Francisco Rodrigues (at all times ET except in any other case indicated)

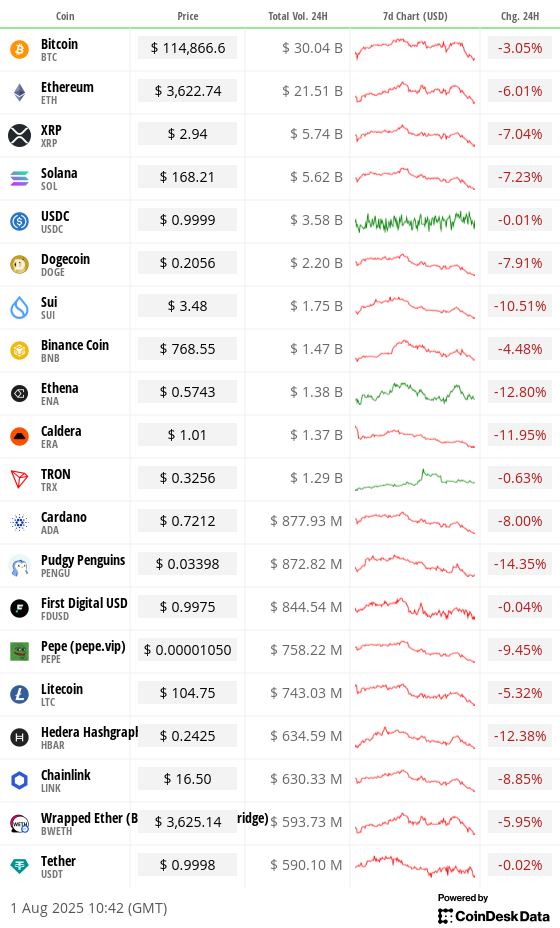

The wind seems to be popping out of the sails of the crypto market. Bitcoin

The Coindesk 20 (CD20) index, a broader market measure, noticed an ether (ETH) drop by 5.7% and 6% after posting the strongest month-to-month improve and XRP in three years

Lose greater than 7%.

The tax ranges from 10% to 41% of imports from main buying and selling companions, together with Canada, the European Union and Japan, as a few of President Donald Trump’s tariffs start to develop into much more efficient as scheduled to start on August seventh.

That led to the Asian inventory markets in its worst week since April, spurring USD rally, sending over 100 greenback indexes for the primary time since Might.

Tariffs additionally raised the Federal Reserve’s precedence inflation measures, Core PCE, to 2.8% year-on-year in June. The rise has weakened hopes for a September fee lower. Polymet Merchants have moved from a 56% likelihood of fee discount to 38%. CME’s FedWatch software exhibits a 39% likelihood.

“For crypto, a free monetary place can be a serious tailwind,” 21Shares strategist Matt Mena stated in an e-mail.

Non-farm pay knowledge at this time might be decisive. The report is anticipated to create 110,000 jobs final month.

Choices merchants are already searching for safety from additional declines.

“We’re trying ahead to seeing you sooner or later,” stated Jake Ostrovskis, OTC dealer at WinterMute. “ETH choices till late August are notably totally different, and positioning is totally bullish when balanced.”

If financial knowledge factors to greater charges for longer, merchants can circumvent in direction of belongings that profit from stricter situations. Stronger and better charges might tweak traders in direction of stubcoins or clear ETH-based safes that help the harvest given passing the Genius Act legislation. Preserve alerts!

What to see

- Crypto

- August 1: Helium Community (HNT), at the moment working in Solana, has lowered its annual new token issuance to HNT 7.5 million after half of the occasion.

- August 1: Hong Kong’s stablecoins ordinance comes into impact and a licensing system can be launched to control stubcoins actions in cities.

- August 1: The brand new Bretton Woods Labs launches BTCD. It says it’s the first absolutely Bitcoin-backed Stablecoin on the Elastos (ELA) mainnet, a decentralized blockchain protected by Bitcoin mining and overseen by the Elastos Basis.

- August 4th: Solana Cell can be delivered worldwide for Seeker Web3 cell units.

- August 15: File the date of the subsequent FTX distribution to the holders of the Class 5 buyer {qualifications}, normal unsecured and comfort claims for Class 6.

- August 18: Coinbase Derivatives launches Nano Sol and Nano XRP US Perpetual Fashion Futures.

- Macros

- August 1st, 8:30am: The U.S. Bureau of Labor Statistics will launch employment knowledge for July.

- Non-farm payroll EST. 110k vs. 147K

- Unemployment fee EST. 4.2% vs. 4.1%

- Authorities wage is prematurely. 73k

- Manufacturing wage EST. -3K vs. entrance. -7k

- August 1st, 9am: S&P International Releases will launch Brazil’s July manufacturing and repair knowledge.

- Earlier than manufacturing PMI. 48.3

- August 1st, 9:30am: S&P International Launch will launch manufacturing and repair knowledge for Canada for July.

- Earlier than manufacturing PMI. 45.6

- August 1st, 9:45am: S&P International Leleases (remaining) July manufacturing and US service knowledge

- Manufactured PMI EST. 49.5 vs. 52.9

- August 1, 10am: The Institute of Provide Administration (ISM) will launch its US Companies Sector knowledge for July.

- It’s a manufactured PMI. east. 49.5 vs. 49

- August 1st 10am: College of Michigan launch (remaining) US shopper sentiment knowledge for July.

- Michigan Shopper Sentiment EST. 62 vs. 60.7

- August 1st 11am: S&P International Launch will launch manufacturing and repair knowledge for Mexico for July.

- Earlier than manufacturing PMI. 46.3

- August 1: Peru’s Nationwide Institute of Statistics will launch shopper worth inflation knowledge for July.

- Earlier than mothers inflation. 0.13%

- Across the inflation fee. 1.69%

- August Sixth, 12:01am: 50% US tariffs can be enforced on most Brazilian imports introduced in President Trump’s July thirtieth govt order.

- August 7, 12:01am: The US mutual tariffs outlined in President Trump’s July 31 govt order can be efficient for a variety of buying and selling companions who haven’t secured transactions by August 1. These tariffs vary from 15% to 41% relying on the nation.

- August 1st, 8:30am: The U.S. Bureau of Labor Statistics will launch employment knowledge for July.

- Income (Estimation primarily based on truth set knowledge)

- August 4: Semler Scientific (SMLR), Put up Market, – $0.22

- August 5: Galaxy Digital (GLXY), in entrance of the market, $0.19

- August 7: Block (XYZ), Put up Market, $0.67

- August 7: Crypto Mining (CIFR), former market

- August 7: CleanSpark (CLSK), Postmarket, $0.19

- August seventh: Coincheck (CNCK), Postmarket

- August 7: HUT 8 (HUT), pre-market – $0.08

- August 8: Terawulf (Wulf), former market, – $0.06

- August 11: Exod, Postmarket

- August twelfth: Bitfarm (BITF), former market

- August twelfth: Foldable (FLD), Put up Market

- August 27: Nvidia (NVDA), Put up Market, $1.00

Token Occasion

- Governance votes and cellphone calls

- Close by protocols are voting for the potential for lowering Close to’s inflation from 5% to 2.5%. Two-thirds of validators should approve the proposal that it’ll move, and if that’s the case, it might be carried out by the second half of the third quarter. Voting will finish on August 1st.

- Venus Dao is voting for a 12-month replace at Chaos Labs for the deployment of the BNB chain at a value of $400,000, specializing in increasing the chance Oracle system for real-time automated threat parameter updates. Voting will finish on August 1st.

- Mixed DAO votes to pick out the subsequent Safety Service Supplier (SSP). Representatives have chosen Chainsecurity & Certora and Cyfrin. Voting will finish on August fifth.

- Unlock

- August 2: Ecena unlocks 0.64% of distribution provide price $23.36 million.

- August 9: Unlocking 1.3% of distribution provide price $12.26 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution provide price $47.95 million.

- August 15: An avalanche unlocking 0.39% of distribution provide price $3,652 million.

- August 15: StarkNet (STRK) unlocks 3.53% of its distribution provide price $1,442 million.

- August 15: SEI unlocks 0.96% of its circulation provide price $15.78 million.

- Token launch

- August 5: Keeta (KTA) listed in Kraken.

assembly

Coindesk Coverage & Regulation Convention (Previously generally known as Cryptographic State) At a one-day boutique occasion held in Washington on September Tenth, generals, compliance officers and regulatory executives will have the ability to meet with civil servants chargeable for crypto legislation and regulatory oversight. House is restricted. Please use Code CDB10 for 10% off registration till August thirty first.

- August. 6-7: BlockChain.rio 2025 (Rio de Janeiro, Brazil)

- August Sixth-Tenth: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August Ninth-Tenth: Baltotic Honey Badger 2025 (Riga, Latvia)

- August Ninth-Tenth: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

- August Eleventh: Paraguay Blockchain Summit 2025 (Asuncion)

- August Eleventh-Thirteenth: MATB 2025 (Intanbul)

- August Eleventh-Seventeenth: Ethereum NYC (New York)

- August Thirteenth-14th: Cryptowinter ’25 (Queenstown, New Zealand)

- August Twenty first-22: Coinfest Asia 2025 (Indonesia, Bali)

Token discuss

By Francisco Rodriguez

- In keeping with NFTPricefloor, Cryptopunks, a dominant assortment, is at the moment recovering the Not possible Token (NFT) market.

- In keeping with Coingecko knowledge, the NFTS market capitalization nearly doubled to $6.4 billion in only a month.

- The meeting was led by a code plant that rose 33.3% over that interval. Different collections equivalent to Pudgy Penguins additionally helped.

- The rise in Cryptopunks accounted for almost 30% of the whole market capitalization of the NFT sector. In ETH terminology, the 52 ETH worth is the perfect in over a 12 months.

Positioning of derivatives

- The variety of open contracts for CME Bitcoin Customary futures has dropped to 27,699, representing the bottom since April of 138,495 BTC.

- Capital flights might be an establishment that prefers spot ETFs over futures and merchants as greenback rally gathers velocity.

- Open curiosity in ether futures has dipped from a current peak of 41,636 to 32,903 contracts. The ether contract is sized at 50 ETH.

- BTC and ETH OI remained rising close to document highs for the offshore everlasting future, with funding charges receding under 5%, an indication of weakening bull sentiment.

- At Deribit, market sentiment is shifting in direction of ether, with decrease price insurance coverage premiums than Bitcoin.

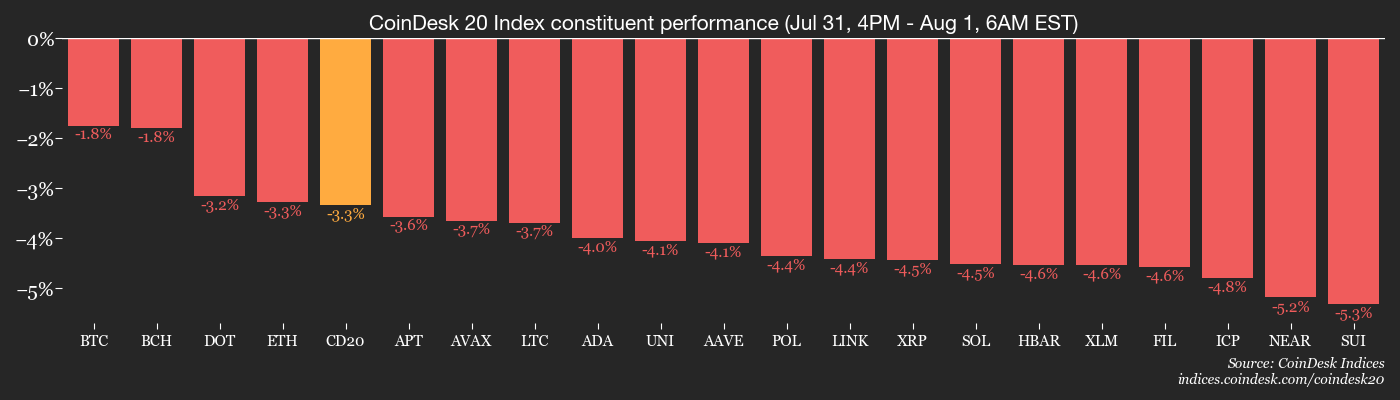

Market actions

- BTC fell 1.32% from 4pm on Thursday to $114,962.47 (24 hours: -2.92%)

- ETH is down 3.09% at $3,619.49 (24 hours: -5.94%)

- Coindesk 20 is down 3.26% at 3,764.26 (24 hours: -6.05%)

- Ether CESR Composite Staking Fee is unchanged at 2.94%

- BTC’s funding fee is 0.0026% (annual fee of two.8448%) by way of vinanence

- DXY is up 0.25% at 100.22

- Gold futures stay unchanged at $3,345.70

- Silver futures fell 0.67% to $36.47

- Nikkei 225 closed 0.66% at 40,799.60

- Hold Seng closed 1.07% at 24,507.81

- FTSE is down 0.40% at 9,096.56

- The Euro Stoxx 50 is down 1.36% at 5,319.92

- DJIA fell 0.74% on Thursday at 44,130.98

- S&P 500 closed 0.37% at 6,339.39

- The NASDAQ composite was not modified at 21,122.45

- S&P/TSX Composite closed 0.40% at 27,259.78

- S&P 40 Latin America closed 0.71% at 2,563.84

- The ten-year monetary ratio within the US is up 3.6 bps at 4.396%

- E-Mini S&P 500 futures fell 0.94% at 6,314.25

- E-Mini Nasdaq-100 futures fell 1.03% at 23,125.00

- The E-Mini Dow Jones Industrial Common Index is down 0.91% at 43,900.00

Bitcoin statistics

- BTC dominance: 61.98% (0.41%)

- Ether to Bitcoin ratio: 0.03150 (-1.38%)

- Hash fee (7-day shifting common): 904 EH/s

- Hashpris (spot): $57.21

- Whole price: 3.96 BTC/$468,378

- CME Futures Open Curiosity: 138,495 BTC

- BTC priced in gold: 34.8 oz

- BTC vs. Gold Market Cap: 9.85%

Technical Evaluation

- Every day charts of Ether-Bitcoin ratio present bearish divergence of RSI. This sample is marked by indicator printing, which is indifferent from the worth of the rise, suggesting a weakening of bullish momentum.

- In different phrases, ether might fall under Bitcoin within the subsequent few days.

- The MACD histogram, an indicator that follows developments, has additionally develop into unfavorable.

Crypto shares

- Technique (MSTR): $401.86 (+1.73%), with -4.2% closed at $385 in entrance of the market on Thursday

- Coinbase International (Coin): $377.76 (+0.07%), closed at -11.15% at $335.65

- Circle (CRCL): $183.52 (-3.66%), closed at -5.19% at $174

- Galaxy Digital (GLXY): $28.41 (-1.68%), $26.15 at -7.97%

- Mara Holdings (Mara): $16.08 (-2.84%), $15.5 at -3.61%

- Riot Platforms (Riot): $13.41 (-0.81%), closed at -8.05% at $12.33

- Core Scientific (CORZ): $13.54 (+3.72%), closed at -4.21% at $12.97

- CleanSpark (CLSK): $11.37 (-0.44%), -3.25% closed at $11

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $25.26 (+2.23%)

- Semler Scientific (SMLR): $35.85 (-0.17%), $35.60 at -0.7%

- Exodus Motion (Exod): $30.84 (+6.05%), closed at -1.85% at $30.27

- Sharplink Gaming (SBET): $18.81 (-3.83%), $17.66 at -6.11%

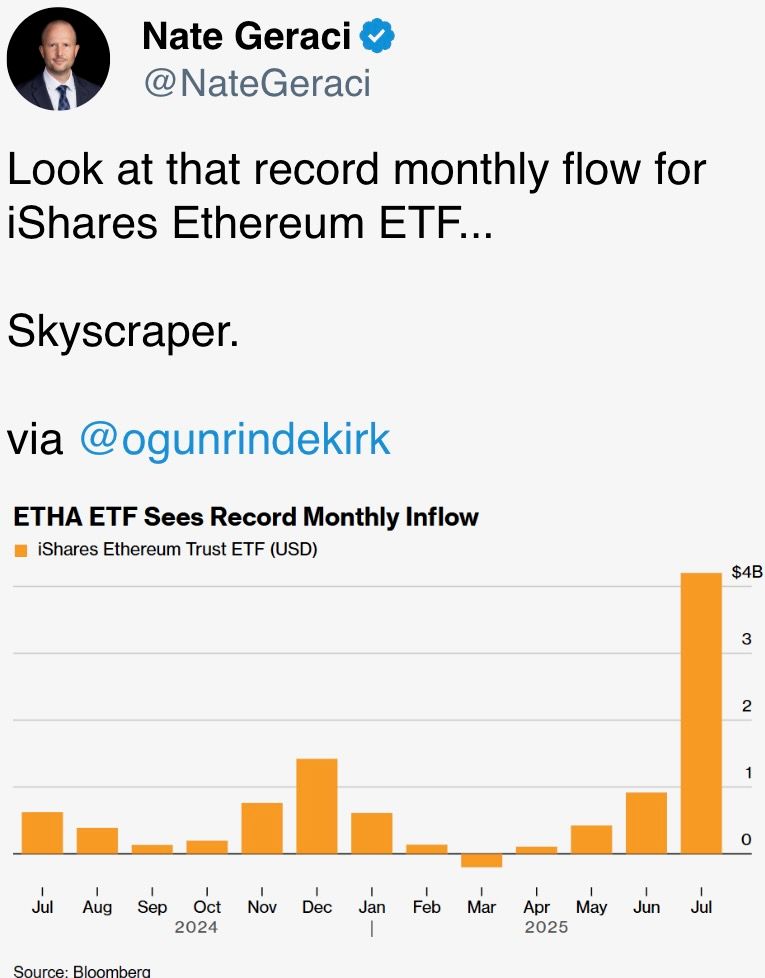

ETF Stream

Spot BTC ETF

- Every day Web Stream: -$114.8 million

- Cumulative internet movement: $549.7 billion

- Whole BTC holdings: 1.3 million

Spot ETH ETF

- Every day Web Stream: $17 million

- Cumulative internet movement: $96.6 billion

- Whole ETH holdings: 573 million

Supply: Farside Buyers

One evening movement

The chart of the day

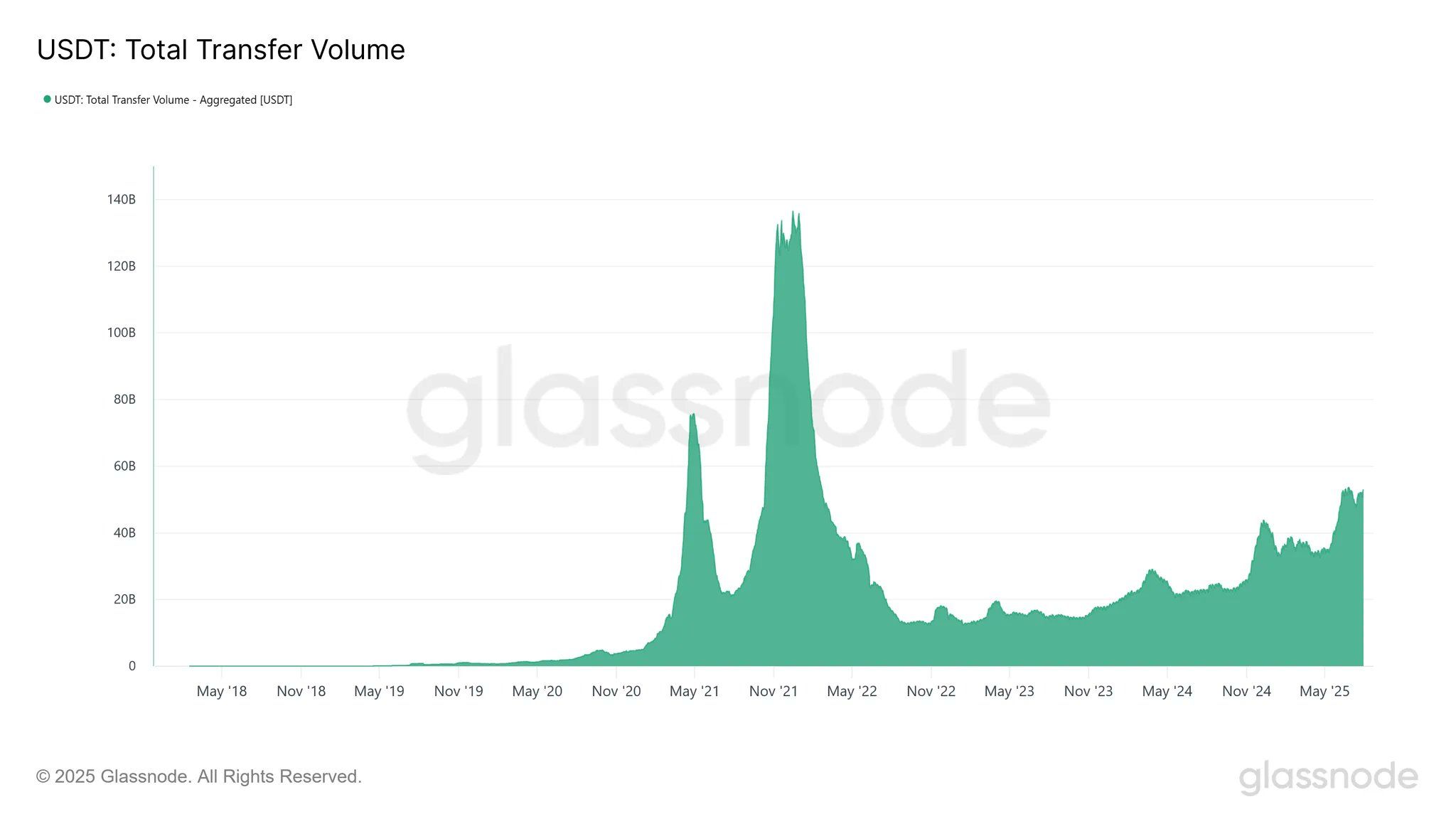

USDT: Whole chain-on-chain switch quantity. (GlassNode)

- The whole quantity of USDT transferred on-chain has risen to $52.9 billion, the very best since early 2022.

- GlassNode exhibits a gradual and constant restoration in Stablecoin velocity and market exercise.

- The 2021 Crypto Bull Market Peak was marked by sharp spikes in USDT speeds.

When you’re asleep

- Donald Trump rekindles the world commerce warfare with the Sweep Tax Regime (Monetary Instances): The 35% tariff on Canadian non-USMCA items will start on August 1, however the broader tariffs introduced in Thursday’s govt order will come into impact on August 7, permitting US customs to be carried out.

- Bitcoin, ether begins in August with a unstable memo as soon as the Greenback Index exceeds 100. Yen hits 4 months earlier than non-farm pay (Coindesk). Main cryptocurrencies noticed unstable buying and selling because the stronger greenback, following new tariffs, might exacerbate inflation and complicate the trail to lowering Fed rates of interest.

- Do merchants do ether? The choices market is at the moment at the next threat of ETH than BTC (Coindesk). Delibit knowledge exhibits that it marks a sentiment shift after weeks of institutional choice for the second largest cryptocurrency.

- El Salvador Scrap Presidential Length Limits, Opens the door for one more Bukere Time period (Reuters): The invoice handed in Parliament on Thursday permits for indefinite re-election, extends presidential phrases to 6 years, eliminates spills, and shortens Bukell’s present time period to coordinate all elections in 2027.

- Goldman calls consideration as the worldwide credit score unfold hits its 2007 low (Bloomberg). The market has proven confidence, however the strategists suggested to take care of hedging, warning traders that they could overlook dangers equivalent to mitigating progress, slowing down output charges, and uneven impacts from commerce insurance policies.

- Bitcoin holders can now get hold of automated yields through the $20 billion SolV protocol (Coindesk). Solv’s BTC+ Vault provides 4.5% to five.5% Bitcoin returns through staking, automation and manually choosing and managing holder holders of Defi lending and protocols.

With ether