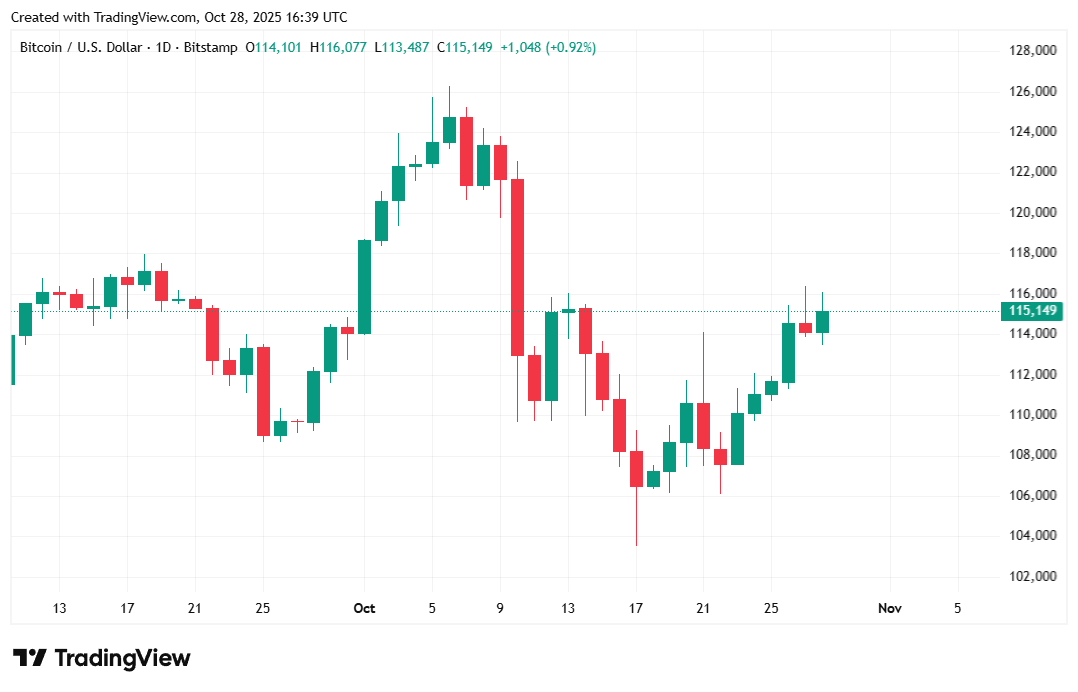

The digital asset briefly regained $116,000 early Tuesday morning after falling to $113,000 in a single day.

BTC briefly rebounds as shares attain new highs

The inventory market was flooded with inexperienced on Tuesday as a number of corporations beat analysts’ expectations. The S&P 500 hit one other intraday excessive as corporations akin to Paypal and UPS reported sturdy third-quarter outcomes, pushing their shares increased. Bitcoin fell to $113,000 throughout after-hours buying and selling, rose to $116,000 within the morning, and settled round $115,000 within the late afternoon.

Personal-sector employment progress introduced by human assets agency ADP additionally boosted shares. The corporate reported that it added a mean of 14,250 jobs within the 4 weeks ending October 11. The US federal authorities shutdown started on the twenty eighth.th On that day, the publication of just about all financial knowledge, together with employment statistics, was suspended. ADP, which publishes month-to-month personal sector employment statistics, has introduced that it’ll now additionally publish weekly employment statistics to fill the hole left by the federal government.

However the true stars of the present have been the businesses that posted sturdy financials and introduced favorable trades that gave merchants confidence that the inventory’s worth would flip round. For instance, Paypal introduced a partnership with OpenAI, which can see the fee supplier built-in with OpenAI’s platform. Following the announcement, PayPal’s inventory worth soared 13%.

“We now have a whole lot of thousands and thousands of loyal Paypal pockets holders, and now they’ll click on the ‘Purchase with Paypal’ button on ChatGPT for a protected and safe checkout expertise,” Paypal CEO Alex Chriss stated in an interview with CNBC.

Overview of market indicators

Bitcoin was down 0.47% on the time of reporting, dropping to $113,566.80 within the after-hours earlier than rising to $116,078.99 within the morning and buying and selling at $114,732.87. The cryptocurrency carried out barely higher on a weekly foundation, rising 0.88% from final week, in keeping with knowledge from Coinmarketcap.

(BTC Value/Buying and selling View)

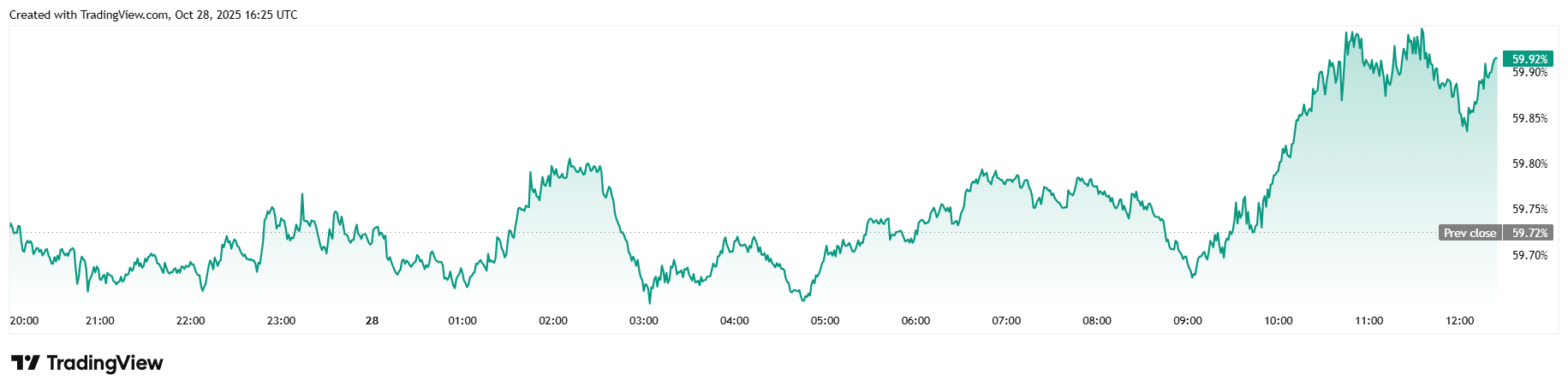

The 24-hour buying and selling quantity decreased by 12.37% to $53.05 billion, and the market capitalization, which fluctuates relying on the worth, decreased by 0.47% to $2.28 trillion. Bitcoin dominance elevated by 0.32% in 24 hours to succeed in 59.91%.

(BTC Dominance / Buying and selling View)

Whole open curiosity in Bitcoin futures fell by 0.67% on the day to $75.38 billion, in keeping with knowledge from Coinglass. The liquidation proceeded comparatively calmly in 24 hours, totaling $72.89 million. Lengthy buyers have been liquidated the equal of $45.2 million, whereas brief sellers misplaced a smaller quantity of $27.87 million.

Often requested questions ⚡

- Why did Bitcoin briefly attain $116,000?

Higher-than-expected company earnings and investor optimism for shares boosted sentiment within the crypto market. - Which corporations led the market’s rise?

Paypal and UPS beat expectations for Q3, with Paypal hovering 13% after saying its OpenAI partnership. - How did the broader market react?

The S&P 500 hit a brand new intraday excessive as merchants cheered optimistic earnings outcomes and personal employment progress. - What’s subsequent for Bitcoin and shares?

Analysts count on each markets to stay sturdy as danger urge for food returns and if earnings momentum continues.