Bitcoin’s sustained value above $100,000 was thought to sign the arrival of Bitcoin as a mature institutional asset. Slightly, the sudden reversal under that threshold spooked merchants and reignited fears of one other crypto winter.

On November 4th, Bitcoin briefly fell to $99,075, the bottom since Could, however has recovered to round $102,437 on the time of writing. Regardless of the value restoration, BTC remains to be down about 3% from its intraday excessive of $104,777. crypto slate information.

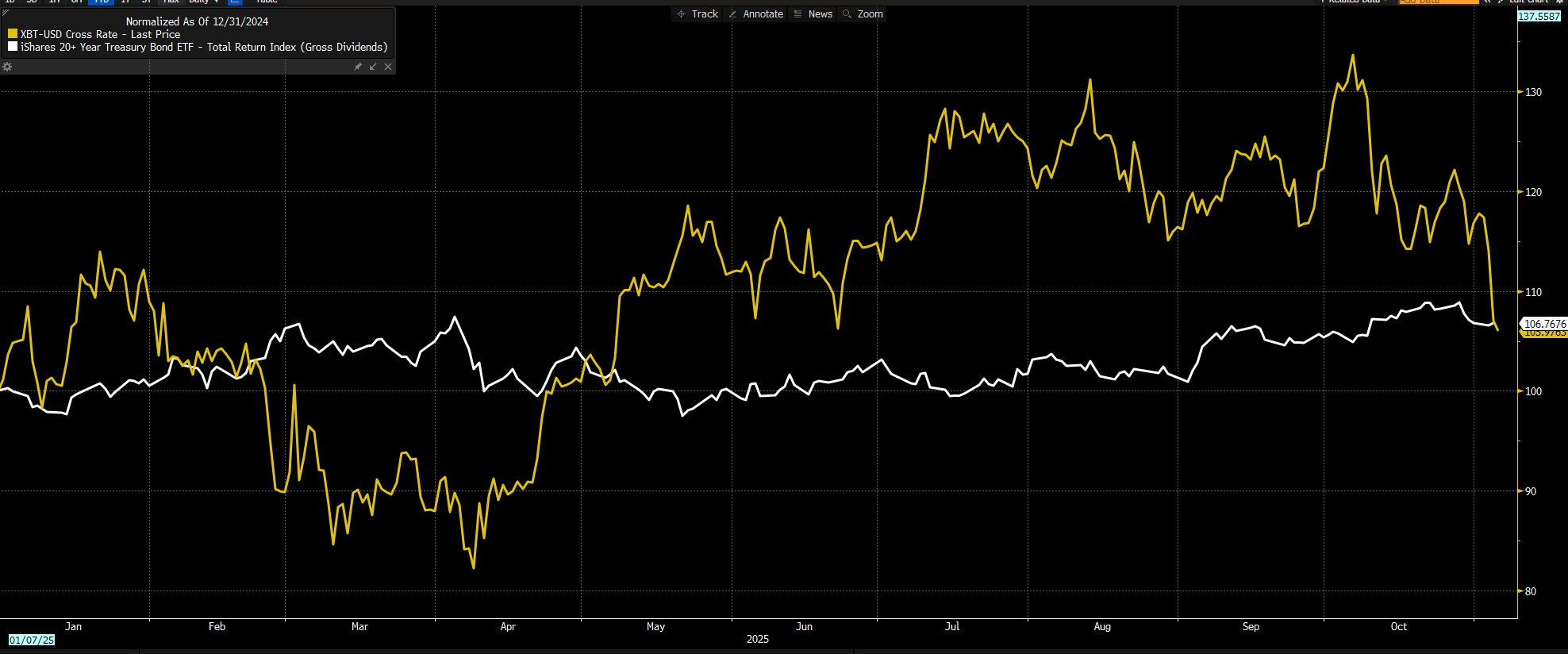

This value efficiency has prompted Bitcoin to lag behind U.S. Treasuries for the primary time this yr, eliminating probably the most common macro trades in 2025.

However analysts say the transfer displays a structural reset relatively than a collapse of the system.

Why is Bitcoin value falling?

Lengthy-term holders have performed a key position in driving the downtrend within the flagship digital asset by realizing positive factors at file charges.

Bitcoin analyst James Van Straten famous that the group has offered greater than 362,000 BTC since July, equal to about 3,100 BTC per day. He stated the tempo has accelerated over the previous three weeks, reaching almost 9,000 BTC per day.

One other analyst, Johan Bergmann, instructed the overall may very well be even increased. He calculated that the cumulative realized positive factors for the LTH cohort elevated from $600 billion in June to $754 billion as of immediately.

In response to him:

“Assuming they offered at a median value of $110,000, that is a revenue of about $72,000 per coin. That is $154 billion / $72,000 ≈ 2.1 million cash offered.”

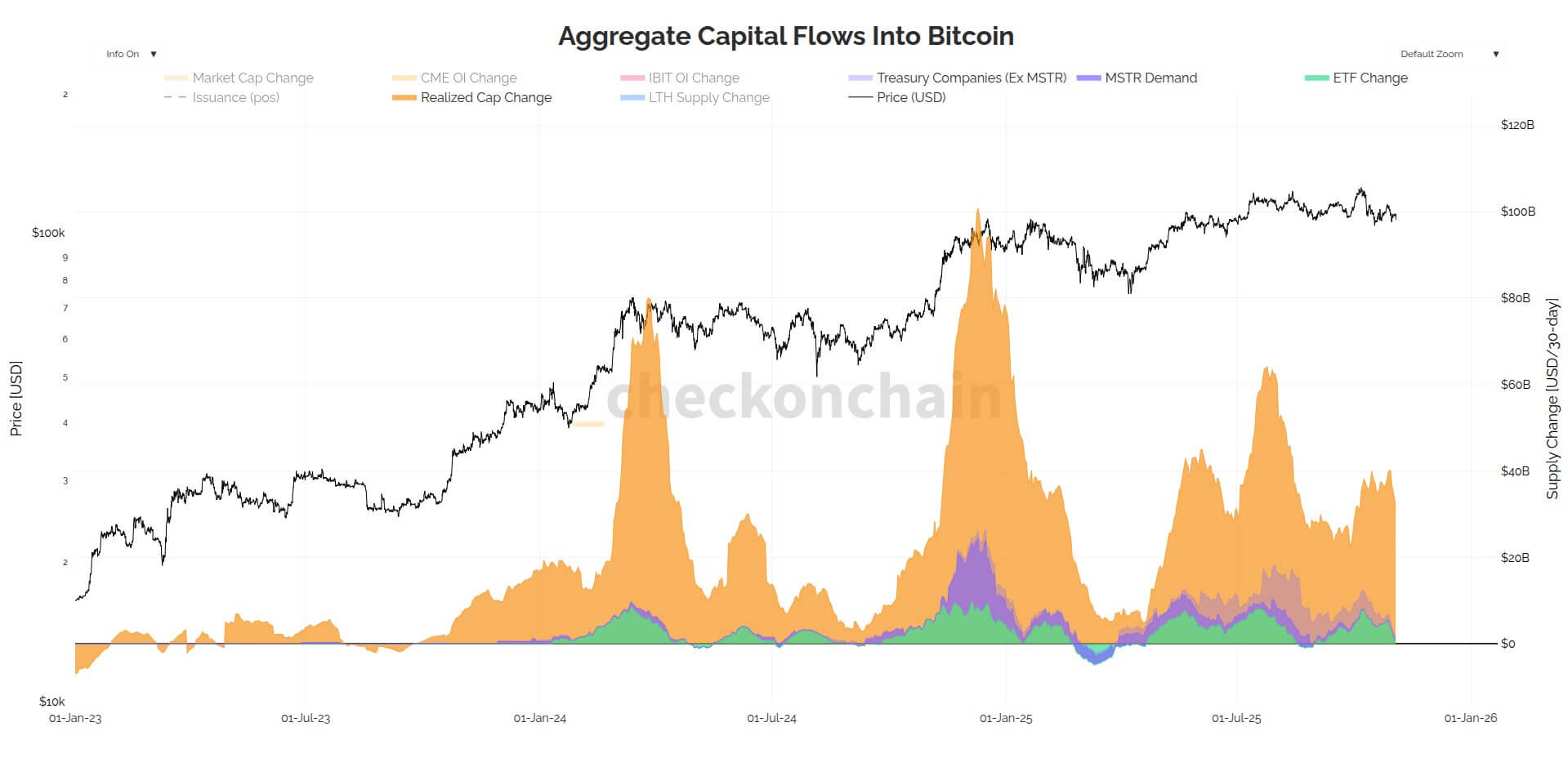

Knowledge from James Verify of CheckOnChain additional reveals that Bitcoin is at the moment going through sell-side stress of $34 billion per 30 days as older cash return to exchanges.

This influx has largely offset the decline in demand from ETFs and company bonds, a few of which have shifted focus to inventory buybacks relatively than new crypto allocations.

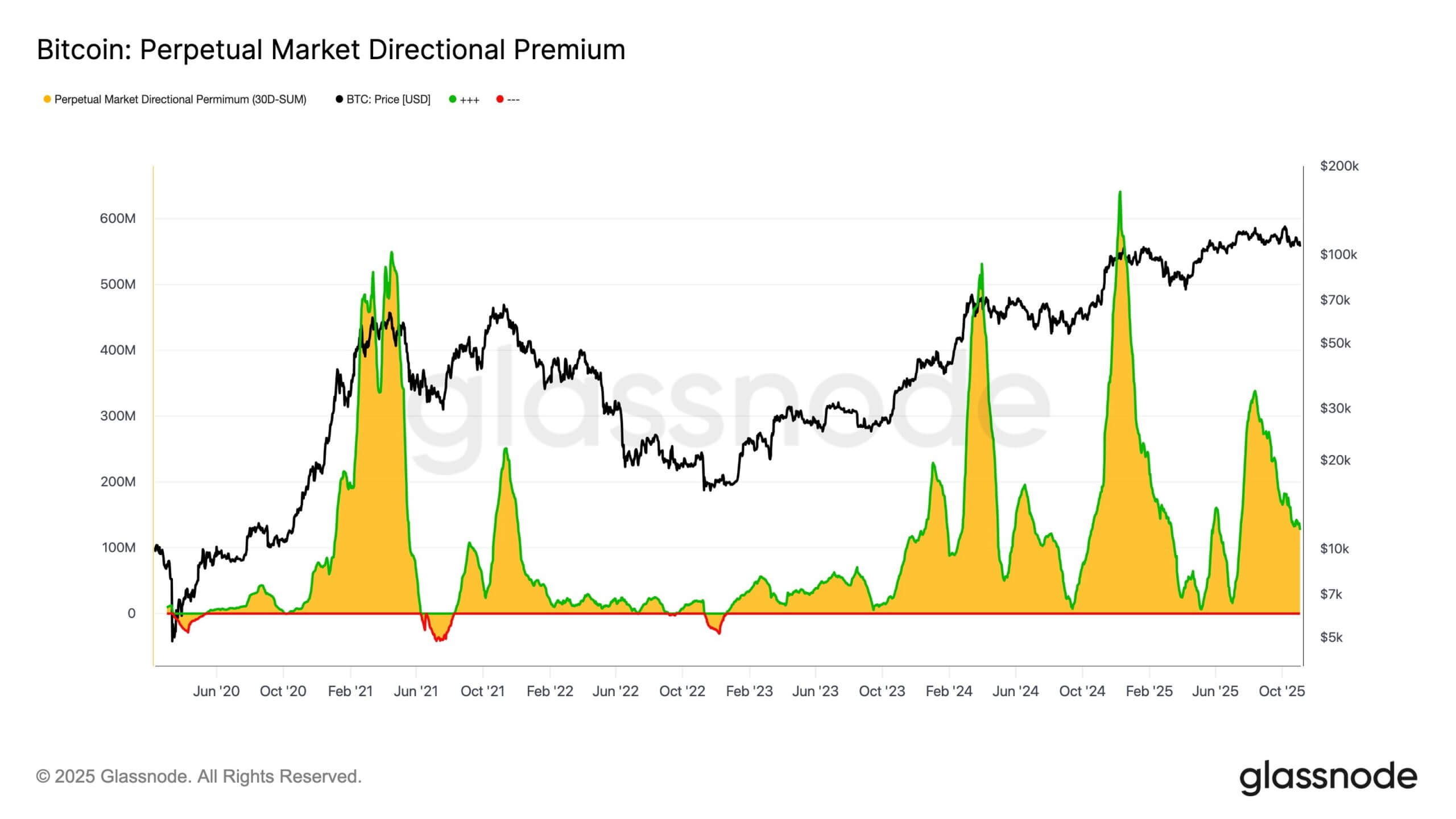

On the identical time, speculative exercise out there can be declining.

Perpetual futures funding charges have fallen 62% since August, from about $338 million to $127 million per 30 days, reflecting decrease leverage, based on Glassnode information.

The corporate said:

“It is a clear indication of a macro downtrend in speculative urge for food, with merchants turning into extra reluctant to pay curiosity to take care of lengthy exposures.”

In the meantime, enthusiasm is waning as international liquidity tightens.

The extended U.S. authorities shutdown, the longest in historical past, has tied up about $150 billion within the Treasury Division’s basic fund, draining liquidity that will usually flow into by threat belongings.

BitMEX co-founder Arthur Hayes famous that for the reason that debt ceiling was raised in July, greenback liquidity has fallen by about 8%, whereas Bitcoin has fallen by 5%, reinforcing the correlation between the 2.

$95,000 turns into market stress level

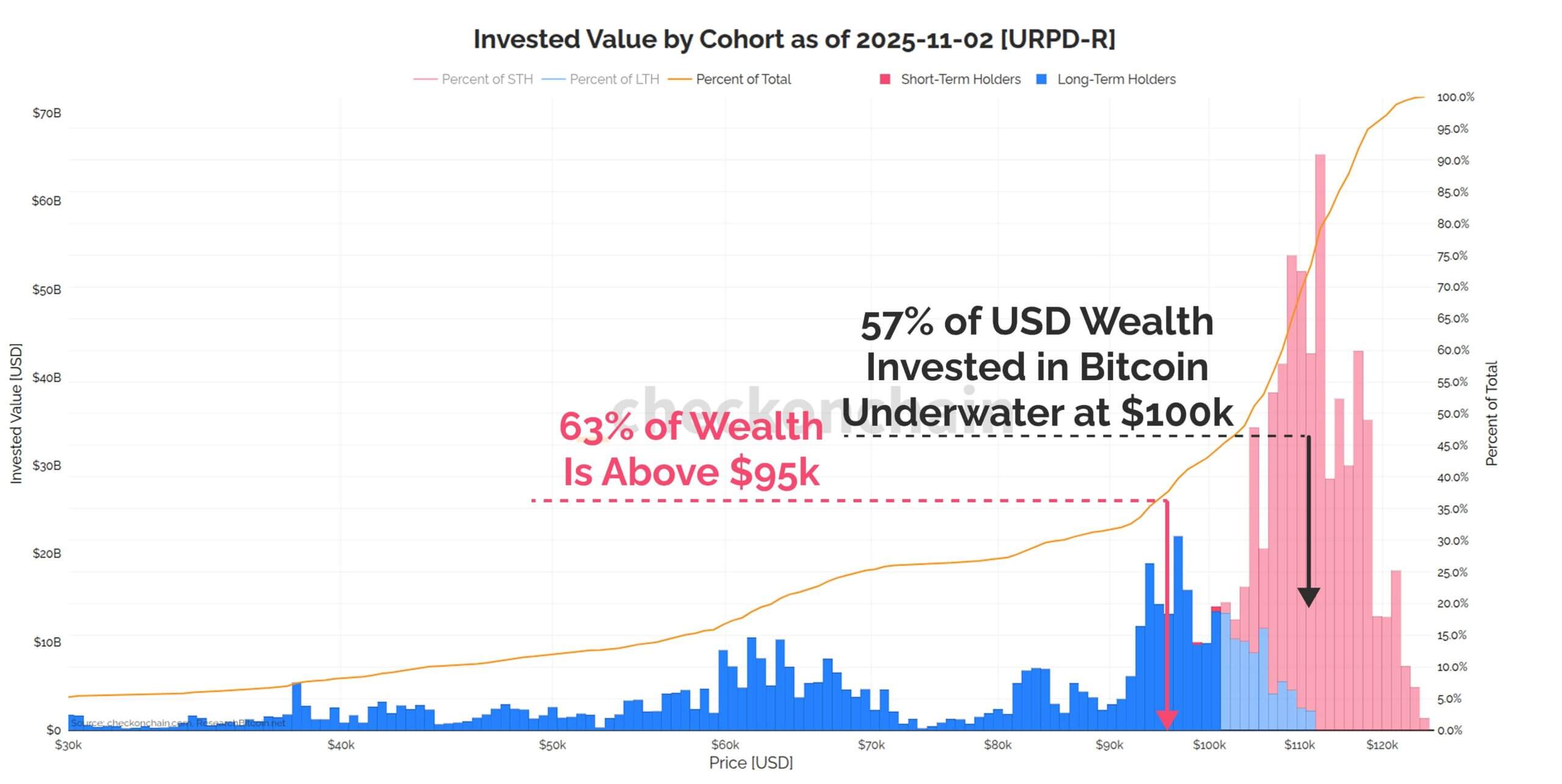

Because of this wave of promoting exercise, Verify estimates that 57% of all {dollars} invested in Bitcoin at the moment are misplaced. His cost-based mannequin values every coin at its final on-chain transaction, reflecting what he calls market recency bias.

He wrote:

“We value each coin when it was final traded on-chain. This helps us interpret sentiment based mostly on recency bias. We don’t take into consideration cash from earlier cycles as a lot as we do about cash we purchased three days in the past.”

Taking this under consideration, he famous that about 63% of invested capital has a value foundation of greater than $95,000, a degree that gives necessary psychological and structural help.

He additionally identified that unrealized losses totaled almost $20 billion, or about 3% of the corporate’s market capitalization. Traditionally, a bear market begins when unrealized losses exceed 10%.

Consequently, he expects sentiment to worsen if costs fall under $95,000. Earlier corrections in 2024 and early 2025 stabilized when losses reached 7-8% of market capitalization. If deeper, it may point out a brand new bearish part is underway.

Verify notes:

“Clearly nobody would make such a call after costs have already fallen, which is why $95,000 is a crucial line to carry as costs fall.”

Is that this the start of a bear market?

Business analysts stay divided on whether or not Bitcoin’s latest decline alerts the beginning of a brand new downtrend or just a mid-cycle reset.

The test stated:

“2025 noticed a major rotation of the coin, with most of it above $95,000. We don’t need the value to fall under $95,000, however we additionally anticipate the bulls to place up a tricky struggle to defend it. Put together for a bear market, however don’t imagine in a catastrophic market.”

Nonetheless, in a latest observe referred to as “Hallelujah,” Hayes stated the decline was on account of a short lived greenback scarcity relatively than a structural failure.

He stated the large issuance of Treasury payments sucked liquidity out of cash markets. However he believes this dynamic will reverse as soon as policymakers reopen the federal government and resume increasing stability sheets.

He wrote:

“If present cash market circumstances proceed, the mountain of Treasury debt will develop exponentially, and because the lender of final resort, the SRF stability must develop. Because the SRF stability will increase, the quantity of fiat {dollars} on the planet will develop as properly. This phenomenon will reignite the Bitcoin bull market.”

In the meantime, Matt Hogan, chief funding officer at Bitwise Asset Administration, stated that whereas he shares Hayes’ long-term optimism, he frames it inside Bitcoin’s evolving maturity.

On CNBC, he described the latest financial downturn as a “story of two markets,” with retail merchants capitulating amid leverage drains whereas institutional buyers have quietly elevated their publicity.

With this in thoughts, Hogan emphasised that whereas BTC’s risk-adjusted outlook stays unparalleled, the times of 100x annual returns are over. He added:

“A 100x return in a single yr is unlikely. Nonetheless, as soon as the distribution stage is accomplished, there’s nonetheless important upside potential…[But we still]imagine Bitcoin will attain $1.3 million by 2035, which I personally take into account to be conservative.”

On the identical time, he believes the times of a 1% BTC allocation are over, as BTC’s decrease volatility makes it extra engaging to carry.

Hogan concluded:

“As an allocator, my response to this transfer is to not promote belongings, however relatively to purchase extra Bitcoin, as I predict it is going to be the world’s best-performing massive asset over the following decade. In different phrases, decrease volatility means it’s safer to personal extra.”