Is winter coming for digital forex? For Bitcoin Treasury Firm (BTCTC), far more is already set in stone.

A wave of crypto treasury firms went public in 2025, aiming to duplicate the once-in-a-generation success of Michael Saylor’s MicroStrategy (MSTR), and maybe benefiting from a US regulatory regime that turns a blind eye to questionable public choices.

The consequence was large losses for traders nearly throughout the board. And because the worth of Bitcoin plummets, BTC$106,825.12 Whereas the carnage of the previous 11 days (sure, the one time BTC peaked above $126,000 was on Monday, October third) could also be partly guilty, BTCTC inventory was falling lengthy earlier than that.

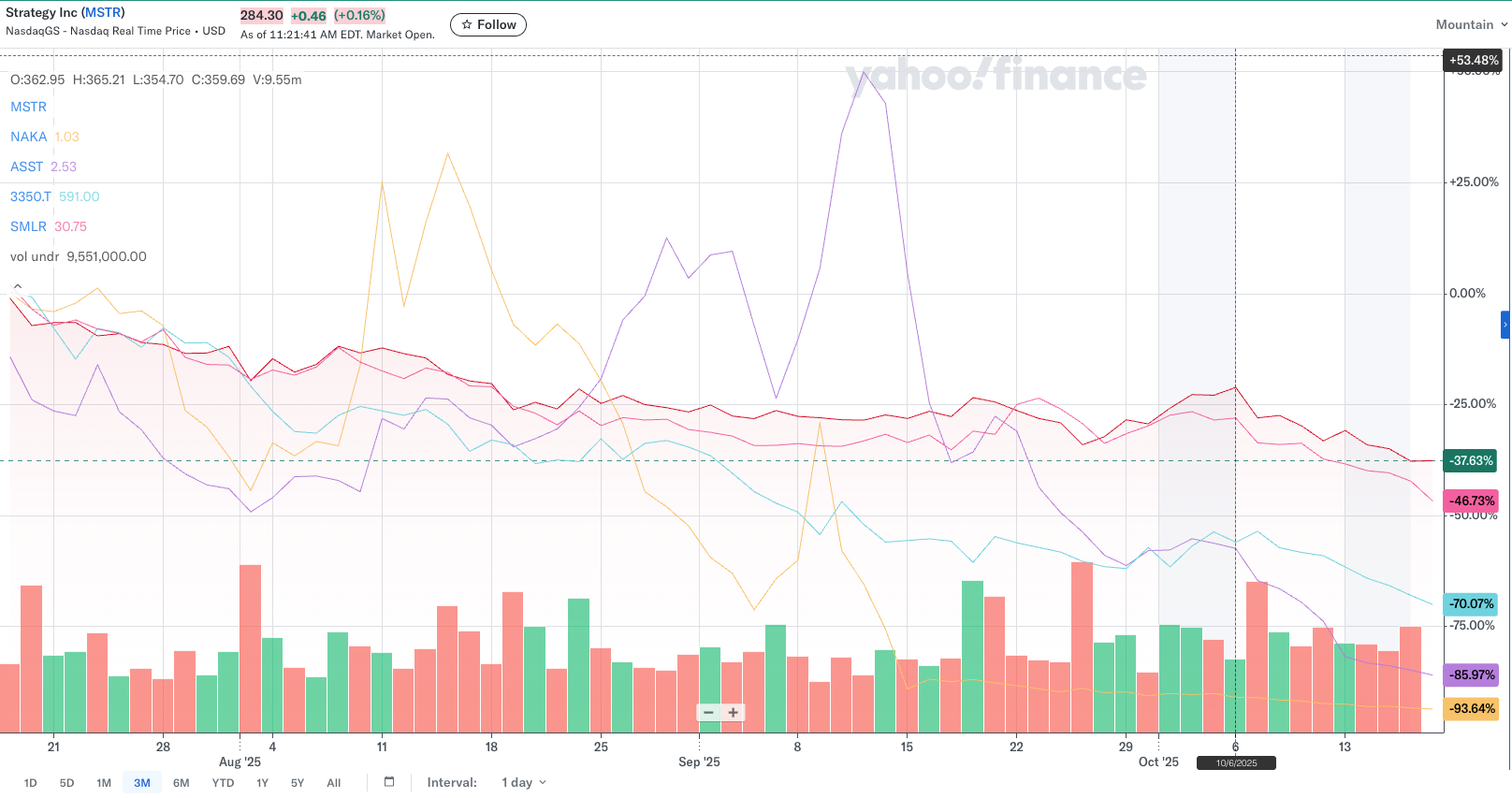

Testing a small variety of BTCTC teams, losses over the previous three months vary from a “mere” 38% for Technique to 94% for KindlyMD (NAKA).

BTCTC (Yahoo Finance) up to now 3 months

“Strong younger individuals”

When his TerraUSD algorithmic stablecoin started unpegging from the greenback in Could 2022, Do Kwon famously tweeted, “Put in additional capital – strong younger individuals.” TerraUSD, which beforehand had a market capitalization of about $50 billion, turned nugatory inside days.

This social media submit has grow to be a meme within the cryptocurrency neighborhood at any time when issues begin to look suspicious for the market or an organization.

Whereas this isn’t to counsel comparable ranges of volatility or criminality or to foretell future BTCTC, a few of these firms’ executives have just lately turned to social networks to defend their enterprise fashions.

Simon Gerovich, CEO of Japan’s MetaPlanet (MTPLF), stated on Friday that whereas the inventory worth has remained excessive since adopting the BTCTC technique in 2024, the inventory worth has fallen 70% up to now three months, and sought to make the case why the transfer to most popular inventory issuance will significantly profit shareholders.

“When the worth of Bitcoin rises sooner than the price of capital, the distinction compounds, growing the worth of Bitcoin per share and benefiting widespread shareholders,” he wrote in a submit on X.

Particulars: Metaplanet traders will profit ‘if the numbers go up’.

KindlyMD CEO David Bailey (whose inventory has plummeted 94% up to now three months to lower than $1 and is on the verge of being delisted from the Nasdaq) determined Thursday that he wanted to disclaim an X poster’s declare that his firm has an “FTX vibe.”

“There aren’t any similarities to FTX in any respect,” Bailey stated. “We’re a regulated registered safety that buys and holds Bitcoin.” When the CEO of a public firm has to say “We’re not FTX” in response to a random poster, it’s protected to say the plan failed.

Subsequent, Ben Workman, CIO of Try (ASST), whose inventory worth has fallen nearly as a lot as NAKA’s and can also be going through delisting, tried to elucidate the difficulties and attainable options going ahead.

“The growth is now gone and plenty of firms are nicely positioned to maneuver on to the second stage of their journey with their steadiness sheets intact,” Workman stated in a really lengthy submit on Firm X.

“Attaining scale is tough, however many firms at the moment are attaining it,” he continued. “Valuations (based mostly on steadiness sheet alone) are reaching deep worth territory, and are valuations that many traders shall be betting on over the long run.”

Workman went on to remind us that many thought Sailors Technique (then MicroStrategy) could be price zero within the crypto winter of 2022. Those that forgot about that perception have been in a position to reap superb advantages. When Do Kwon made his “Secure Younger Man” submit, MSTR was buying and selling at round $30. Even after the latest drop, the inventory remains to be hovering round $290, making it nearly a 10-bagger over the previous three and a half years.

No matter what the longer term holds for BTCTC, one factor is for certain: the temper is much from optimistic for the time being. If any of the latecomers need to mirror the good success of the primary mover technique, it could require greater than an increase in Bitcoin costs.

This editorial is a part of CoinDesk Bitcoin Authorities Bond Theme Week hosted by Genius Group.