Coinbase’s head of analysis has warned that advances in quantum computing might pose broader dangers to Bitcoin than easy pockets theft.

Future quantum machines might have the ability to break the cryptographic signatures that safe transactions, giving quantum-powered miners a major velocity benefit, stated David Duong, the corporate’s international head of funding analysis. These two separate threats will affect each person funds and Bitcoin’s financial mannequin.

Quantum threat goes past keys

Duong stated that a couple of third of Bitcoin’s provide may very well be structurally uncovered, as Bitcoin’s public keys are already seen on the blockchain. This quantity is near 33%, or about 6.51 million BTC, and is held in an tackle kind the place the general public secret’s publicly out there and, in idea, a sufficiently highly effective quantum pc might derive the non-public key. The report highlights that tackle reuse and outdated pockets codecs are the principle causes of this breach.

Consultants say there are two essential technological threats

One of many threats is signatures. Quantum algorithms like Shor can recuperate non-public keys from public keys at scale, permitting attackers to signal transactions and exfiltrate funds.

The second is the potential for mining points. Quick sufficient quantum miners might discover proof of labor a lot sooner than conventional rigs, disrupting incentives and block manufacturing. Duong et al. stress that the danger of signatures is theoretically short-lived, because it solely requires cracking the signature related to the uncovered public key.

what the business is doing

In accordance with the report, phrase has already reached fund managers and requirements our bodies. Some institutional filings are beginning to flag quantum dangers, and NIST and different organizations are pushing for post-quantum cryptography efforts for a broader vary of techniques.

BTCUSD buying and selling at $92,010 on the 24-hour chart: TradingView

Engineers within the cryptocurrency discipline are contemplating a migration path to interchange it with a quantum-resistant scheme, however such adjustments to Bitcoin can be complicated and would require widespread consensus.

Lengthy-term issues, not fast issues

Duong and different commentators say right this moment’s quantum machines are too small and too noisy to crack Bitcoin’s code. This warning is a couple of doable level sooner or later, referred to as “Q-day,” when a sufficiently giant and steady machine will have the ability to run Scholl and associated algorithms at scale. Schedules range broadly between professionals. Some predict it can take a long time, whereas others say inequality is closing sooner than many anticipated.

In accordance with business insiders, if a correctly designed quantum machine is in place, cash remaining in addresses which have already tolerated public key vulnerabilities will likely be most in danger. This makes finest practices similar to avoiding tackle reuse and shifting new balances to quantum-resistant addresses as soon as outdated balances can be found a prudent step. However consultants say there is no such thing as a simple answer that may repair the whole ecosystem in a single click on.

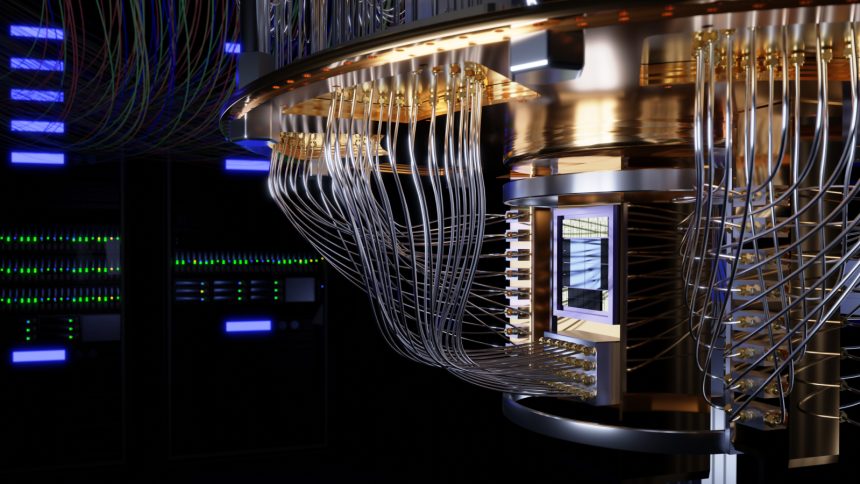

Featured picture by Peter Hansen/Getty Photos, chart from TradingView