A rescue rebound in BTC might happen if the cumulative quick place reaches $113,000. Main cash are exhibiting indicators of reaching native bottoms, and there are predictions of additional restoration.

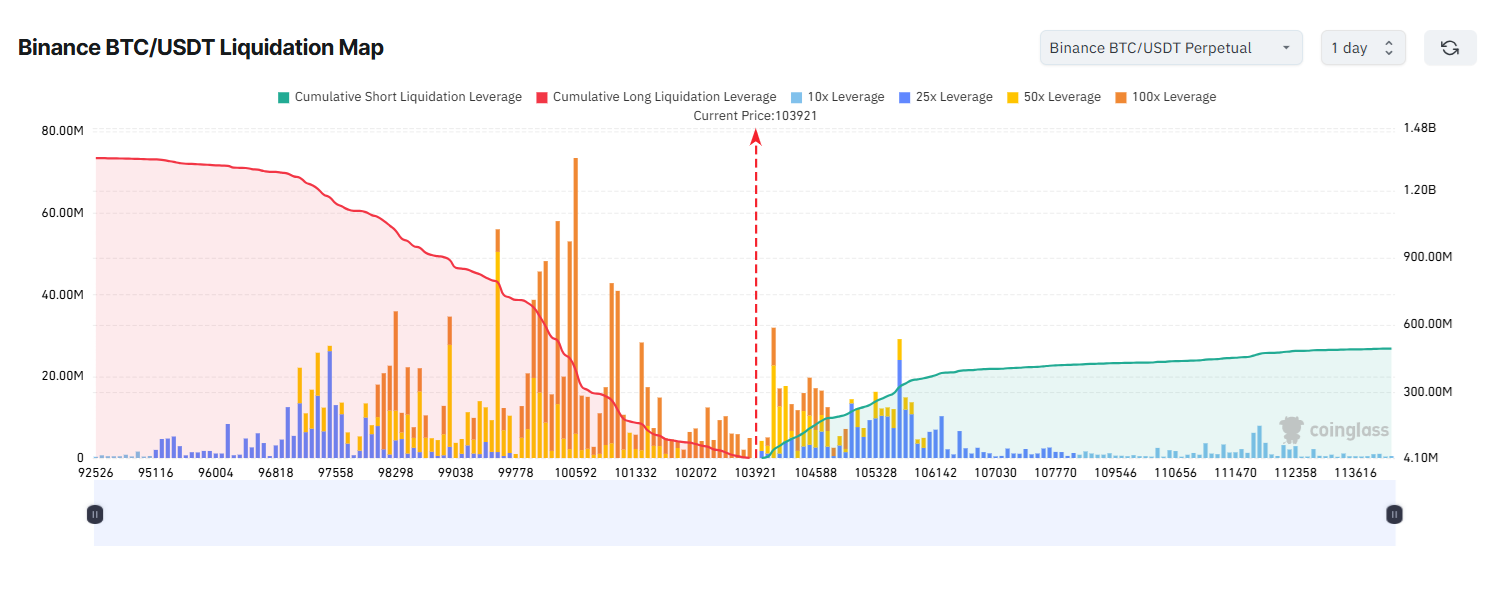

One alternative for a BTC restoration could possibly be a brief squeeze that liquidates positions of as much as $113,000. Liquidity is on the rebound, which has traditionally led to fast good points.

BTC has been rebuilding its liquidity deficit, which led to a fast restoration above $103,000. |Supply: Coin Glass

Though the existence of short-term liquidity doesn’t assure worth appreciation, it may be an necessary consider increasing BTC costs, a minimum of within the quick time period.

BTC open curiosity just lately recovered by $1 billion previously day, rising to $33.52 billion. Over 71% of BTC positions are lengthy on common. HyperLiquid is an exception, with over 43% of whales taking quick positions.

Though accrued quick liquidity has been excessive for the previous few days, it doesn’t assure a continuous rally. Quick liquidity reached $130,000 in October, however there was no vital quick squeeze.

On the draw back, BTC might dominate lengthy positions, particularly the excessive leverage cluster round $100,500.

BTC remains to be buying and selling with excessive worry

The BTC index has risen to 23 factors from its current low of 21 factors and stays buying and selling with excessive worry.

This main coin is buying and selling with the best volatility (1.98%) over the previous 6 months. The coin stays unpredictable, with hopes that the current financial downturn could also be over. Though BTC has not misplaced its upward channel but and reveals no indicators of a bear market, its worth actions nonetheless trigger concern.

BTC’s benefit is 58.4%, however that is as a result of poor efficiency of altcoins slightly than Bitcoin’s inherent energy.

Is BTC worth forming a neighborhood backside?

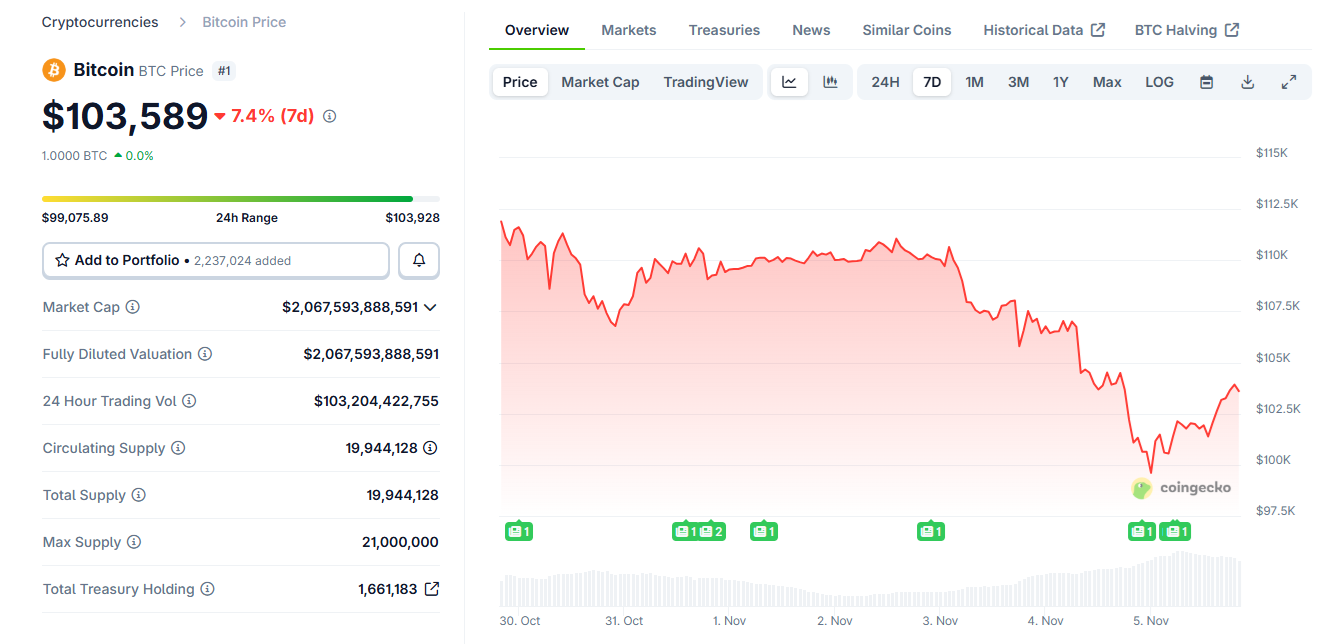

BTC has proven the flexibility to bounce again, suggesting that the $100,000 vary will act as a neighborhood backside.

BTC rebounded from weekly lows and averted a break under $100,000. Though buying and selling stays unsure, the coin has proven the flexibility to bounce again within the quick time period. |Supply: Coin Gecko

Shortly after forming a cluster of extremely leveraged quick positions as much as $105,000, BTC rose once more. Inside a brief time frame, the value recovered to $103,743.15, triggering a market-wide rebound from current lows.

BTC’s restoration additionally pushed ETH greater, pushing the token above $3,400.

This transfer instantly resulted in $5.9 million briefly liquidations in BTC and $9.6 million briefly ETH positions. Though that is solely a fraction of the out there liquidity, the quick squeeze was a minimum of partially realized. On a 4-hour foundation, BTC recorded $18.33 million in short-term liquidations.

On a 24-hour foundation, lengthy liquidations continued to dominate, with over $300 million of BTC longs liquidated.

There are different indicators of a market backside. Quick-term holders accomplished one other spherical Give up. There are additionally indicators that whale spot orders are growing, main ETFs to extend their BTC purchases.

The current market downturn is seen as a change in sentiment and never a break within the general bullish pattern.