Because the Bitcoin (BTC) market worth steadily recovers, a preferred market analyst underneath the username KillaXBT predicts one other important correction within the coming days.

Historic Bitcoin information reveals that the worth has repeatedly fallen by 8% each month.

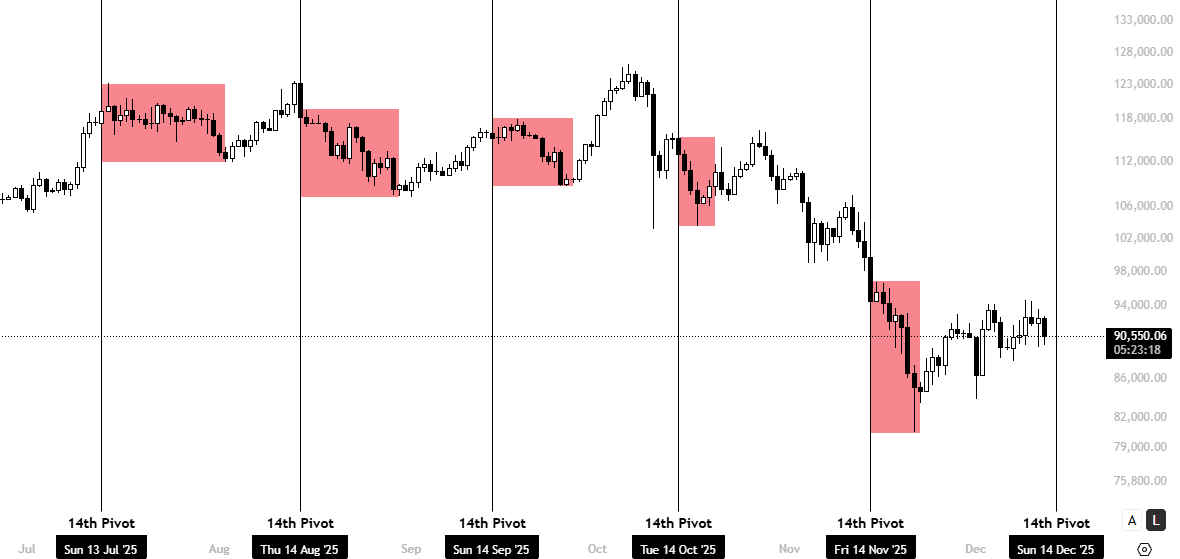

In a Dec. 12 put up on X, KillaXBT outlined cautious market insights that recommend Bitcoin is headed for a worth decline. Based on famend analysts, this top-tier cryptocurrency has constantly recorded an 8% worth decline since 14 days out of the previous 5 months. KillaXBT describes this statement because the 14th pivot, which has necessary implications for Bitcoin within the quick time period. Since hitting a low of $80,000 in late November, BTC has fashioned an upward channel, repeatedly recording steady lows and highs.

Nevertheless, KillaXBT’s prediction is that it might escape of this channel and halt the preliminary uptrend. Analysts say that based mostly on common worth patterns, Bitcoin traders ought to count on a worth decline of at the least 5% after December 14th. This implies the potential of retesting the $85,000 to $86,000 worth vary.

Given the asset’s broader bullish market construction, such a transfer might solely be a short-term pullback. Nevertheless, the extended correction seen early within the fourth quarter is already precedent-setting, leaving room for additional declines if momentum weakens.

Will BTC drop under $50,000?

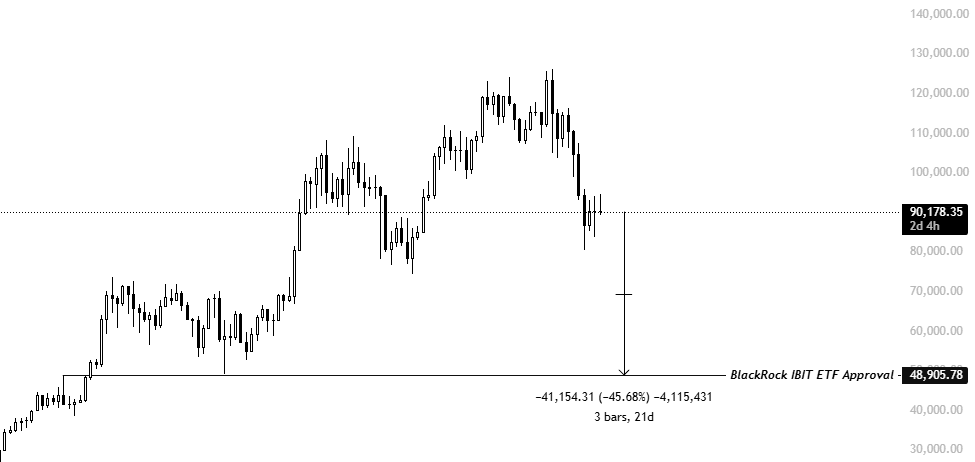

In one other X put up, KillaXBT shares a extra bearish prediction for the Bitcoin market. This time, skilled analysts predict that the cryptocurrency market chief will attain a worth ground of $48,905, regardless of the latest worth rise. KillaXBT’s ground goal represents the Bitcoin worth on the time the BlackRock IBIT ETF was authorised together with 11 different Bitcoin spot ETFs in January 2024. This prediction will be attributed to the frequent rationale that the present bull market is essentially supported by inflows from institutional traders.

Specifically, the Bitcoin Spot ETF has been on the middle of those institutional traders’ inflows, with whole web belongings of $119.18 billion. BlackRock IBIT holds greater than half of this traction because the undisputed market chief with web belongings of $71.03 billion and cumulative web inflows of $62.68 billion.

If Bitcoin returns to its pre-ETF approval worth degree, it will symbolize an estimated 46% drop from its present market worth. Such a transfer would seemingly sign a pointy reversal within the positions of monetary establishments, suggesting that sustained ETF outflows, relatively than retail capitulation, may very well be the primary catalyst for a brand new crypto winter.

On the time of writing, Bitcoin continues to commerce at $90,348, reflecting a decline of two.18%.

Featured pictures from Pexels, charts from Tradingview