evaluation |Supply: Crypto.Information

The latest massive pink candlestick close to $72,000 signaled a capitulation-type transfer, with costs briefly falling to the low $60,000s earlier than rebounding. since then, $BTC It is hovering round $65,000 to $70,000.

The Superior Oscillator (AO) continues to be in damaging territory, however the inexperienced bar is rising, suggesting bearish momentum is weakening. In the meantime, the stability of energy (0.66) has turned constructive, indicating that patrons are attempting to regain short-term management.

Quick resistance lies close to $70,000, adopted by a stronger prime close to $75,000, the place the earlier breakdown occurred. On the draw back, main help lies at $65,000, with deeper ranges close to $60,000 if promoting resumes.

For now, Bitcoin appears to be stabilizing. A decisive break above $70,000 might open the door to a restoration, however failure to maintain $65,000 might lead to new downward stress.

learn extra: Coinbase’s Base leaves Optimism stack, OP token sinks