The Bitcoin market has skilled a big value correction prior to now few hours, with the worth dropping to round $110,000 because the US-China commerce conflict might nonetheless resume. Previous to this decline, the cryptocurrency market chief led a robust rally, hitting a brand new all-time excessive of $126,198.17 on October 6, 2025. Apparently, latest knowledge from the Bitcoin choices market confirmed a wave of cautious positions amongst institutional buyers amid this value rally previous to the present market downturn.

Monetary establishments retreat as Bitcoin rally turns to euphoria – Glassnode

In an October tenth put up on X, blockchain analytics agency Glassnode affords some attention-grabbing insights in its weekly choices market replace. Specifically, Glassnode analysts report that whereas Bitcoin costs have soared greater than 10% within the latest rally to new all-time highs, institutional merchants seem like sustaining a peaceful strategy to the market, selecting to lock in income and shield the draw back slightly than chasing the upside.

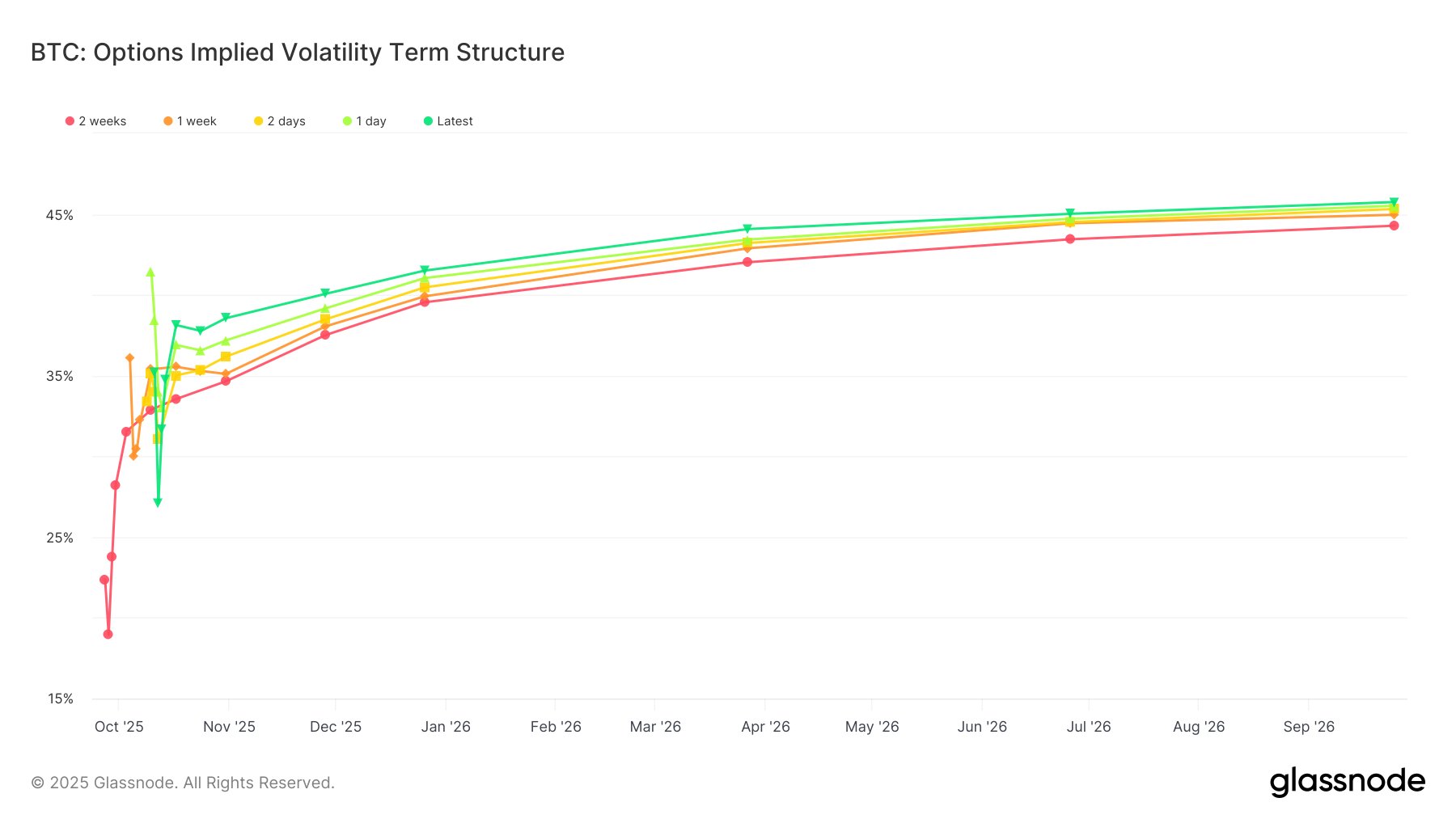

Regardless of the sharp rise, implied volatility, a measure of anticipated value motion, has remained largely unchanged, hovering round 38-40%. Usually, a rally of this magnitude would result in extra volatility as merchants rush to name and enhance their publicity. Nonetheless, the muted response suggests the coolness of institutional buyers who had been both already making ready for this transfer or just weren’t keen to pay for the extra upside room.

Glassnode analysts additionally be aware one other refined however apparent skew in sign-in choices. Even on the top of the bull market, demand for put choices remained sturdy and the market continued to rise. This exhibits that many massive gamers had been promoting calls by the choices market, successfully capping potential upside whereas sustaining insurance coverage in case the market reversed.

Furthermore, the put-call ratio additionally reinforces this cautious sample amongst monetary establishments. Amid choices expiration on Friday, October 9, this ratio rose above 1.0, indicating that there have been extra places than calls as merchants had been busy hedging positions forward of the present decline slightly than chasing momentum and locking in latest features.

Usually, Glassnode explains that the Bitcoin market has adopted a distinct dynamic this cycle, pushed by institutional self-discipline slightly than the spike in volatility and retail growth seen in earlier cycles. The preponderance of institutional funding by spot ETFs and the latest emergence of crypto treasury corporations could have added maturity to the $2 trillion market.

BTC market overview

On the time of writing, Bitcoin is buying and selling at $110,805, down 7.54% prior to now 24 hours. In the meantime, the each day buying and selling quantity surged 150.37%, indicating elevated market exercise as merchants reacted to the sharp pullback.

Featured picture from Flickr, chart from Tradingview