The Bitcoin market is presently at a essential juncture, hovering above the psychological stage of $85,000. Other than psychological plausibility, this essential help additionally seems to have technical significance. Subsequently, the market could check its energy earlier than displaying any directional momentum. Nonetheless, latest evaluation has revealed a grim image relating to the way forward for the primary cryptocurrency.

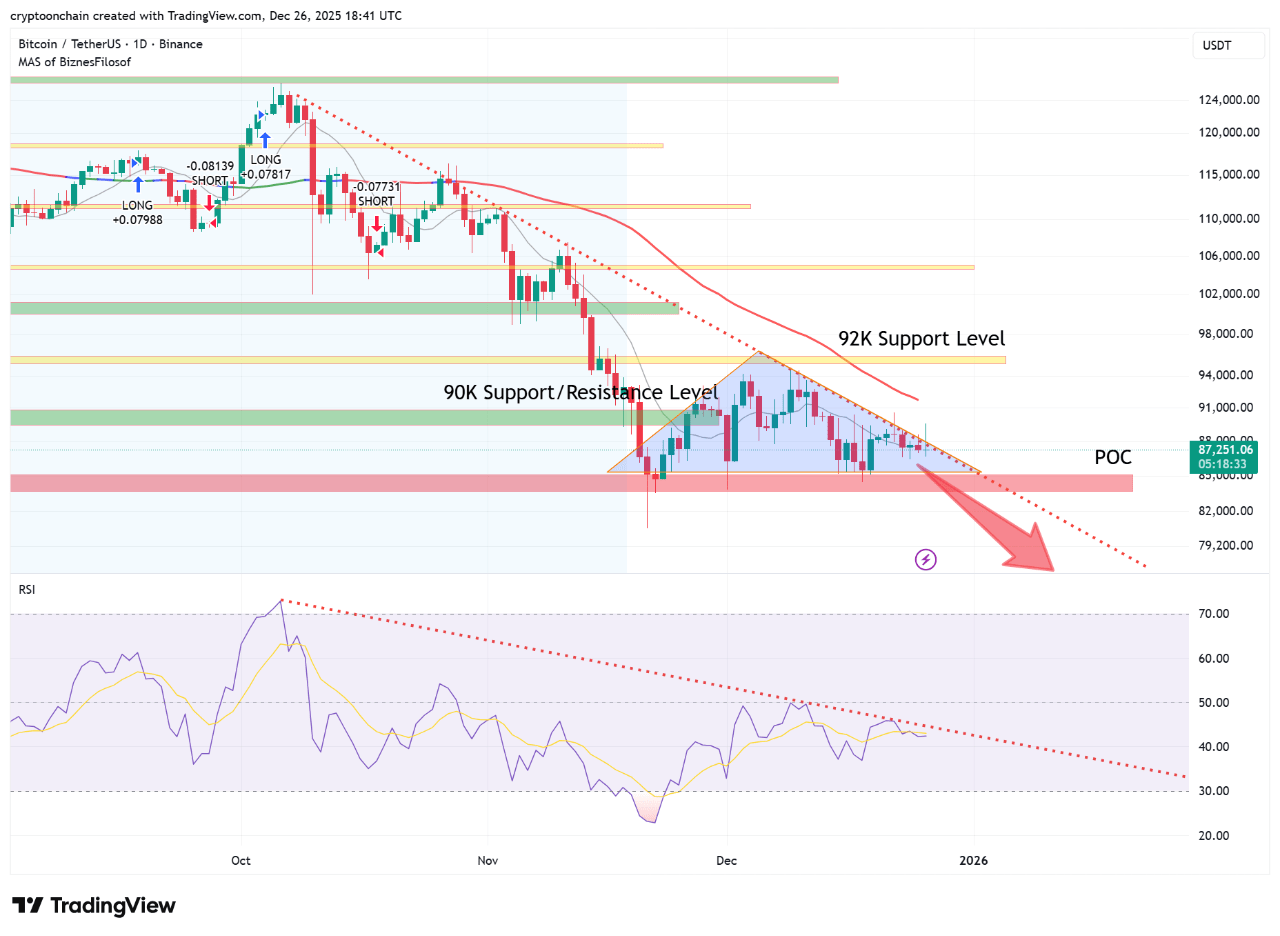

Forming a descending triangle with help close to $85,000

In a latest put up on QuickTake, CryptoOnchain revealed that there was the emergence of a basic technical sample indicating bearish continuation intent for the asset. This sample, which exists on Bitcoin’s every day timeframe, is characterised by a sequence of swing lows and highs as the value compresses towards the horizontal help that serves as the bottom of the triangle.

Curiously, the value stage often known as the Level of Management (POC) (the place there may be probably the most buying and selling quantity) can be positioned close to the $85,000 help. This additional reinforces the significance of worth stage. If this worth stage is decisively breached, Bitcoin costs might fall quickly as a liquidation or capitulation occasion is prone to comply with. We might see elevated draw back strain, particularly if there may be little or no demand to reassert bullish momentum.

Trade exercise falls to multi-year low

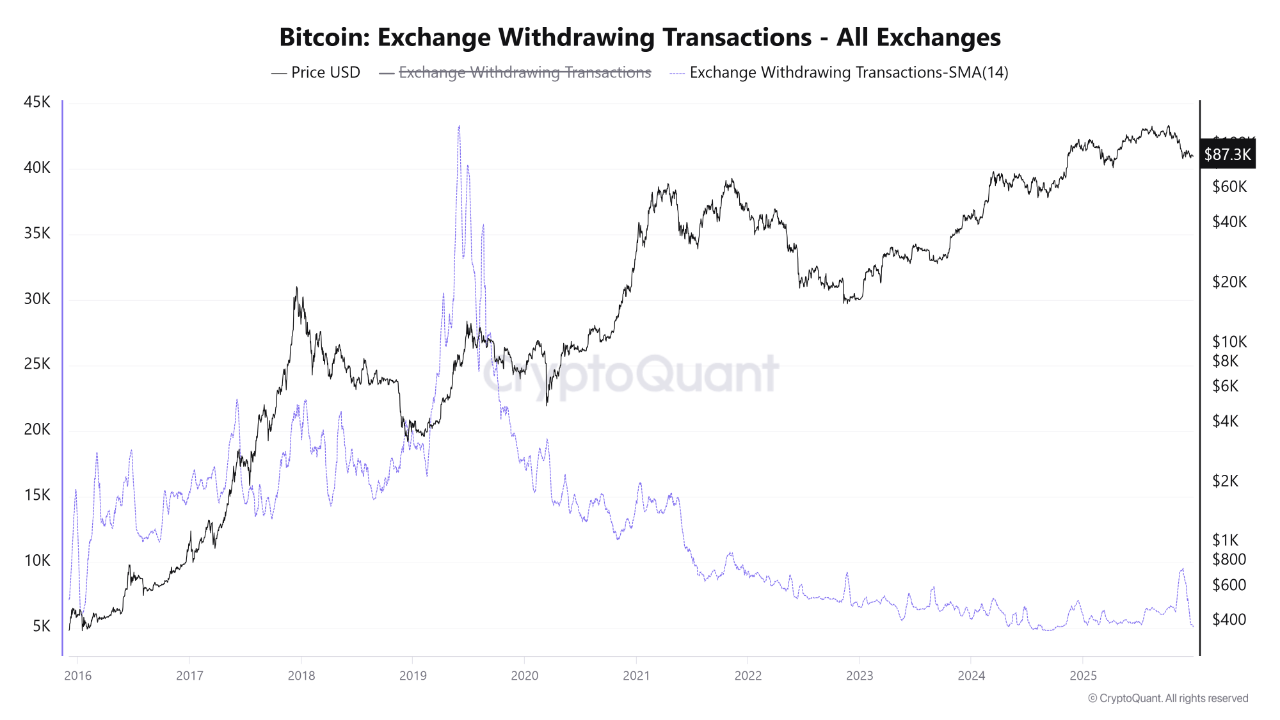

CryptoOnchain helps his bearish speculation with one other notable on-chain commentary. The metric right here is the Bitcoin Trade Withdrawal Transactions (7-day Transferring Common) metric, which screens the variety of on-chain withdrawal transactions comprised of crypto exchanges over a 7-day interval.

The analyst highlighted that the index’s readings have fallen to a stage of round 5,000, the bottom since 2016, about 9 years in the past. Curiously, this present stage is under what was measured throughout previous bear markets (2018, 2020, and 2022). Trade withdrawal exercise gives perception into investor confidence and accumulation habits. Since cash despatched from exchanges are usually saved in non-public wallets, elevated withdrawal exercise means a higher need to build up and elevated belief.

Conversely, this vital drop in trade withdrawal exercise signifies a deep sense of apathy amongst Bitcoin buyers, or an absence of perception that’s essential for long-term holding. Other than the plain lack of urgency to get cash into non-public wallets, the low studying from this indicator additionally reveals that buyers will not be actively accumulating BTC. Analysts concluded that “the info suggests widespread skepticism and exhaustion, and there may be little actual non-speculative demand.”

if The $85,000 help fails and with no consumers, Bitcoin worth might fall shortly. On the time of writing, Bitcoin is value $87,410, however there was no actual motion because the previous 24 hours.

Featured photographs from Pexels, charts from Tradingview