Bitcoin fell practically 11% in January amid widespread market turmoil, extending its shedding streak to 4 months, its longest since 2018. Opportunistic buyers are maintaining a tally of the decline as gold additionally faces a pointy decline.

abstract

- Bitcoin value stays beneath $80,000 because the cryptocurrency market continues to battle amid a widespread market downturn.

- U.S. inventory markets rose modestly, whereas oil costs fell and gold retreated from file highs.

- Technical indicators and market sentiment counsel that Bitcoin’s restoration may very well be a bullish lure, and if it fails to regain momentum above $100,000, it may fall additional to $70,000.

Bitcoin ($BTC) is presently hovering simply above $78,400. In truth, the market capitalization of all cash elevated by 1.7% to over $2.7 trillion, however it’s nonetheless a great distance from the all-time excessive of about $4.1 trillion set in August 2025.

Prime tokens as of Monday afternoon (EST) embody MYX Finance, Memecore, River, Jupiter, Morpho, and Hyperliquid.

The inventory market posted modest beneficial properties, with main massive indexes such because the S&P 500 and Nasdaq 100 up 0.7% and 1.1%, respectively. The iShares Russell 2000 ETF led the market’s beneficial properties, rising 1.32% by noon.

You may additionally like: Neo founder launches NGR to advance analysis and real-world adoption of Neo 4

In the meantime, oil costs plummeted as US troops gathered within the Gulf.

World benchmark Brent fell 4.75% to $66, whereas West Texas Intermediate plunged to $61. On the identical time, gold, usually seen as a safe-haven asset, retreated from its all-time excessive of $5,568 to $4,600.

Additional information from Polymarket reveals that the chance of the US attacking Iran continues to say no. The chance of a strike by the top of the yr rose from 80% to six.69%.

The cryptocurrency crash additionally stalled because the Concern and Greed Index fell to 14, the bottom stage this yr. Generally, a cryptocurrency rebound happens when the index strikes into the acute worry zone.

Bitcoin value technical evaluation suggests this rally may very well be a bullish lure

$BTC Worth record |Supply: crypto.information

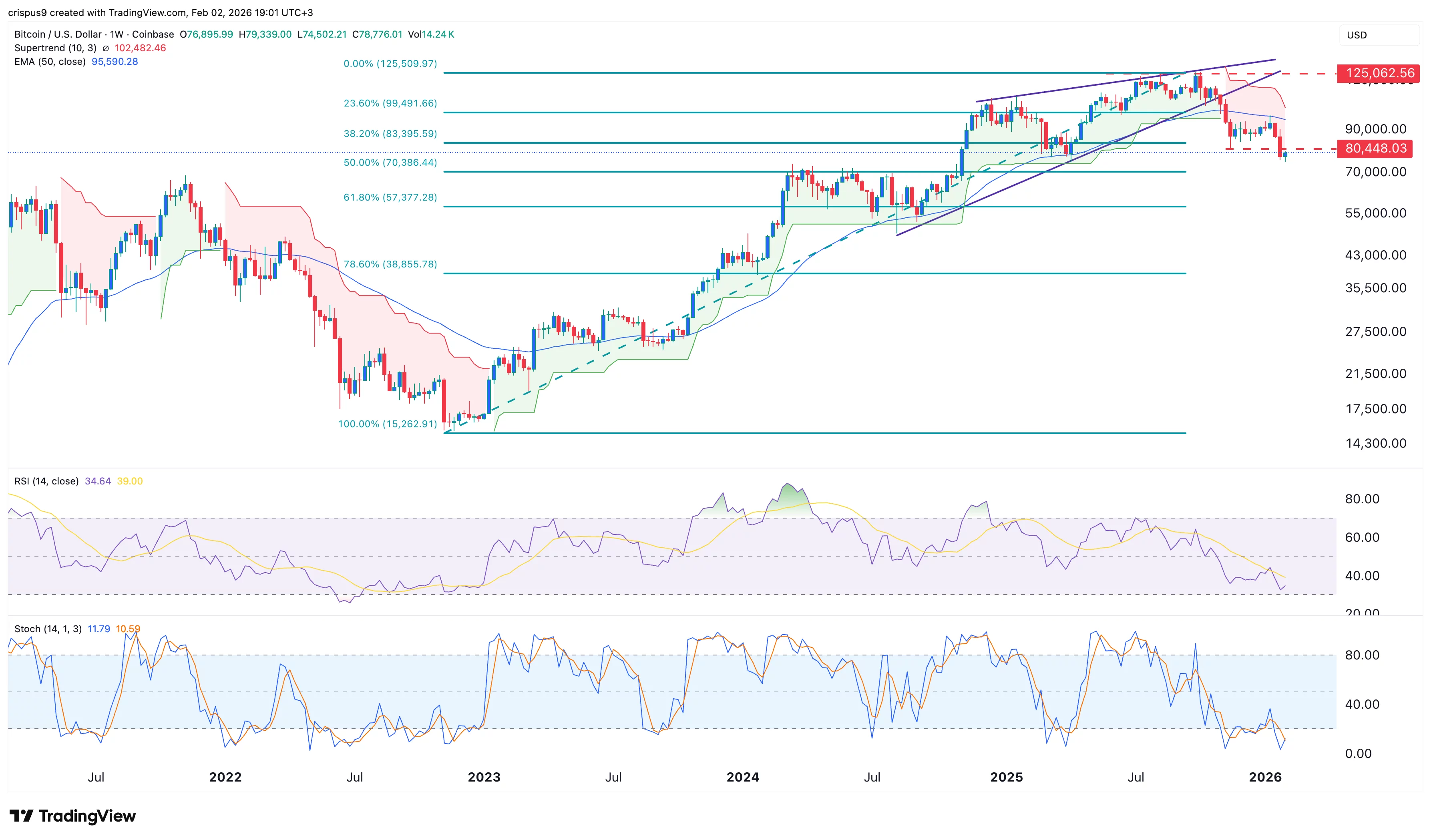

Trying on the weekly chart, $BTC Costs have plummeted previously few months.

The tremendous pattern indicator has already switched from inexperienced to purple. The final time this occurred was in 2021, after which the coin fell by over 70%.

Bitcoin fell beneath the 38.2% Fibonacci retracement stage and the 50-week exponential transferring common. The relative energy index and stochastic oscillator continued to say no.

Due to this fact, these technical indicators counsel that Bitcoin value might proceed to say no within the quick time period. If this occurs, the decline may proceed and fall to the 50% retracement stage of $70,000. Due to this fact, there’s a threat that cryptocurrencies will proceed to fall within the coming weeks.

This view is according to Michael Novogratz’s current prediction {that a} full restoration shall be confirmed when Bitcoin crosses $100,000 and $103,000.

learn extra: Jeffrey Epstein information reignite crypto hypothesis as Ripple rejects XRP hyperlink