Bitcoin rallied above the $92,000 milestone on Monday as a mixture of sturdy shopping for and new geopolitical noise. Merchants have been watching Bitcoin rally towards $93,000 after briefly gaining on world markets, earlier than reaching about $92,800 in early U.S. buying and selling.

Geopolitical instability and market actions

US President Donald Trump’s feedback about doable motion in Colombia elevated market uncertainty and prompted capital flows into dangerous property comparable to Bitcoin, in line with a market report.

Merchants offered some positions and acquired again Bitcoin as costs stabilized close to the highs. Inflows into ETFs have additionally been cited as supporting demand, with one report noting that internet inflows into Bitcoin spot ETFs reached round $645 million across the similar session.

Bitcoin’s price of improve was modest, however the greenback quantity attracted consideration. In line with the information, BTC traded within the low $92,000 vary earlier than trying to rally in direction of $93,000. Experiences additionally level to liquidations and futures trades that rebalance brief positions, prompting fast strikes in each instructions.

President Trump is saying this now.

Trump: “Columbia is being run by a sick man. He will not final for much longer.”

Reporter: “So does that imply there might be a U.S. operation in Colombia?”

Trump: “I feel that is an excellent factor.” pic.twitter.com/66fQM7cEIY

— Kobeissi Letter (@KobeissiLetter) January 5, 2026

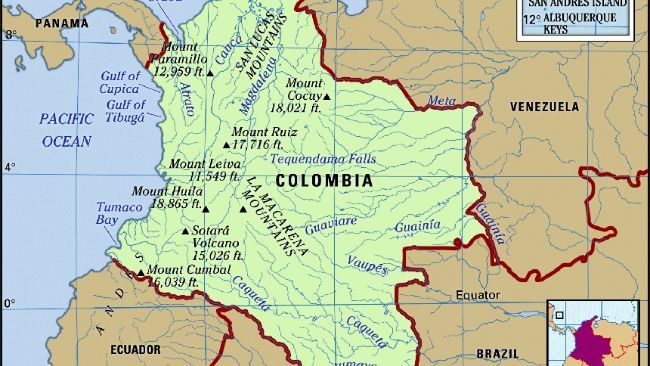

Colombia in Trump’s sights

In line with stories, current US operations in Venezuela and broader tensions in Latin America performed a task within the change in sentiment.

In a speech on Sunday, President Trump criticized Colombia over cocaine trafficking and stated a brand new U.S. army operation tied to the nation “looks like an excellent factor to me,” in line with Reuters. He additionally warned that motion could also be wanted in Mexico.

President Trump described Colombia as “very sick” and accused Colombian leaders of fueling the cocaine commerce into america, saying the state of affairs “will not final lengthy.”

Whole cryptocurrency market valuation on each day chart is $3.12 trillion: TradingView

Institutional circulate and market construction

Alternatively, through the rally, spot ETF purchases and macro merchants have been lively. The inflows cited in market literature recommend that monetary establishments proceed so as to add publicity regardless of the rise in headline threat. On the similar time, the Derivatives Desk reported notable liquidations that briefly elevated volatility.

Some analysts have advised the media that there are technical hurdles across the present vary that would restrict beneficial properties with out new catalysts. Others stated the following necessary ranges to look at are lows round $93,000 and $88,000 to $90,000, the place cease orders and margin calls may trigger sharper strikes.

blended sign

Market alerts stay blended. ETF inflows point out regular curiosity from a bigger pool of capital, however geopolitical headlines within the area preserve a threat premium on costs. Merchants are maintaining a tally of U.S. financial knowledge this week. It’s because addressing employment and inflation developments may change the tone for each shares and cryptocurrencies.

Bitcoin’s rise above $92,000 got here at a second of heightened information circulate intersecting feedback from US President Donald Trump and shopping for by main institutional traders. Costs are transferring quick, the numbers are necessary, and merchants are actually centered on whether or not demand can maintain close to present ranges or whether or not headline dangers will pressure it decrease.

Featured picture from Britannica, chart from TradingView