Japan’s 10-year authorities bond (JGB) yield has reached ranges not seen since 2008, making a situation that places strain on Bitcoin via spot depth and order e-book mechanisms slightly than direct correlation.

The long-term sale of Japanese authorities bonds has raised home yields, lowering the inducement for Japanese institutional traders to hunt returns in abroad markets.

Life insurers have already proven a choice for home yen property in current quarters, and the current spike in yields has accelerated that development.

World greenback liquidity has shrunk barely as Japanese capital retreats from abroad danger positions, weighing on danger property equivalent to shares and cryptocurrencies.

How rising authorities bond yields put strain on Bitcoin

Consumers have fled Japanese authorities bonds amid heightened political and monetary dangers, inflicting yields to soar and now redirecting the stream of cash to monetary establishments. The simultaneous depreciation of the yen is including to the strain.

A weaker yen retains the greenback robust, and the mix requires lowering danger throughout carry trades and leverage methods.

Rising hedging prices and widening charge differentials make it costlier to keep up leveraged positions, drain liquidity from exchanges, and make Bitcoin value actions extra mechanical.

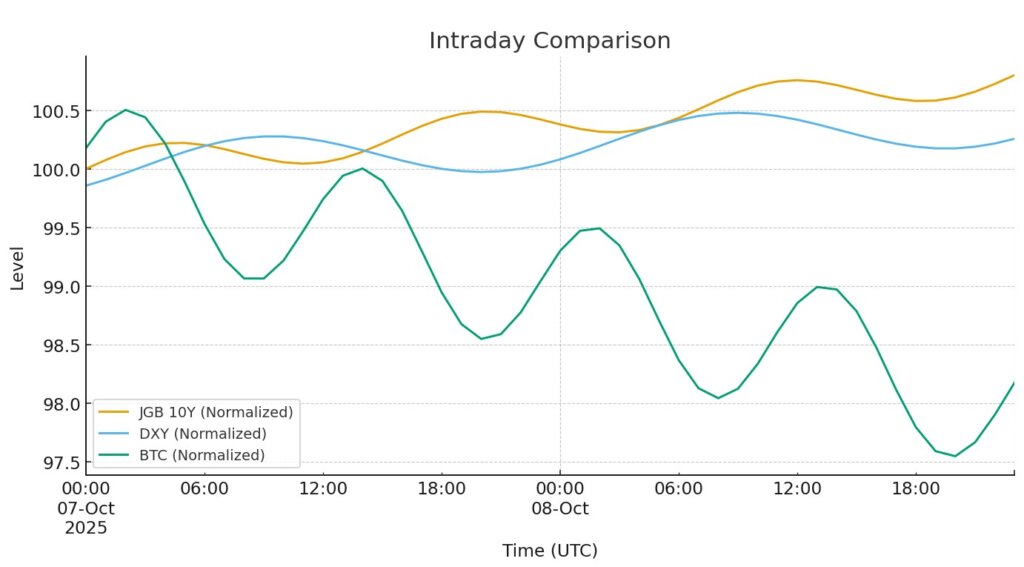

This week, the greenback strengthened because the yen weakened, a transfer that thinned the spot market and elevated volatility.

A robust greenback and tight monetary circumstances have repeatedly coincided with decrease spot liquidity and better short-term volatility. In consequence, greenback power is inversely correlated with Bitcoin and infrequently causes corrections.

This sample is necessary now as a result of the thinner order e-book makes value actions extra flow-driven and fewer depending on underlying demand.

If the Financial institution of Japan escalates its hawkish rhetoric to forestall the yen from weakening, the rate of interest differential may all of a sudden drive costs up, creating new volatility in danger property.

As Reuters lately reported, a former Financial institution of Japan govt mentioned the weakening yen may immediate the central financial institution to boost rates of interest in October, a transfer that would slender the unfold with U.S. yields and ease the greenback bid.

ETF demand will proceed in the interim

U.S.-traded spot Bitcoin ETFs recorded web inflows of $2.1 billion from October 6 to October 7, in keeping with knowledge from Pharcyde Traders, exhibiting stable demand whilst macroeconomic circumstances tighten.

On October 7, the fund rebounded to shut at $121,368.23 after withdrawing $875.6 million, whilst Bitcoin corrected 2.4% and briefly misplaced the $121,000 stage.

This resilience means that ETF inflows can offset greenback power and liquidity constraints within the brief time period, however whether or not that offset is sustained depends upon whether or not inflows preserve their current tempo.

Two countervailing forces decide how lengthy ETF demand can soak up macro pressures. First, if the tempo of inflows of billions of {dollars} per week slows, the influence of a stronger greenback and weaker yen on Bitcoin liquidity will change into extra pronounced.

Second, if the Financial institution of Japan tightens financial coverage, the hole between Japan and the US rates of interest will slender and the greenback bid will fall, thereby easing strain on danger property and doubtlessly restoring some spot depth. In consequence, ETF inflows stay robust however are at present delicate to adjustments within the greenback and actual yield atmosphere.

The Oct. 8 influx knowledge will assist make clear how traders are dealing with the newest developments in rising authorities bond yields, a weaker yen, and a stronger greenback.