Bitcoin worth is present process a market correction. On Tuesday, the inventory fell to $107,000 after briefly exceeding $111,000 yesterday.

On-chain knowledge analysts now acknowledge the present worth level as a key inflection level. At this level, it’s determined whether or not the asset will keep its bullish pattern or face a average correction within the medium time period.

Essential crossroads of bullish momentum

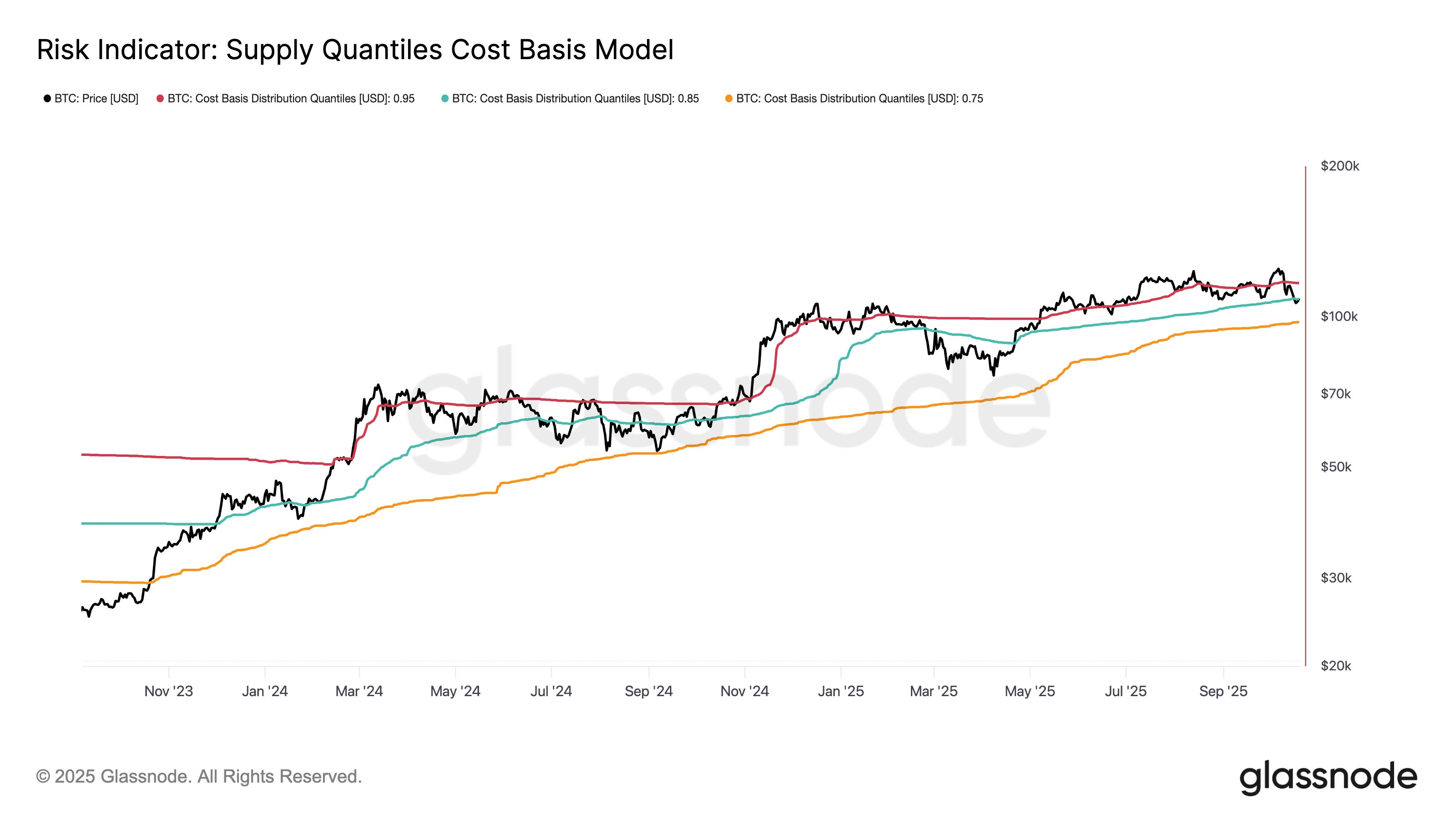

Glassnode, an on-chain knowledge analytics platform, highlighted this case by sharing a cost-based distribution quantile mannequin chart on X.

This mannequin analyzes the distribution of acquisition prices for Bitcoin traders and assesses the chance of taking income at present worth ranges. Not like conventional technical evaluation, this device makes use of actual blockchain knowledge to establish accumulation patterns and offers a extra correct view of institutional help and resistance zones.

The chart incorporates a number of quantile traces, together with the 0.95 line (crimson). This line represents the typical worth paid by the highest 5% of Bitcoin holders, these with the very best price base.

Threat indicator: provide quantile cost-based mannequin. Supply: Glassnode

If the Bitcoin worth rises above this 0.95 line, it signifies a high-risk zone the place the market is overheated and revenue realization (promoting) is prone to enhance. Conversely, when the value falls beneath the 0.95 line, the market enters a pattern transition or equilibrium state. That is precisely the place Bitcoin landed after the flash crash on October tenth.

Pivot level: 0.85 quantile

The present worth degree is hovering across the 0.85 quantile boundary. It is a type of key help. A sustained break beneath this line is normally interpreted as a rise in medium-term correction threat.

Glassnode warned: “If patrons can maintain this zone, momentum may get well from right here. But when they lose it once more, the market is prone to fall again into the draw back. It is a crucial space to look at.”

Derivatives merchants count on additional draw back

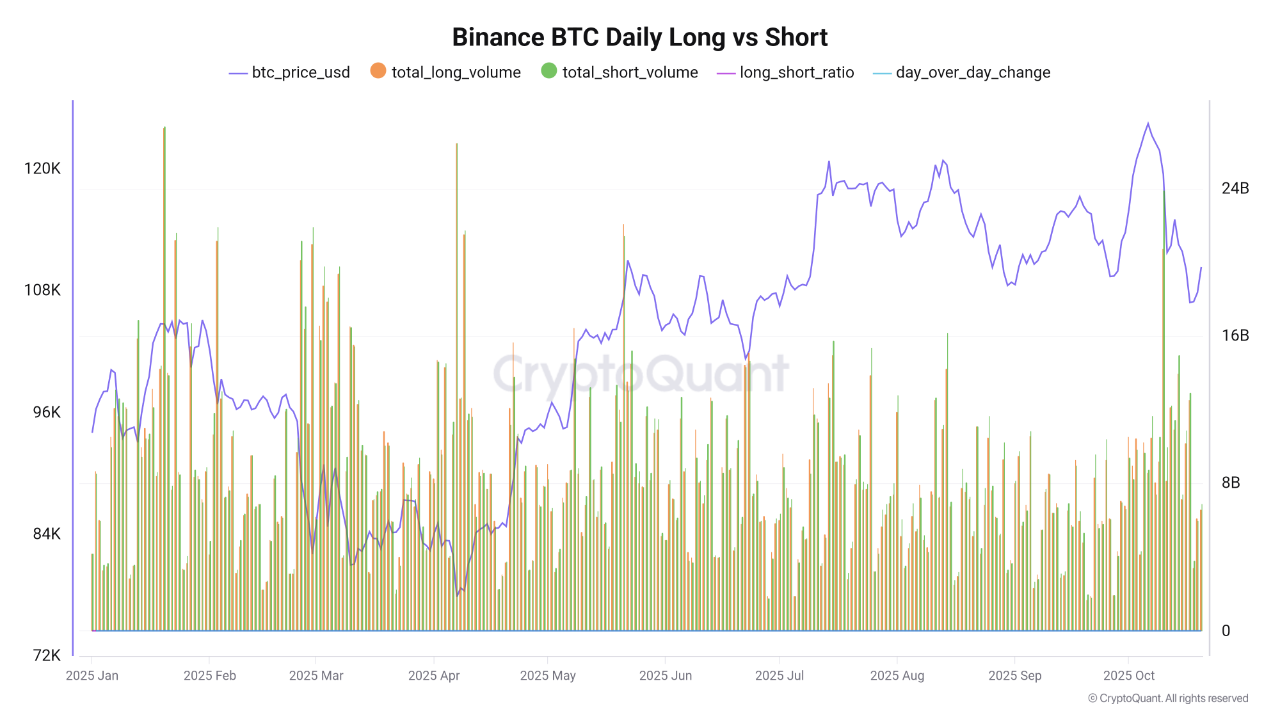

Investor sentiment towards Binance, the biggest crypto derivatives platform by buying and selling quantity, can be leaning towards anticipating additional correction.

“Bitcoin futures buying and selling quantity on Binance elevated in October, with sellers dominating most days till yesterday,” stated Arab Chain, an analyst at CryptoQuant.

Binance BTC Every day Lengthy and Quick. Supply: CryptoQuant

Binance’s Bitcoin futures place is presently tilted barely to the promote facet from an nearly 50:50 stability. The present lengthy/quick ratio is 0.955, and the day-over-day change (DOC) of -0.063 signifies that the constructive momentum is slowing down.

Arab Chain concluded: “General, the present knowledge displays a fragile stability between patrons and sellers, tilting barely in favor of promoting strain. If this pattern continues, it may pave the way in which for additional correction except the market reveals renewed shopping for exercise or energy in institutional demand within the coming days.”

Article after Bitcoin hits main help. The put up Analysts Warn About Deeper Correction appeared first on BeInCrypto.