This week, Bitcoin costs have been caught in a tricky vary this week as forming pennant patterns and crypto horror and grasping indexes level to rebound.

abstract

- Bitcoin Value has shaped a bullish pennant sample on its day by day charts.

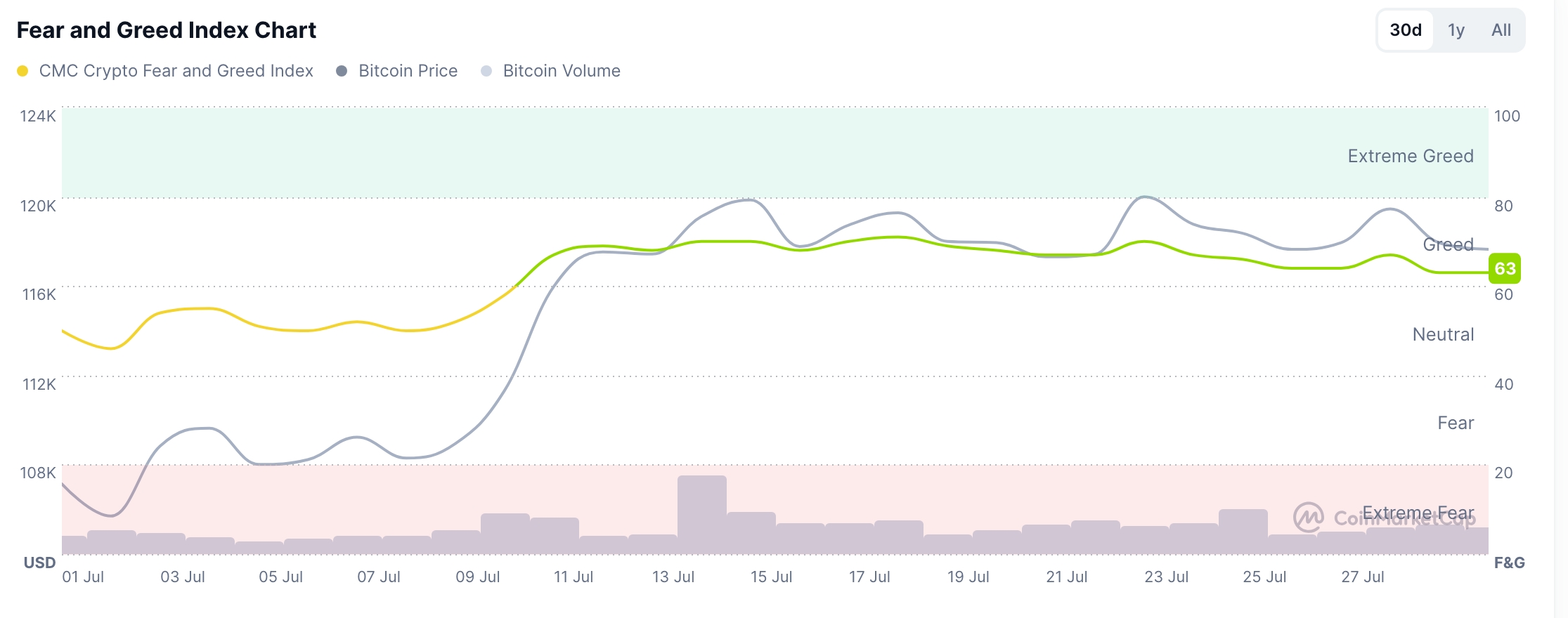

- The cipher’s worry and grasping index stay within the gear zone.

- Technical exhibits a surge within the value of Bitcoin on the finish.

Bitcoin (BTC) has remained inside a slender vary since July 14 when it was pulled again after hitting a file excessive of $123,200.

The Crypto Concern and Greed Index is 63

The carefully watched gauge exhibits that Crypto traders are nonetheless grasping regardless of the continual pullback within the Altcoin market. The Crypto Concern and Greed Index stays within the grasping zone because the starting of the yr at 71.

You would possibly prefer it too: Why is the Crypto market falling right now and rebounding?

This index is impressed by an identical index launched by CNN Cash. We’ll discover 5 key metrics to measure market sentiment within the cryptocurrency business. For instance, take a look at the value momentum of the highest 10 cash besides Stablecoins and the way they work.

Different metrics are Bitcoin and Ethereum volatility, derivatives market and market composition. Then, use CoinMarketCap’s personal information to evaluate social media sentiment. Generally, cryptocurrencies work properly if there may be greed available in the market.

Crypto horror and grasping index | Supply: CoinMarketCap

CNN Cash’s worry and grasping index additionally stays within the inexperienced zone of 68. This greed is pushed by inventory value energy, inventory value vary, and put-and-call choices within the excessive greed zone.

The 2 worry and greed gauges present a closing Bitcoin value rebound, doubtlessly following the Federal Reserve fee choice. The bullish case is predicated on a steady accumulation by institutional traders because the ETF influx continues.

Bitcoin value expertise evaluation

Bitcoin Value Chart | Supply: crypto.information

In keeping with technical evaluation, Bitcoin costs are nonetheless in a good vary this week. Consequently, the three rows of Bollinger bands grew to become narrower. It is a signal of volatility depletion. Generally, this efficiency is often squeezed in both path.

The squeeze may very well be the other way up because the coin shaped a bullish pennant sample. This sample consists of vertical traces that resemble a triangle that’s symmetrical to a flagpole.

This sample of flagpole is about 20%. Should you measure the identical distance from a possible breakout level, the surge is as much as $143,550.

You would possibly prefer it too: Sui Value drags regardless of the TVL increase, can it catch up?