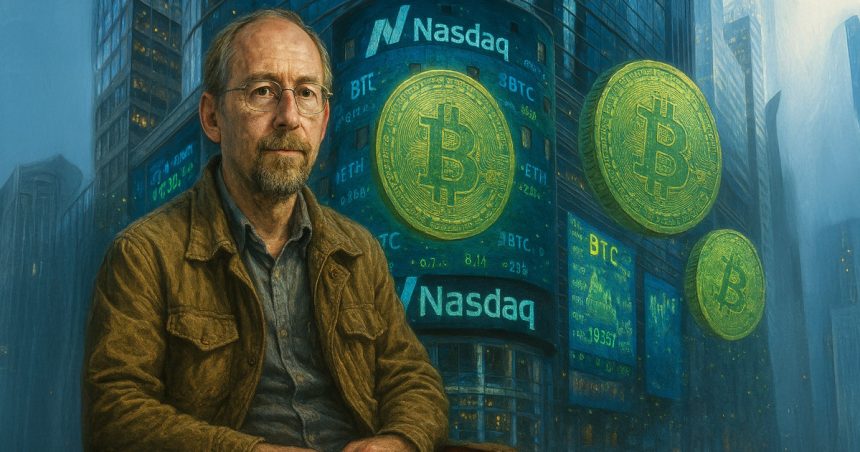

Bitcoin Normal Treasury Firm has agreed to combine with Cantor Fairness Companions I (CEPO) in a SPAC transaction that reveals Bitcoin-centric monetary autos on Nasdaq as soon as the contract is closed.

The events signed the enterprise mixture settlement dated July sixteenth, Right this moment’s announcement.

BSTR is planning to launch with 30,021 Bitcoin (BTC) and as much as $1.5 billion in FIAT pipe finance, with CEPO Belief contributing to roughly $200 million eligible for redemption.

The Finance Stack consists of $400 million widespread inventory dedicated at $10 per share, a convertible senior be aware as much as $750 million, and a convertible most well-liked inventory of as much as $350 million, which can be transformed with a typical inventory value $13.

The corporate has additionally secured pipe funding inside 5,021 BTC. This was provided by longtime Bitcoin members at a inventory reference value of $10.

Suggested by Blockstream Capital Companions, the founding shareholder will donate 25,000 BTC on the identical $10 reference.

BSTR stated the overall sources shall be offered as of July seventeenth, the fourth largest publicly reported Company Bitcoin Treasury.

Particularly, the announcement Take a look at the latest experiences Cantor Fitzgerald was in discussions to amass roughly $3 billion in Bitcoin from Blockstream.

Veterans take part as executives

Adam Again will function CEO and Sean Invoice will function Chief Funding Officer. Again is thought for inventing Hashcash, a piece proof system cited in Bitcoin White Paper, and co-founding Blockstream.

Invoice has beforehand targeted on advancing one of many earliest Bitcoin allocations via the US public pension scheme, integrating digital property into the establishment’s portfolio.

BSTR frames its mission as accumulating Bitcoin, producing Bitcoin yields, and Bitcoin measured in BTC per share advising firms and sovereigns on spiritual monetary methods.

Buck stated within the announcement:

“By securing each Fiat and Bitcoin funding on the primary day, together with the primary spherical of conversion precedence introduced alongside the Bitcoin Treasury area merger, we place unprecedented firepower behind a single mission: maximizing Bitcoin possession whereas accelerating precise Bitcoin adoption.”

Brandon Lutnick, chairman of Cantor Fairness Companions I, known as the transaction “one other step in direction of the mixing of the Bitcoin financial system and conventional funds.”

The merger was accredited by each the BSTR and CEPO boards. The closure requires approval from CEPO shareholders and achievement of customary phrases.

CEPO will submit extra info equivalent to enterprise mixture agreements, pipe paperwork, and investor displays within the upcoming Kind S-4 registration assertion, together with present experiences on Kind 8-Okay and prospectus supplies.