In Japanese time at 6pm on Saturday, Bitcoin has shifted its arms at $112,985 after immersing its low $111,987 from a excessive of almost $123,000 in current weeks at $111,987, with each futures and non-compulsory metrics flashing blended indicators over main spinoff exchanges.

Bitcoin Dip, however Delibit Merchants are nonetheless aiming for $140,000 + strike worth

Bitcoin fell 4.6% this week, with a market capitalization of $2.23 trillion and a 24-hour buying and selling quantity of $363.5 billion. On the every day charts, BTC has been low since mid-July, with consecutive bearish days falling under short-term help.

The hourly chart confirms secure gross sales strain and bottoms out at $111,987 throughout the morning session within the US. Regardless of the decline, every day doses stay reasonable in comparison with the extremely unstable stretches seen in late Might to early July. On the similar time, the Bitcoin derivatives market is telling a very totally different story, from prime to backside.

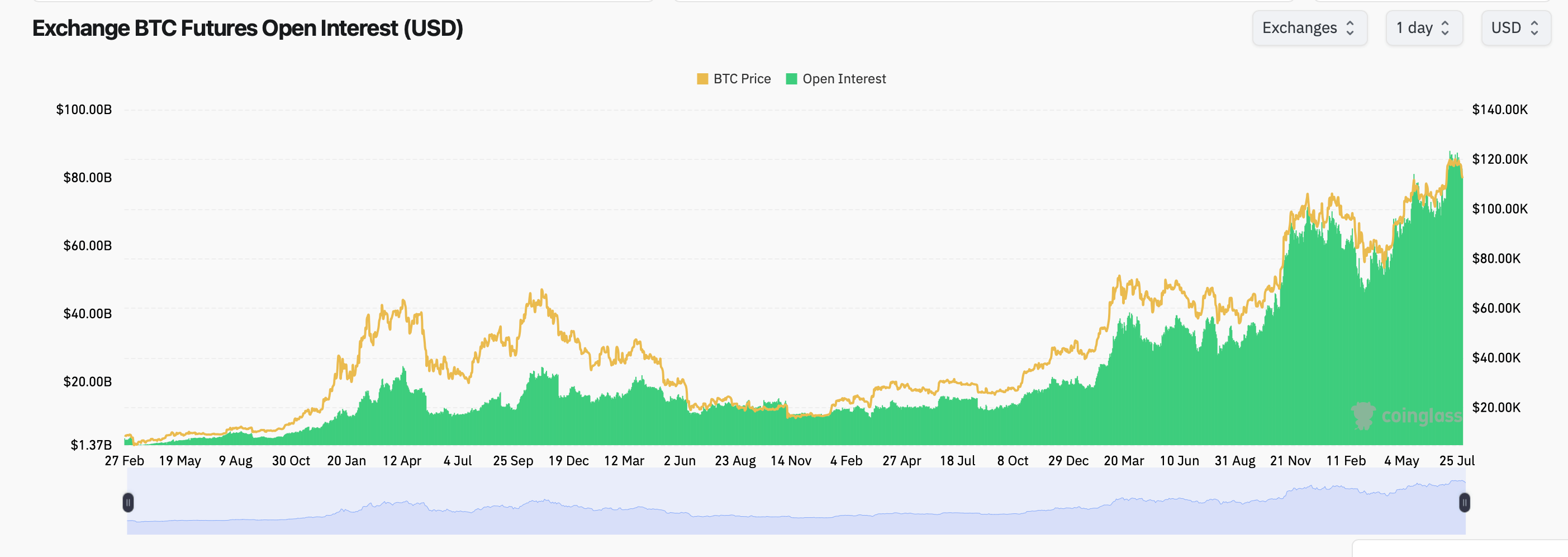

In response to metrics on Coinglass.com, Futures Open Curiosity (OI) is $80.14 billion throughout all exchanges. CME and Binance lead with $15.94 billion and $141.2 billion, respectively. Bibit confirmed essentially the most aggressive one-hour OI improve at +0.31%, with MEXC’s OI rising by 1.32% over 24 hours.

Nevertheless, the 24-hour liquidation exceeded $577.19 million on Saturday, with Lengthy making up nearly all of the damages. Ethereum merchants have been hit hardest at $185.7 million in each lengthy and quick liquidations, adopted by $93.67 million in Bitcoin. This implies that when costs have been lowered, a number of lengthy positions have been washed away excessively.

Regardless of the bearish spot motion, choices merchants look optimistic. The decision represents 61.8% of all open curiosity within the BTC choices market, with 210,458.73 BTC within the name place and 130,099.39 BTC within the put. Nevertheless, during the last 24 hours, quantity shifted extra evenly, with 54.99% at 45.01% on calls, reflecting short-term defensive positioning.

Excessive revenue negotiation costs embody a $140,000 name (10,616.4 BTC in OI) on December 26, 2025, in addition to a $200,000 name (8,685.7 BTC). This reveals confidence within the long-term advantages regardless of the battle for BTC to carry the $112K degree.

The oscillator turns into weaker from impartial and bearish. The relative energy index (RSI) is 40, and the MACD degree signifies promoting. The Commodity Channel Index (CCI) is extremely unfavorable at -293 and is commonly interpreted as a possible buy zone. The momentum reverses to -6,171, suggesting that the downward drive is at work.

Shifting averages are blended. All easy, exponential shifting averages for 10, 20 and 30 days are flashing gross sales indicators. Nevertheless, 50, 100, and 200-day SMA and EMA are referring to a long-term upward development at $99,213 for the 200-day SMA and $100,471 for the EMA.

Bitcoin is navigating technical modifications amid stable spinoff exercise and heavy lengthy liquidation. Brief-term indicators recommend extra space to shortcomings, whereas choices and long-term shifting averages recommend underlying bullish sentiment.

Whether or not BTC is consolidating or persevering with its decline might rely upon the rebalancing of macroeconomic knowledge and derivatives early subsequent week.