Bitcoin value is attempting to cross the $95,000 degree after sinking to an area low round $89,000, which triggered a pointy enhance in implied volatility.

abstract

- Bitcoin value is on observe to interrupt above $95,000 after falling from its all-time excessive of $126,000.

- A rise in implied volatility and choice skew signifies that merchants are bracing for bigger strikes.

- Technical indicators recommend a brief restoration, however the downtrend stays intact.

BTC is buying and selling round $92,858 on the time of writing, up about 1.8% on the day however nonetheless down 9% over the previous week and 14% over the previous month. Bitcoin is at the moment down 26% since its all-time excessive of $126,080 on October sixth.

Spot buying and selling slowed considerably. Bitcoin (BTC) day by day buying and selling quantity fell 2.3% to $83.8 billion, suggesting merchants are taking a step again and ready for clearer route. Nonetheless, derivatives are a special story.

Futures buying and selling quantity elevated almost 15% to $123.2 billion, and open curiosity elevated 3.9% to $67.4 billion. Elevated open curiosity throughout financial downturns normally means merchants should not betting on a fast restoration and are hedging or leaning into brief positions.

On-chain alerts present weak demand

In keeping with a November 19 GlassNode Insights report, Bitcoin is at the moment buying and selling beneath the short-term holder price commonplace and the -1 commonplace deviation band.

This has put many latest consumers within the pink, with the $95,000 to $97,000 space being the first resistance zone. The primary signal that the market is regaining stability can be a transparent break above that zone.

You may additionally like: What’s behind the sudden rise in Zcash’s value? Lan Neuner explains

The report additionally factors to a major enhance in implied volatility throughout all maturities, unwinding of speculative leverage, and enormous withdrawals from spot ETFs. Choices skew stays closely tilted towards places as a result of merchants are paying extra for draw back safety, particularly across the $90,000 strike value.

On the similar time, the DVOL index, which tracks how choices merchants anticipate the market to maneuver, hit a month-to-month excessive, which means greater value strikes are doable.

Promoting strain has led short-term holders to appreciate losses of $523 million per day, the very best degree since FTX’s collapse. The following vital assist degree is the realized value for energetic traders, which is round $88,600.

Since $82,000 acts because the final important structural assist, a transparent break beneath that degree might set off a extra extreme bearish part.

Technical evaluation of Bitcoin value

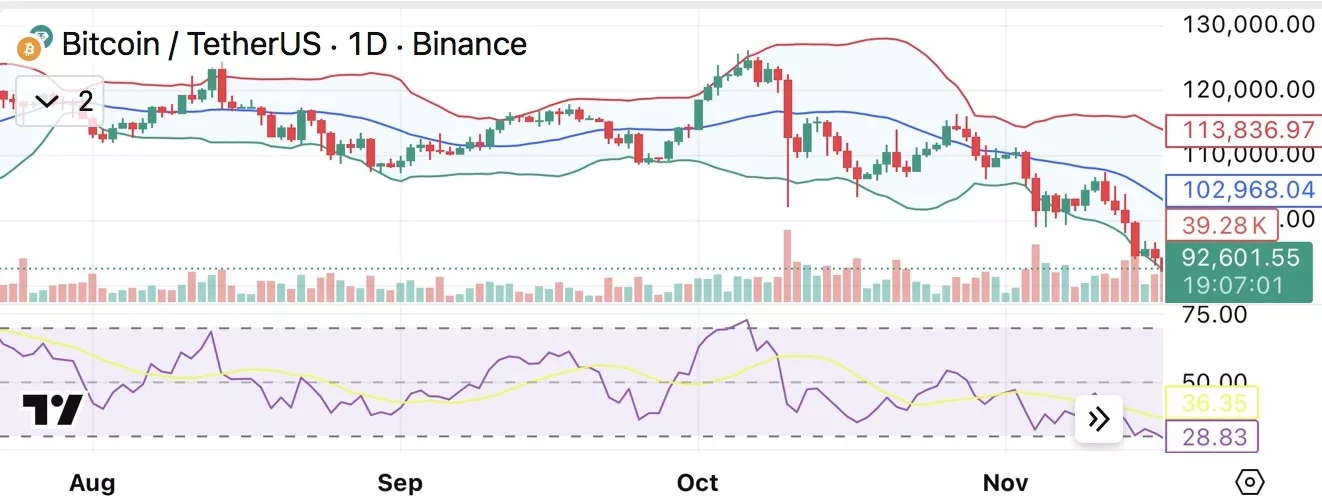

The chart exhibits Bitcoin buying and selling beneath all main transferring averages, with Bollinger Bands widening as value rides the decrease band. This means sturdy draw back momentum and the market is on the lookout for assist. The 36-year-old is exhibiting little momentum however is just not but critically oversold.

Bitcoin day by day chart. Credit score: crypto.information

Though most indicators are in impartial territory, some indicators are beginning to present bullish indicators. Each the Commodity Channel Index and Momentum have turned optimistic, suggesting a short-term financial restoration is feasible as volatility eases. Nonetheless, the MACD stays considerably adverse, and the common directional index of 40 signifies that the downtrend continues to be firmly current.

For sentiment to alter, Bitcoin would want to shut above $95,000, and ideally above $97,000. If these ranges should not regained, the market stays liable to retesting the $90,000 mark and will fall to the low $80,000 vary if sellers regain management.

learn extra: Ripple and XRP give attention to staking as Canary Capital ETF sparks new investor curiosity